Bitcoin price traded to a new monthly low towards $3,340 and later recovered against the US Dollar. Yesterday’s highlighted key bearish trend line is intact with resistance at $3,450 on the hourly chart of the BTC/USD pair (data feed from Kraken). The price may start a short term rebound if there is a proper break above $3,450 and $3,480. Bitcoin price dipped to a new yearly low and later recovered against the US Dollar. BTC could decline once again if it fails to break the $3,450-3,480 resistance area in the…

Day: January 30, 2019

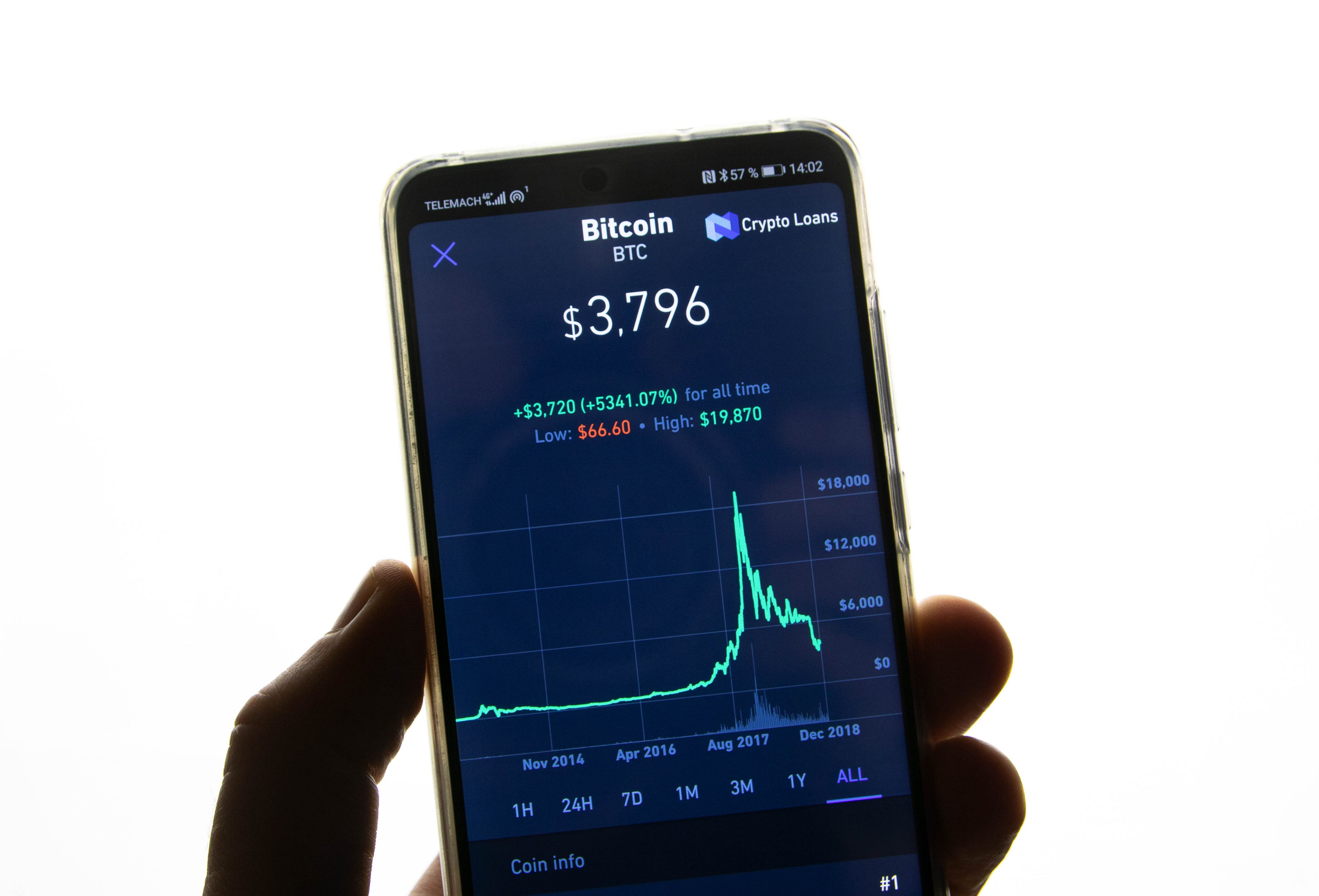

Analyst: Bitcoin (BTC) At $3,000 Looks “Symmetrical” To $20,000 Top, Reversal Possible

Crypto Analyst: Bitcoin Chart Resembles $20,000 Top Bitcoin Bravado trader, Jack “Sparrow,” recently took to his Twitter page to tout a recent bit of analysis he completed that could indicate that the broader crypto market is finally nearing a bottom. Jack, asking if Bitcoin has begun to reverse, noted that BTC’s current inverted chart is reminiscent of the asset’s $20,000 all-time high, which was established in late-December 2017. $BTC reversal pattern? This $3k bottom looks awfully symmetrical to the $20k top… Just saying pic.twitter.com/sLfKQcsTZI — Bitcoin Jack (@BTC_JackSparrow) January 29,…

Ripple Price Analysis: XRP At Clear Risk of Further Declines

Ripple price remained below the $0.2900 and $0.2950 resistance levels against the US dollar. There are two bearish trend lines in place with resistance near $0.2900 on the hourly chart of the XRP/USD pair (data source from Kraken). The pair remains at a risk of more losses as long as it is trading below the$0.2900 and $0.2950 resistance levels. Ripple price is facing a lot of hurdles on the upside against the US Dollar and Bitcoin. XRP/USD is likely to extend the current decline below $0.2800 unless buyers push it…

Ethereum Price Analysis: ETH Forming Bearish Continuation Pattern

ETH price stayed below the $107 resistance level, with bearish signs against the US Dollar. There is a major bearish pennant formed with resistance near $106 on the hourly chart of ETH/USD (data feed via Kraken). The pair could accelerate losses below the $100 level if there is a bearish break below $103. Ethereum price is forming a bearish continuation pattern against the US Dollar and bitcoin. ETH/USD remains at a risk of more losses as long as it is trading below $107. Ethereum Price Analysis Yesterday, we saw a…

JP Morgan: Blockchain Needs To Be Separated From Bitcoin & Crypto

“Blockchain, Not Crypto” Romp Continues Since Bitcoin was founded, the cryptocurrency has been bashed to hell and back. Yet, the technology behind it has been extolled, especially by financial & political incumbents who wish to handle the reins of the blockchain bull. A recent interview with JP Morgan’s chair of global research, Joyce Chang, only cemented this theme. Per Bloomberg, which conducted the candid conversation, Chang was hesitant to admit that decentralized (or centralized) ledgers would overhaul the global financial system. However, she made it abundantly clear that the technology…

Report: New Zealand Cryptopia Exchange Hack Continues

Two weeks after it first reported a hack, New Zealand-based cryptocurrency exchange Cryptopia is still compromised by cyber criminals, according to a blog post from blockchain infrastructure firm Elementus on Jan. 29. The exchange suspended services after detecting a major hack that reportedly “resulted in significant losses” on Jan. 15. Cryptopia stated that the hack occurred the previous day on Jan. 14. The platform initially stated that it was undergoing unscheduled maintenance, issuing several brief updates before disclosing the breach. On Jan. 20, Elementus reported that as much as $16 million…

JPMorgan Notes Marginal Improvements to Payment System With Blockchain Technology

Experts at financial services giant JPMorgan say that blockchain technology will provide benefits to banks and payment systems, Bloomberg reports on Jan. 29. JPMorgan’s chair of global research, Joyce Chang, said, “Blockchain isn’t going to reinvent the global payment system, but it will provide marginal improvements. The most meaningful impact will probably be three to five years away and mostly on trade finance.” A recent report led by Chang purportedly states that blockchain applications in trade-finance are more common because of the high potential gains from efficiency through digitization.…