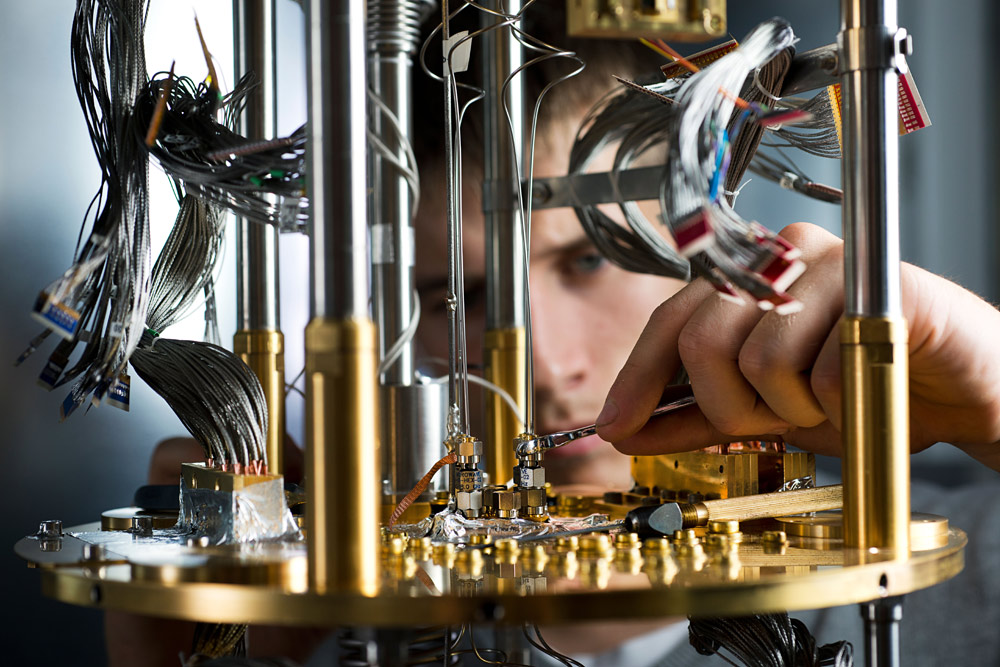

“Japan is the birthplace of quantum annealing and has remained a global leader in quantum application development,” said Alan Baratz, D-Wave executive VP of research and development. “Our collaboration with global pioneer NEC is a major milestone in the pursuit of fully commercial quantum applications.” Source

Day: December 11, 2019

BTC and These 9 Cryptos Set to Resume Downtrend

Paris-based asset management firm Napoleon AM has announced the launch of a specialized professional fund under French law, the Napoleon Bitcoin Fund. The fund would replicate the price of the cash-settled Bitcoin futures listed on the Chicago Mercantile Exchange. According to the company, this is one of the first regulated products giving exposure to Bitcoin, with which institutional investors can diversify their portfolio. While the firms are launching crypto products for professional investors, not every investor is confident about the future of Bitcoin. Billionaire investor Mark Cuban believes that BTC…

Ethereum Builder ConsenSys Shutters India and Philippines Operations

The cutbacks follow a round of layoffs late last year that saw about 13 percent of ConsenSys’ then-1,200-person staff let go (it’s down to about 1,000 now). The venture studio grew rapidly during the last crypto bull run when the price of ethereum tokens reached over $1,000 but began refocusing priorities in the depths of crypto winter. Source

What the Wild History of Digital Currency Tells Us About The Future

The history of the cryptocurrency project can be traced to the 1970s. One key factor was the fear of future surveillance. Both surveillance and the possibility to more directly manipulate transaction data. I wrote about Paul Armor, a computer scientist who worked on and off in the Department of Defense, and at Rand in the 70s, where they asked him to design a next-gen surveillance system, to keep tabs on the Soviet Union and anticipate their moves. His team came up with an electronic payments system. They realized tracking money flows…

Crypto Exchange Kraken Adds Support for Tezos Staking

Cryptocurrency exchange Kraken is launching support for Tezos (XTZ) staking, according to an announcement published on Dec. 11. Starting on Dec 13., Kraken will enable its users to trade with XTZ and obtain instant financial rewards. To begin staking XTZ, users have to put the cryptocurrency into their Kraken Staking Wallet, but already having XTZ in their Spot Wallet. Those users who stake XTZ will reportedly receive a 6% return annually, with rewards paid two times a week. Kraken further notes that it will charge clients a 15% service fee…

Elliptic Launches Tool to Connect Banks with Cryptocurrency Exchanges

London-based cryptocurrency compliance firm Elliptic has launched a new tool that allows banks to work more closely with crypto exchanges. Dubbed Elliptic Discovery, the product collects detailed profiles of more than 200 global crypto exchanges to enable banks to manage risks associated with crypto transactions, Business Insider reports Dec. 11. Elliptic Discovery includes data collected since 2013 Designed specifically for banks, Elliptic Discovery reportedly provides compliance teams with necessary insights to identify flows of funds on crypto assets and assess risks including money laundering. The tool is reportedly based on…

Bitcoin Rises Against Strong Bearish Mood; Deeper Decline Coming?

Bitcoin on Wednesday moved slightly upward as traders remained puzzled about its next big price rally. The bitcoin-to-dollar exchange rate surged by as much as 0.80 percent to establish an intraday high of $7,263.31. The move uphill accompanied a moderate rise in volume. The conformity between price and volume showed traders’ inclination to retest the strong resistance area lurking above $7,500. Nevertheless, the possibility of bitcoin jumping above the purpled ceiling (in the chart below) remains meager given the prevailing bearish trend. The BTC/USD pair is consolidating as downtrend sentiment…

Danish Authorities to Clamp Down on Bitcoin Tax Evaders

Denmark is set to enforce robust bitcoin tax compliance at its tax agency has received information about 20,000 crypto owners in the country. The Scandinavian nation is the latest country to move towards combating crypto tax evasion. Danish Tax Agency Authorized to Gather Bitcoin Tax Info At the start of 2019, BTCManager reported that the Danish government was set to impose taxes on crypto trading. According to an announcement on the Danish Tax Authority’s website, about 20,000 crypto owners in the country have received warning letters. These warning letters follow…

Never Mind Adoption, This was a Year of Steady Infrastructural Progress

Despite having operable smart contract blockchains like Ethereum in production, projects have struggled with product-market fit for decentralized applications in recent years. The industry might simply be too early. If we look back to how “mobile applications” progressed, they didn’t really solidify into a multi-billion dollar business until their infrastructure — smartphones like iPhone and mobile operating systems like Android — became extremely accessible, usable, and affordable. In the same way, blockchain infrastructure in the form of scalable blockchains, user-friendly wallet experiences, node and data services, and financial industry support…

New York Regulator Details Changes to Contentious BitLicense

The guidance released Wednesday includes two specific updates that the public can comment on: Any coins that the regulator approves for listing in New York can be listed by any exchange that operates in the state, as long as they provide notice to NYDFS, and the regulator will publish a model framework for coin listings that exchanges should model their versions around. Source