Barry Silbert, founder and chief executive officer of venture capital Digital Currency Group, said he is bullish on Bitcoin (BTC) as an investment vehicle, CNBC reported July 18. Speaking at the Delivering Alpha Conference in New York on Wednesday, Silbert said that he thinks “we’ve probably hit the bottom for the year. I actually put some money into Bitcoin last week.” He added that “as an asset class it is here to stay … I’m 100 percent confident a decentralized, non-fiat form of money is here to stay.” Jeremy Allaire…

Day: July 18, 2018

Nervos Network Blockchain Startup Secures $28 Mln From Sequoia China, Polychain Capital

Nervos Network, a Chinese blockchain startup founded by a former researcher and developer of the Ethereum Foundation, has announced today July 18, that it has raised $28 million to develop its enterprise blockchain solutions. According to a statement shared with Cointelegraph, Nervos has secured investment from a number of blockchain-related enterprises, including crypto hedge fund Polychain Capital and venture capital firm Sequoia China. Nervos will use the new capital to expand its product and engineering teams, accelerate development of its enterprise blockchain solutions, and form strategic partnerships. The company is…

Bitcoin Trading Volume Is Up 100% From Its Recent Low

With yesterday’s dramatic $600 bitcoin rally came a sharp rise in trading volume, more specifically a 100 percent increase from its 7-month volume low set just four days ago. As of Monday, bitcoin’s 24-hour trading volume had fallen to $2.92 billion, a level last seen on November 7. However, as price volatility tends to follow dramatic volume lows, bitcoin’s breakout yesterday was no exception to the rule: 24-hour trading volume reached $5.9 billion. All in all, this marked a 103.7 percent increase from the 36-week low set this past Saturday.…

French Startup Offers Idle Servers Part-Time Job to Power Ethereum DApps

While it is true that humankind put a man on the moon using the computing power equivalent to a modern programmable calculator, there are many great things that still don’t happen because the computational power is scarce and expensive. High-performance computing is still a closely guarded secret weapon of the rich and privileged. Large banks and traders use proprietary algorithms for automated trading, movie makers create impressive special effects, pharmaceutical companies research new drugs and enormous mining farms generate Bitcoin wealth from the thin air. The future seems already to…

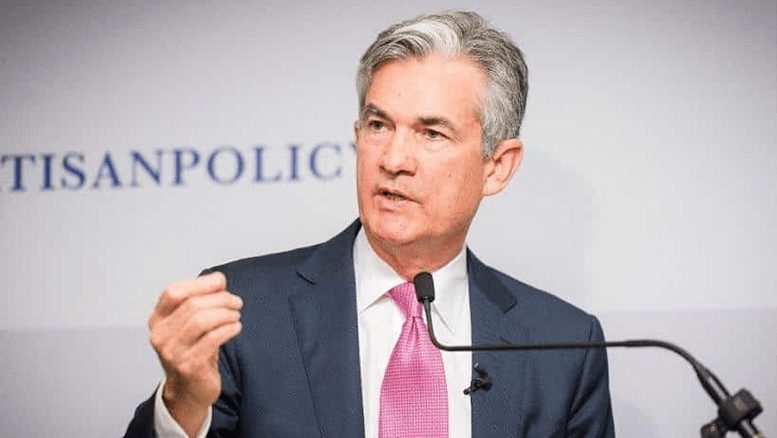

Fed Chairman on Crypto | Crypto Presents Investor Risk

Yesterday, bulls charged the crypto market, which caused Bitcoin to add $9B to its market capitalization in less than thirty minutes. But the Fed chairman on crypto is swinging the opposite way. Today, we’ve seen a few bears emerge from the forest. Specifically, the head of the Federal Reserve spoke on cryptocurrencies today, providing comments that indicate he is bearish on virtual currencies. Fed Chairman on Crypto: A Risky Investment On Wednesday, Jerome Powell, the head of the Federal Reserve, which is the US’s central banking system, spoke with members…

Crypto Presents a Challenge Beyond Hard and Fast Asset Classifications

Witnesses before the U.S. House of Agriculture Committee at a public hearing July 18 were unanimous in their view that digital assets complicate the hard and fast distinctions of existing regulatory frameworks. The hearing was chaired by Texas U.S. Representative Michael Conaway, who convened six eminent witnesses to give testimony — former Goldman Sachs partner and U.S. government regulator Gary Gensler, Andreessen Horowitz managing partner Scott Kupor, the CFTC’s Daniel Gorfine, law professor Joshua Fairfield, Clovyr CEO Amber Baldet, and Perkins Coie managing partner Lowell Ness. A key takeaway from…

Citadel CEO Says Bitcoin Is Still a ‘Head Scratcher,’ Tells Young Generation to Stay Away

Ken Griffin, the CEO and founder of the Citadel hedge fund, has reiterated his negative stance on Bitcoin (BTC) in an interview with CNBC Wednesday, July 18. Speaking at the Delivering Alpha Conference in New York, Griffin admitted that he “still scratch[es] [his] head” about Bitcoin, claiming that the younger generation should “do something more productive than invest in digital currencies.” To prove his point of view, the billionaire pointed out that none of his clients have ever suggested investing in cryptocurrencies: “I don’t have a single portfolio manager who…

Is India About To Reverse Its Crypto Trade Ban?

On July 20, the Supreme Court of India will hold a hearing regarding the state of cryptocurrencies in the country. It is a decisive date for the local crypto industry that has been significantly suppressed in the past month by the Reserve Bank of India’s (RBI) ban on all banks’ dealings with crypto-related businesses. The hope for an overview of the hardline approach lives on, however, as last week a report citing anonymous sources in the government suggested that cryptocurrencies might be viewed as commodities in the future, and hence…

Crypto Bull Run | New Blockchain Patents Push Market Upwards

The cryptocurrency market is booming this morning after a slew of crypto-positive announcements have hit the media. Is a crypto bull run upon us? Bitcoin (BTC) is eyeing the $7,500 mark, and Ethereum is just under $500. Stellar (XLM) and Cardano (ADA) are leading the market today as both coins are seeing over 20% price gains. Mastercard, Bank of America, and Wells Fargo all announced this morning that they are pursuing new blockchain-related patents. This very well could be the reason why investors are buying into crypto this morning. Wells…

Most ICOs Retain Centralized Control, Break Whitepaper Promises, Academic Report Shows

Initial Coin Offerings (ICO) “failed” to provide protection against insider trading or stick to their whitepaper promises, a new report from the University of Pennsylvania Law School released July 17 reveals. The lengthy study of the ICO phenomenon, dubbed “Coin-Operated Capitalism,” begins with a frank appraisal of investor expectations versus reality, the four contributing professors finding basic inconsistencies in the behavior of a “significant” number of projects. In the introductory comments, they state that their “inquiry reveals that many ICOs failed even to promise that they would protect investors against…