Bitcoin coincidentally formed a positive correlation with the US stock market on Tuesday, observed Mati Greenspan of eToro. The senior market analyst noted that the benchmark cryptocurrency plunged by more than $1,500 right after the S&P 500 index made a similar move. He recognized the zero correlation between the two extremely polarized markets but added that them moving in tandem was an extraordinary coincidence. Excerpts from his tweet published today: “Plunge in the US stock market (orange line) proceeded the bitcoin breakout (blue). I know it’s an uncorrelated asset but…

Day: September 25, 2019

25K Retail Stores in France to Enable Crypto Payments with EasyWallet

In a recent press release by retail software firm Global POS at the Paris Retail Week, it was announced that a new crypto payment method will enable 25,000 major retail stores in France to accept payments in Bitcoin(BTC)trade by 2020. The system will use the applications “EasyWallet” and “Easy2Play,” which will enable 30 major French retailers to accept Bitcoin as a mode of payment; these retailers include Sephora, Foot Locker, Norauto, Conforama and Decathlon. Even though the payments will be in Bitcoin, the currency will be changed to Euros at…

Peter Thiel-Backed Investment Fund 1Confirmation Raises $45 Million

Crypto investment fund 1Confirmation, backed by tech billionaire Peter Thiel, has raised $45 million for its second fund. Following the raise, 1Confirmation has over $75 million in assets under management for investing in new projects in the crypto industry, the firm’s founder Nick Tomaino announced on Sept. 25. San Francisco-based 1Confirmation is one of the earliest crypto investment firms that have high-profile backers such as PayPal co-founder Thiel, billionaire investor Mark Cuban, Andreessen Horowitz’s co-founder Marc Andreessen, and global private equity fund-of-funds Horsley Bridge, the post notes. $60 million initially…

KPMG Releases Free Study on How Blockchain-Enabled Tokenization Will Transform Commerce

KPMG along with partners at Ketchum Analytics has launched a new, free research report that explores how blockchain-enabled tokenization is transforming the way consumers interact with each other and businesses. advertisement The findings indicate that tokenization is ushering in a new generation of commerce, and brings to light the strategic value of deploying blockchain infrastructure for the many business opportunities it offers – from creating new customer engagement opportunities to driving new revenue streams. However, the potential is vast in those industries where consumers already express high levels of loyalty.…

US Consumers Highly Willing to Use Blockchain Tokens

63% of American consumers perceive blockchain tokens to be an easy form of payment, according to a new survey from “Big Four” auditor KPMG. VentureBeat reported the survey’s results on Sept. 25, citing an accompanying statement from KPMG’s United States blockchain leader Arun Gosh: “Tokenization […] provides inspiring new ways to classify value, either by creating new assets or reimagining traditional ones […] Businesses that take advantage of tokenization can open the door to entirely new process improvements, revenue streams and customer engagement opportunities.” 82% would use blockchain tokens in…

How Decred Aims to Build a Decentralized Governance Model

How Decred Aims to Build a Decentralized Governance Model September 25, 2019 by Amin Rafiee One of the most important aspects of a decentralized network is governance. This is the method by which decisions are made, funds are raised or allocated, and operations are expanded. You can view this feature as the community hall where people can voice their opinions regarding issues that directly impact their ecosystem. Governance plays an important role, as currently voices are limited in a great deal of decentralized projects. Also read: Bitcoin Price Sitting Still at…

University of Cambridge Delivers New Blockchain Model To Improve Global Supply Chains

The University of Cambridge Institute for Sustainability Leadership (CISL), has recently completed a successful blockchain experiment bringing together Sainsbury’s, BNP Paribas, Unilever, Barclays, Standard Chartered and Rabobank. The study has shown how a new model of blockchain and other data-sharing technologies can enhance the sustainability of global supply chains without increasing production costs. advertisement Thomas Verhagen, Senior Programme Manager, CISL, said: “This is a significant step towards further development and understanding of how technology-driven innovation can support the delivery of the UN Sustainable Development Goals.” “Collaboration between multi-nationals, financial institutions…

Filecoin Testnet to Launch in December — Mainnet in Q1 2020

Decentralized file hosting protocol Filecoin announced in a post published on its blog on Sept. 24, that its alphanet will be launched tomorrow, testnet on Dec. 11 and mainnet in Q1 2020. “These windows are best estimates” However, the Filecoin team acknowledges that “these windows are best estimates, and could potentially slide.” Per the announcement, this year the project’s team open-sourced the Filecoin implementation written in Go, launched the first public development networks and put multiple implementations of the protocol in development. The current focus of the team is reportedly…

Gold Beats Bitcoin as Trump Faces Impeachment Probe

Gold outperformed Bitcoin on Wednesday as an impeachment inquiry into US President Donald Trump triggered demand for safe-haven assets. The yellow metal came near its three-week peak, with its spot trading at $1,530.29 per ounce as of 10:00 UTC. At the same time, US gold futures surged 0.1 percent to $1,538.30. Bitcoin, unlike Gold, trended lower upon undergoing a sharp decline in its prices late Tuesday. The benchmark cryptocurrency slipped by circa $1,000 in just 30 minutes, a sell-off allegedly triggered by margin calls and contract liquidations on BitMEX, a…

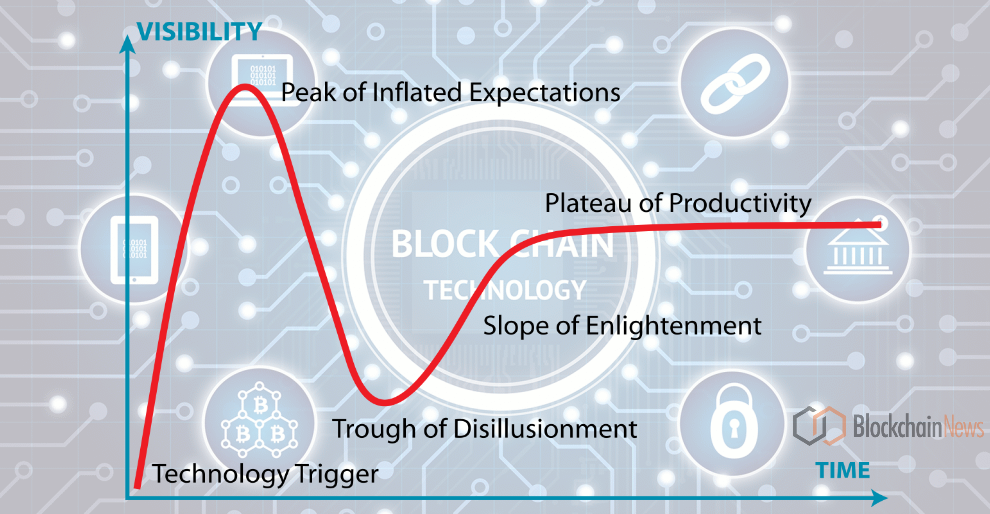

Global Blockchain Market is Expected to Reach USD 169.5 Billion by 2025

The global Blockchain market is expected to grow from USD 1.3 Billion in 2017 to USD 169.5 Billion by 2025 at a CAGR of 83.8% during the forecast period 2018-2025, according to the new report published by Fior Markets. The adoption of blockchain technology in retail and supply chain management and ease in business processes which creates transparency are the two major factors for the market growth. advertisement Growing investments in venture capital funding and blockchain technology is a major factor driving the market. In addition, ease in business processes…