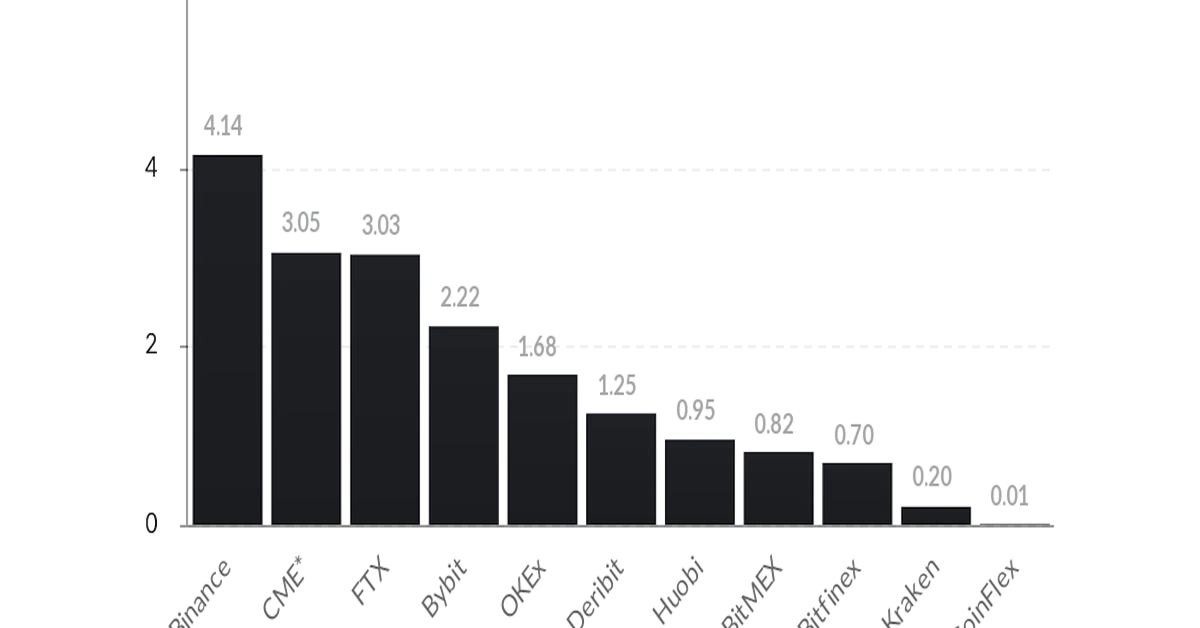

This is notable because the exchange is seen as a proxy for institutional demand. Further, its latest jump from last month’s fourth spot is reminiscent of the exchange’s rise to the top seen during bitcoin’s four-fold institutional-driven rally to nearly $40,000 in the final three months of 2020.

2020′s Bull Redux? CME Improves Its Ranking in Biggest Bitcoin Futures Exchanges List — CoinDesk