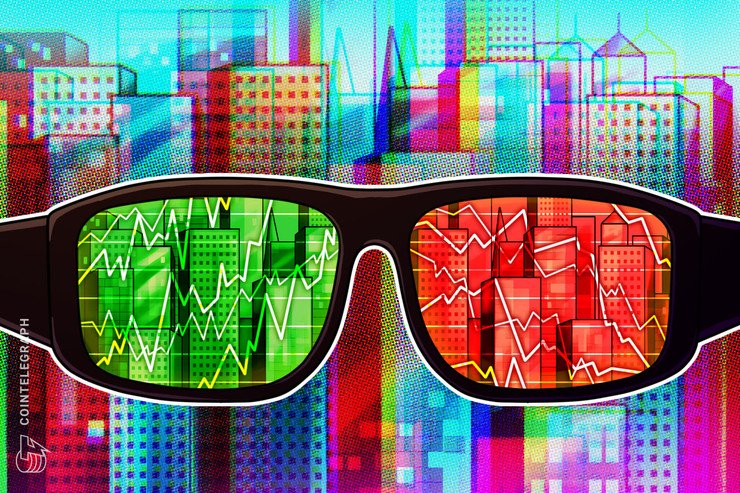

Most cryptocurrencies have bounced off their immediate support levels, a positive as this shows demand at lower levels. BitMEX Research recently pointed out that the correlation between the S&P 500 and Bitcoin (BTC) has reached a new high, eclipsing the previous high recorded in March 2018. This shows that with all the money being printed to support the economy, a tiny bit might be finding its way into the crypto space, which is a huge positive. Over the long-term, only a fraction of the total stimulus packages announced around the…

Day: March 30, 2020

Riot Blockchain Cites COVID-19 Disruption Risks on SEC Form 10-K

Nasdaq-listed cryptocurrency mining firm, Riot Blockchain, filed its Form 10-K annual report to the United States Securities and Exchange Commission (SEC), March 25. Among a long list of other potential risk factors to the business, the report assesses the potential disruptions due to the COVID-19 pandemic. COVID-19 will affect cryptocurrency mining business As part of the Form 10-K a company must include information about any significant risks to its business. Riot further subdivides these risks into several sections, although interestingly lists the risks from COVID-19 as a cryptocurrency-related risk, rather…

How Bitcoin’s (BTC) Current Price Around $6,000 is Reminiscent of 2018

In brief: Bitcoin has so far defied the Death Cross which is evident on the daily chart. The King of Crypto is currently trading at $6,350, reclaiming the important $6,000 support zone. However, the current price movement is reminiscent of 2018 and could fall further as all markets are affected by the Coronavirus. With the new month of April only a few hours away, there is a lot of optimism with respect to the direction of the crypto markets. Generally, when CME Bitcoin futures contracts expire like they did last…

How Bitcoin’s (BTC) Current Price Around $6,000 is Reminiscent of 2018

In brief: Bitcoin has so far defied the Death Cross which is evident on the daily chart. The King of Crypto is currently trading at $6,350, reclaiming the important $6,000 support zone. However, the current price movement is reminiscent of 2018 and could fall further as all markets are affected by the Coronavirus. With the new month of April only a few hours away, there is a lot of optimism with respect to the direction of the crypto markets. Generally, when CME Bitcoin futures contracts expire like they did last…

Blog: Grwipau cymunedol a COVID-19

Blog gan Ian Hulme, Cyfarwyddwr Sicrwydd Rheoleiddiol yr ICO. Wrth i COVID-19 barhau i ysgubo ar draws y Deyrnas Unedig, mae mwy a mwy o bobl yn cael eu sbarduno i helpu’r rhai sy’n fwyaf agored i niwed yn ein cymunedau. Mae grwpiau eglwysig, cymdeithasau cymdogaeth a chymdeithasau trigolion yn cael eu sefydlu i gefnogi gwaith grwpiau cymunedol, gwasanaethau ac elusennau sy’n bodoli eisoes. Yn aml, mae angen i’r grwpiau hyn ymdrin â gwybodaeth bersonol sensitif a’i rhannu gydag eraill. Ac mae hynny’n golygu ystyried y gyfraith ar ddiogelu data. Os…

Bitcoin Mining Roundup: BTC Regains 100 Exahash, Miners Close Shop, Pre-Halving Shake-Up

In 44 days, BTC miners will face the third reward halving as the block subsidy will soon shrink from 12.5 to 6.25 coins per block. Following the market carnage in mid-March, BTC’s hashrate plummeted 44% to a 2020 low of 75 exahash per second (EH/s). Since then the hashrate has climbed back above 100EH/s, but profitability between SHA256 networks like BCH and BSV has been a lot more erratic than usual. Also read: Bitcoin Hashrate Down 45% – Miners Witness Second-Largest Difficulty Drop in History BTC Recaptures 100 Exahash –…

The Need to Report Carbon Emissions Amid the Coronavirus Pandemic

JPMorgan Chase, the first American bank to create and successfully test a digital coin representing a fiat currency, also provided the most fossil fuel financing out of any bank in the world, according to a 2019 report titled “Banking on Climate Change.” The bank recently joined a chorus of other financial institutions and endowments that have declared that they will, going forward, be reluctant to provide funding to the fossil fuel industry — which energizes emerging digital technologies and companies — in order to mitigate the effects of climate change.…

Bitfinex DeFi Offshoot Burns $20M Tokens in Bid to Drive DEX Adoption

DeversiFi, the decentralized exchange (DEX) spin-off of former Bitfinex sister exchange Ethfinex, has burned $20 million worth of its governance and utility token, Nectar (NEC). According to a statement, March 30, this is designed to drive DEX adoption after large centralized exchanges struggled to cope during the recent cryptocurrency sell-off. Governance token switches to deflationary model The Nectar token was originally launched with an inflationary model, in which it was awarded to Ethfinex traders, giving them a stake in the future of the exchange. However, with Ethfinex’s pivot towards decentralization…

Tron Launches Djed, a Platform That Looks Suspiciously Like MakerDAO

On March 28, Tron (TRX) founder Justin Sun tweeted to announce the release of Djed, a system for collateralized loans he described as “something new.” The platform was immediately criticized as many see it as a plagiarized version of MakerDAO (MKR). Sun teased the launch on Jan. 16 when Sun let his fans choose the name of a planned decentralized stablecoin that was initially to be backed by TRX and BitTorrent Token (BTT). Self-described TRX whale and Tron fan Mike McCarthy was the one who proposed the name Djed, just…

Bitcoin Price Pumps $600 to CME Gap, But $6.6K May Be End for Bulls

The price of Bitcoin (BTC) retraced to $5,800 during the weekend, which left the markets with an open CME gap between $5,900 and $6,620. Aside from that, buyers have stepped in at the $5,850 level, leading to a $600 rise in the price on Monday. However, is the correction over or is the market range-bound? Crypto market daily performance. Source: Coin360 Bitcoin finds support at the $5,850 level The bearish scenario showed the movements in the previous article, which stated the support levels at $5,800 as significant levels to be…