According to derivatives markets, Ether (ETH) traders are still confident that there is the chance formore upside even though the 23% correction on Sept. 7 took a hit on prices.

Ethereum network congestion also peaked on Sept. 7 when the average transaction fee reached $60, and since then it has remained above $17. As a result of the lingering challenges experienced by the network, investors have shifted into Ethereum competitors with bridge and layer-two capabilities. For example, Polkadot’s DOT rose by 29% over the past week and Algorand’s ALGO spiked 67%.

Undoubtedly, there’s a quest for interoperability and layer-two scaling solutions, aiming to quickly meet the explosive demand for nonfungible tokens (NFTs) and decentralized finance (DeFi) applications.

Whether the Ethereum network will sustain its absolute leadership position seems irrelevant right now, as the industry’s net value locked (adjusted total value locked) in smart contracts has risen from $13.6 billion in December 2020 to its current $82 billion.

Regulatory fear coming from the United States is likely curbing investors’ optimism in cryptocurrencies. According to a document released by a House committee on Sept. 13, lawmakers aim to close a loophole that previously allowed investors to claim capital gains deductions. The Internal Revenue Service currently considers cryptocurrencies as property in “wash sales,” and as a result, they are exempted from 30-day repurchase rules.

The brief $4,000 test on Sept. 3 momentarily caused derivatives markets to enter overdrive. The nonstop 45-day long rally had raised Ether’s price from $1,735 on July 20, a 130% increase. Meanwhile, the $3,200 support held firmly and boosted bulls’ confidence even though the altcoin dropped by 16% in eight days.

ETH futures data shows bulls are still “bullish”

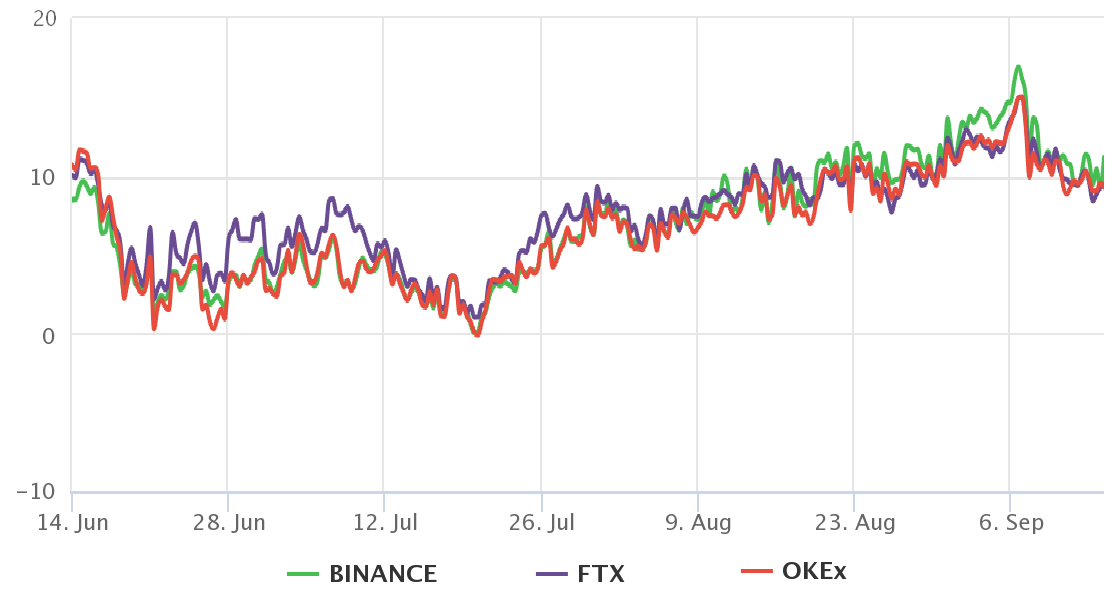

Ether’s quarterly futures are the preferred instruments of whales and arbitrage desks. Due to their settlement date and the price difference from spot markets, they might seem complicated for retail traders. However, their most notable advantage is the lack of a fluctuating funding rate.

These fixed-month contracts usually trade at a slight premium to spot markets, indicating that sellers request more money to withhold settlement longer. Consequently, futures should trade at a 5% to 15% annualized premium on healthy markets. This situation is known as “contango” and is not exclusive to crypto markets.

As displayed above, Ether’s futures contracts have been holding a decent 8% premium since Aug. 9. Apart from the brief surge above 15% on Sept. 7, derivatives traders have remained cautiously optimistic.

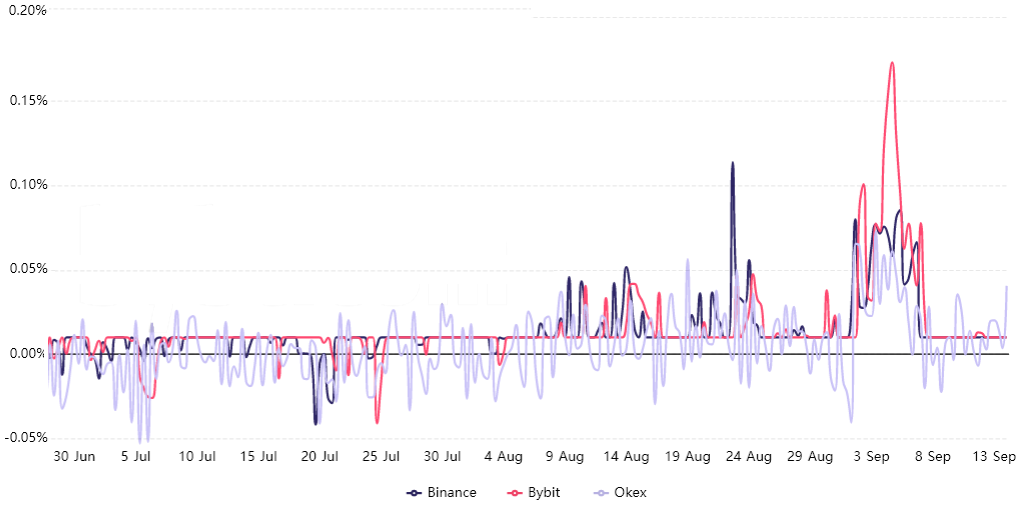

To understand whether this movement was exclusive to those instruments, one should also analyze perpetual contracts futures data. Even though longs (buyers) and shorts (sellers) are matched at all times in any futures contract, their leverage varies.

Consequently, exchanges will charge a funding rate to whichever side is using more leverage to balance their risk, and this fee is paid to the opposing side.

Data reveals that modest excitement started building up on Sept. 2, lasting less than five days. The positive funding rate shows that longs (buyers) were the ones paying the fees, but the movement seems reactive to the price increase, and it faded as Ether crashed on Sept. 7.

At the moment, there are no signs of weakness from Ether derivatives markets, and this could be interpreted as a bullish indicator. Investors’ attention remains focused on developments in regulation and Ethereum 2.0, which everyone assumes should settle the scalability problem for good.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.