▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Hello, Guys welcome to Crypto Guruji ; In this video I will show you a investment site Disclaimer – If you will deposit in this site so it is your own risk ☑️Link… ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Day: April 10, 2020

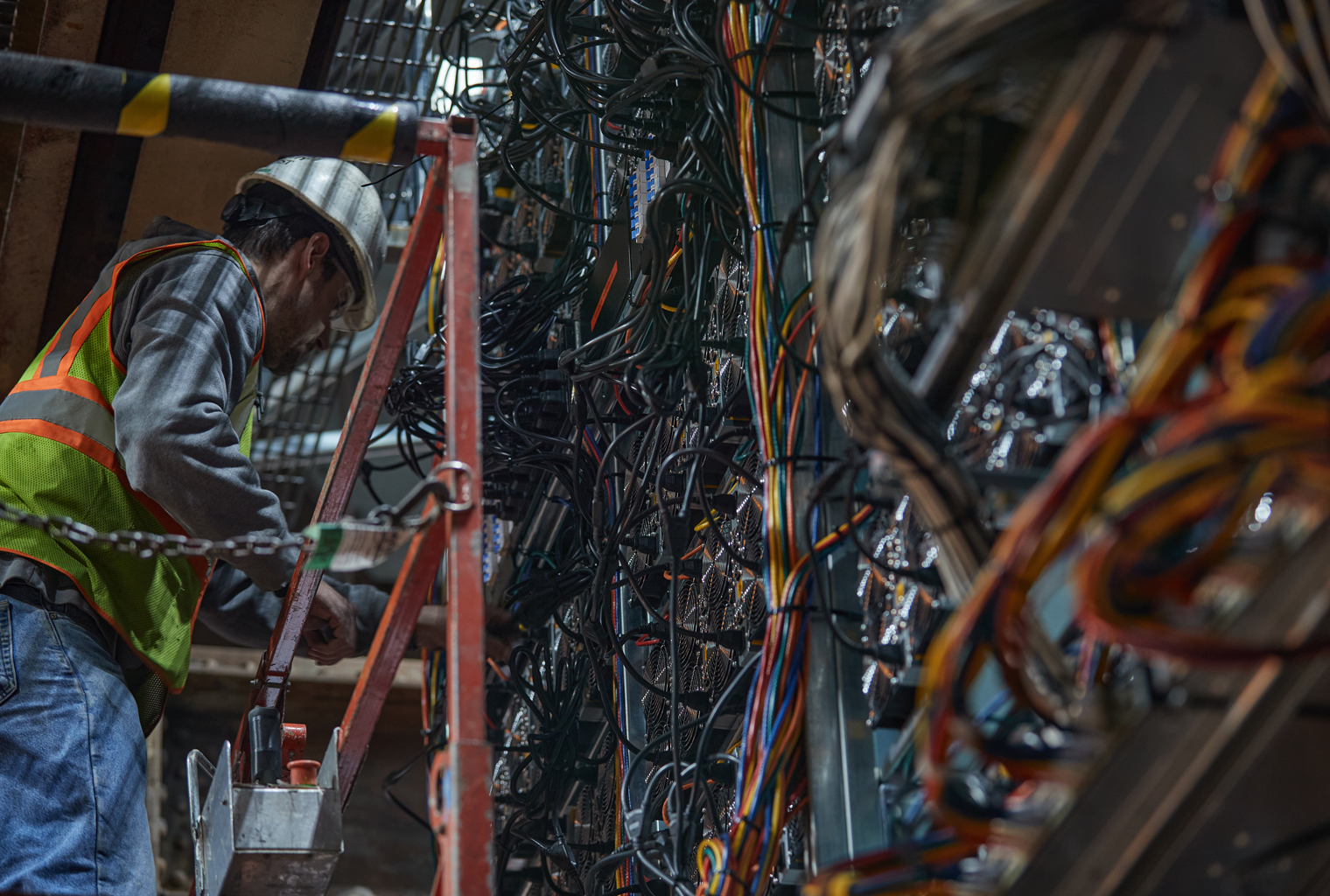

Bitcoin Going Industrial: New York-Based Natural Gas Provider Sells Fully Compliant ‘Hashpower Contract’

During the first week of March, news.Bitcoin.com reported on a $65 million investment into the ‘behind-the-meter’ bitcoin mining operation, Greenidge Generation LLC in Dresden, New York. The Greenidge plant operates 7,000 bitcoin miners and on April 8, the firm revealed the sale of 106 petahash of hashpower to an undisclosed buyer. The purchase is considered a watershed moment for bitcoin mining, as the institutional sale of hashpower indicates that mining operations are trending toward industrial solutions. Also read: Bitcoin Mining Helps Oil Companies Reduce Carbon Footprint ‘Behind-the-Meter’ Mining Operation Greenidge…

Bitcoin Going Industrial: New York-Based Natural Gas Provider Sells Fully Compliant ‘Hashpower Contract’

During the first week of March, news.Bitcoin.com reported on a $65 million investment into the ‘behind-the-meter’ bitcoin mining operation, Greenidge Generation LLC in Dresden, New York. The Greenidge plant operates 7,000 bitcoin miners and on April 8, the firm revealed the sale of 106 petahash of hashpower to an undisclosed buyer. The purchase is considered a watershed moment for bitcoin mining, as the institutional sale of hashpower indicates that mining operations are trending toward industrial solutions. Also read: Bitcoin Mining Helps Oil Companies Reduce Carbon Footprint ‘Behind-the-Meter’ Mining Operation Greenidge…

Coronavirus Crisis Accelerates CBDC Race, Cash No Longer Untouchable

The COVID-19 pandemic is pushing the global economy toward a major recession, but there may be a silver lining in all this for the crypto industry: The accelerated adoption of central bank digital currencies. The use of cash seems to be plunging these days — particularly now, as people are increasingly wary of engaging with potentially germ-infested surfaces. Meanwhile, some central banks are reevaluating their strategies in favor of digital currencies, which they believe may carry more benefits than just stopping the virus from spreading further. So, how likely are…

Expanding My Gold Mining Empire & Crafting Jewelry! – Hydroneer Gameplay

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Expanding My Gold Mining Empire & Crafting Jewelry! – Hydroneer Gameplay Today Camodo Gaming plays Hydroneer, This is a mining and base building … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Non-Stimulus Tax Rules You’ll Need This Year

The United States Internal Revenue Service delayed tax day this year from April 15 to July 15, and perhaps that means many Americans aren’t thinking about taxes during this very strange time. Indeed, they seem understandably focused on the variety of new government programs that comprise part of the CARES Act, enacted to try to boost the slumped economy and put some needed dollars in people’s hands. Related: IRS Delays Tax Day to July 15, Still Monitors Crypto The CARES Act includes provisions for checks for consumers and benefits for…

Binance Users Can Now Buy Crypto Using Debit Cards in 5 New Fiat Currencies

Cryptocurrency exchange Binance is enabling citizens in five further countries to buy cryptocurrency using Visa debit and credit cards with their national fiat currencies. The new service, announced April 10, will extend card support for the Colombian peso, the South Korean won, the Kenyan shilling, the Kazakhstani tenge and Peru’s neuvo sol. At launch, a total of five cryptocurrencies are available for purchase: Bitcoin (BTC), Ether (ETH), Binance Coin (BNB), XRP, Binance USD (BUSD) and Tether (USDT). A busy month Binance’s announcement — evidently a positive step for its international…

Anthony Pompliano says get ready for the bitcoin halving and price escalation to $100k

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io The bitcoin halving that is set to take place in May will be like “rocket fuel” for an already bullish asset, this according to Anthony Pompliano, host of The Pomp … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Fintech Lenders May Struggle to Qualify Under U.S. Gov’t COVID-19 Relief Plan

Nonbank fintechs may be left unable to contribute to the United States government’s relief plan for small businesses hit by the COVID-19 crisis. On April 3, the U.S. Small Business Administration (SBA) launched a Paycheck Protection Program (PPP) as part of the federal government’s $2 trillion coronavirus relief package. The PPP aims to support small businesses during the pandemic by providing them with access to low-interest, forgivable loans. The $349 billion loan program — specifically targeted at Main Street firms that need urgent liquidity to cover their payrolls and other…

Canada: Bitcoin (BTC) Fund 3iQ Scores Listing on Toronto Stock Exchange

Canadian digital assets investment firm 3iQ has announced the listing of its Bitcoin Fund on the Toronto Stock Exchange following the completion of its initial public offering. 3iQ Bitcoin Fund Finally Completes IPO According to a press release on Thursday (April 9, 2020), 3iQ merged with 3iQ Bitcoin Trust, with the Bitcoin Fund having an outstanding 1,491,800 Class A shares valued at approximately $14 million. The Class A units with the symbol QBTC.U. began trading on Canada’s largest stock exchange and targets different investors. An excerpt from the announcement reads:…