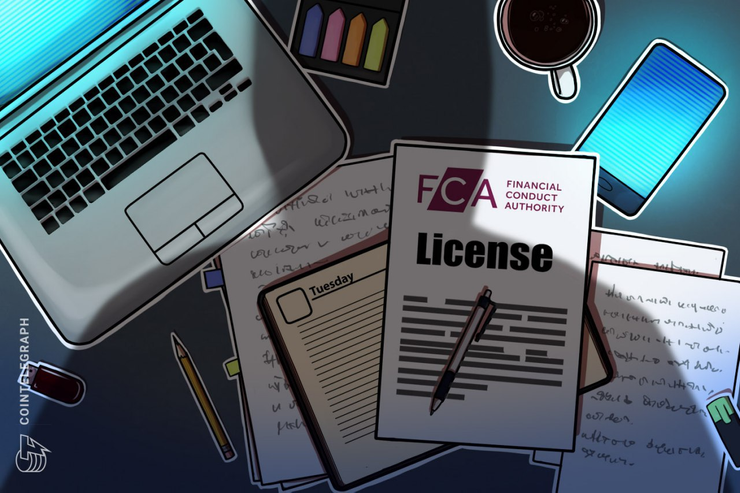

British financial watchdog, the Financial Conduct Authority (FCA), is preparing a potential ban on the sale of crypto derivatives to retail investors, according to an official document released on July 1. In the document, titled “Restricting contract for difference products sold to retail clients,” the FCA revealed that the regulator will soon publish a consultation paper (CP) on a potential ban on crypto derivatives such as bitcoin (BTC) futures and other crypto-related trading products. The FCA wrote: “We will shortly publish a CP on a potential ban on the sale…

Day: July 2, 2019

Ripple Pledges $500 Million to ‘Create Real Use Cases for XRP’

In under 12 months, according to Ethan Beard, an executive at Xpring, an initiative created to improve the Ripple ecosystem and create use cases around XRP, Ripple has committed more than $500 million. In the upcoming months, Beard stated that Xpring will invest in various open source protocols, developer projects, and large scale partnerships related to XRP to develop more “real use cases for XRP”. Is the breakthrough XRP needed near? Throughout the past several months, despite positive developments and deals especially in the Asia crypto market, the price of…

Ripple Pledges $500 Million to ‘Create Real Use Cases for XRP’

In under 12 months, according to Ethan Beard, an executive at Xpring, an initiative created to improve the Ripple ecosystem and create use cases around XRP, Ripple has committed more than $500 million. In the upcoming months, Beard stated that Xpring will invest in various open source protocols, developer projects, and large scale partnerships related to XRP to develop more “real use cases for XRP”. Is the breakthrough XRP needed near? Throughout the past several months, despite positive developments and deals especially in the Asia crypto market, the price of…

Ripple Alum to Spearhead Binance US Crypto Exchange

After two years as head of XRP institutional liquidity at Ripple, Catherine Coley is moving to greener pastures. Coley was named CEO at BAM Trading Service at Binance U.S., according to her LinkedIn profile. Her experience with both one of the largest cryptocurrencies, XRP, and institutional investors should serve her well in this high-profile role in which she will seemingly oversee the trading of more than just one cryptocurrency. There do not appear to be any hard feelings with her former boss, Brad Garlinghouse, who congratulated her on social media. Big…

Operator of Newly Launched Binance US Appoints Former Ripple Exec as New CEO

The operator of United States-based division of Binance crypto exchange has appointed former Ripple exec as its new CEO, the company officially announced on July 2. BAM Trading Services (BAM), the operator of recently launched Binance US, has hired Catherine Coley, former liquidity management expert at Ripple, to oversee the launch of Binance US and bring BAM’s market to North America. After joining Ripple in 2017, Coley served as Head of XRP Institutional Liquidity, her most recent position prior to Binance US. Coley’s professional experience includes forex exchange (forex) expertise…

Ethereum SubZero Freeze Announced As ETH Bears Press Lower

Ethereum (ETH) falls, down 7.5 percent SubZero freeze marks the end-of-June phase 0 ETH prices are falling back as price action strives for balance. Following the SubZero freeze notifying the community of Phase 0 amends, the community is expectant of a price recovery. At spot rates, ETH is under pressure and could consequently slide to $230 in days ahead. Ethereum Price Analysis Fundamentals Good news for ETH holders and Ethereum as an ecosystem is that the network is ready to transition from proof-of-work to a staking consensus system. Controversial in…

Crypto Exchange Bitfinex Repaid $100 Million to Stablecoin Operator Tether

Cryptocurrency exchange Bitfinex announced that it repaid $100 million of outstanding loan facility to stablecoin operator Tether in a post on its official blog on July 2. Per the announcement, Bitfinex made the repayment via wire transfer to Tether’s bank account and the amount was not yet due to be paid to the operator under the facility. Still, the exchange reportedly made the decision to complete the prepayment based on its financial position at the end of the second quarter of 2019. The post concludes: “Also on July 1st, Bitfinex…

UK Financial Watchdog Grants License to London-Based Crypto Asset Firm

London-based crypto asset management firm Prime Factor Capital has obtained a license from the Financial Conduct Authority (FCA) to operate as a full-scope Alternative Investment Fund Manager (AIFM). The development was announced in a press release on July 1 Being FCA-authorized gives Prime Factor Capital the right to operate as a full-scope AIFM under the European Union’s AIFM Directive (AIFMD). The Directive is a regulation applied to private equity funds, hedge funds, and real estate funds, which sets standards for marketing in regards to raising private capital, risk monitoring and…

Why IBM’s Blockchain Isn’t a Real Blockchain

Stuart Popejoy has 15 years experience in building trading systems and exchange backbones for the financial industry. Prior to co-founding Kadena with Will Martino in 2016 and becoming the company’s president, Stuart worked at JPMorgan Chase in the new products division, where he led and developed JPMorgan’s main blockchain product, Juno. Stuart also wrote the algorithmic trading scripts for JPMorgan, which informed his creation of Kadena’s simple, purpose-built smart contract language, Pact. The views and opinions expressed here are solely those of the author and do not necessarily reflect the views…

Bitcoin Surge is Legitimate, Tether is Transparent Reflection of Crypto Exchanges

The price of bitcoin closed the second quarter of 2019 at a profit of approx 189 percent. Many claimed that it was Facebook’s Libra announcement that injected a fresh wave of optimism in the bitcoin market. Others believed that the ongoing US-China trade war and its impact on the macroeconomic sentiment influenced investors to consider bitcoin as “safe-haven.” Nevertheless, there is also the third theory, which is not as picturesque as the two stated above. Decrypt reported that almost $1 billion of new Tether (USDT), a controversial stablecoin, entered the cryptocurrency…