Maerki Baumann, an unlisted family-owned bank in Switzerland, is expanding its cryptocurrency services by introducing crypto custody and trading. Following regulatory approval from the Swiss Financial Market Advisory Authority, or FINMA, Maerki Baumann will be offering its clients the trading and custody of crypto starting from June 2020. Five crypto assets will be available at the launch Announcing the news on May 29, the Zurich-based private bank said that the launch of new crypto features comes in line with Maerki Baumann’s crypto strategy initiated in early 2019. As part of…

Day: June 1, 2020

The Fed Can’t Prop up the Housing Market Forever

Housing market forbearances leveled off in May, but lenders are still facing a huge cash shortfall. The Federal Reserve is pumping the housing market full of froth. The backlash will be jarring when baby boomers flood the market with supply. The U.S. housing market received another nugget of good news last week. The number of mortgages in forbearance suddenly leveled after swelling to an astonishing figure of 4.76 million loans – equivalent to $1 trillion in unpaid principal – in just two months. That’s a welcome sign for mortgage servicers,…

#BreakingBitcoin Market Analysis!🔴 Crypto & FOREX Live!🔴Tuesday Market Update!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io #BreakingBitcoin is going live this Tuesday for our daily #Bitcoin #crypto #FX #stocks technical analysis! Show Teaser Start 0:00:00 Bitcoin Analysis 05/11/2020 0:04:54 Forget the Halving, 9 reasons why to be bullish on BTC 0:41:28 Billionaire investor Paul Tudor Jones reveals 1-2% of his fortune is now in BTC 0:55:47 Bitcoin Halving Countdown Live 0:54:37 Signoff 4:21:54 Join us every weekday afternoon 12PM CST, 1PM EST10AM PST, 6PM UK. Subscribe for Daily Live Stream News Q&A & More! – – – Professional…

Target’s Stock Poised to Continue Rally Despite Rioting & Looting Across U.S.

Target is temporarily closing stores in 175 locations. Even amid closures, Target’s stock is likely to continue soaring. Target’s growth in the digital sector can compensate for the losses of non-performing locations. Retail giant Target (NYSE:TGT) announced it is temporarily closing hundreds of its stores amid widespread rioting and looting. While the shuttering of some of its locations may impact revenue in the near term, nothing is suggesting that Target’s stock will take a nosedive soon. Target to Scale Back on Operations as Protests and Riots Continue Target announced Saturday…

Bitcoin News Roundup for June 1, 2020

CryptoX is a multi-platform publisher of news and information. CryptoXtrade has earned a reputation as the leading provider of cryptocurrency news and cryptomarket analysis, bitcoin and other cryptocurrencies, blockchain technology, finance and investments. CryptoXtrade have become a known leader in the cryptocurrency information market. We work only with trusted information sources providing latest financial and technological innovations that improves the quality of life of CryptoX readers by focusing on Cryptocurrency and Blockchain. CryptoX Portal

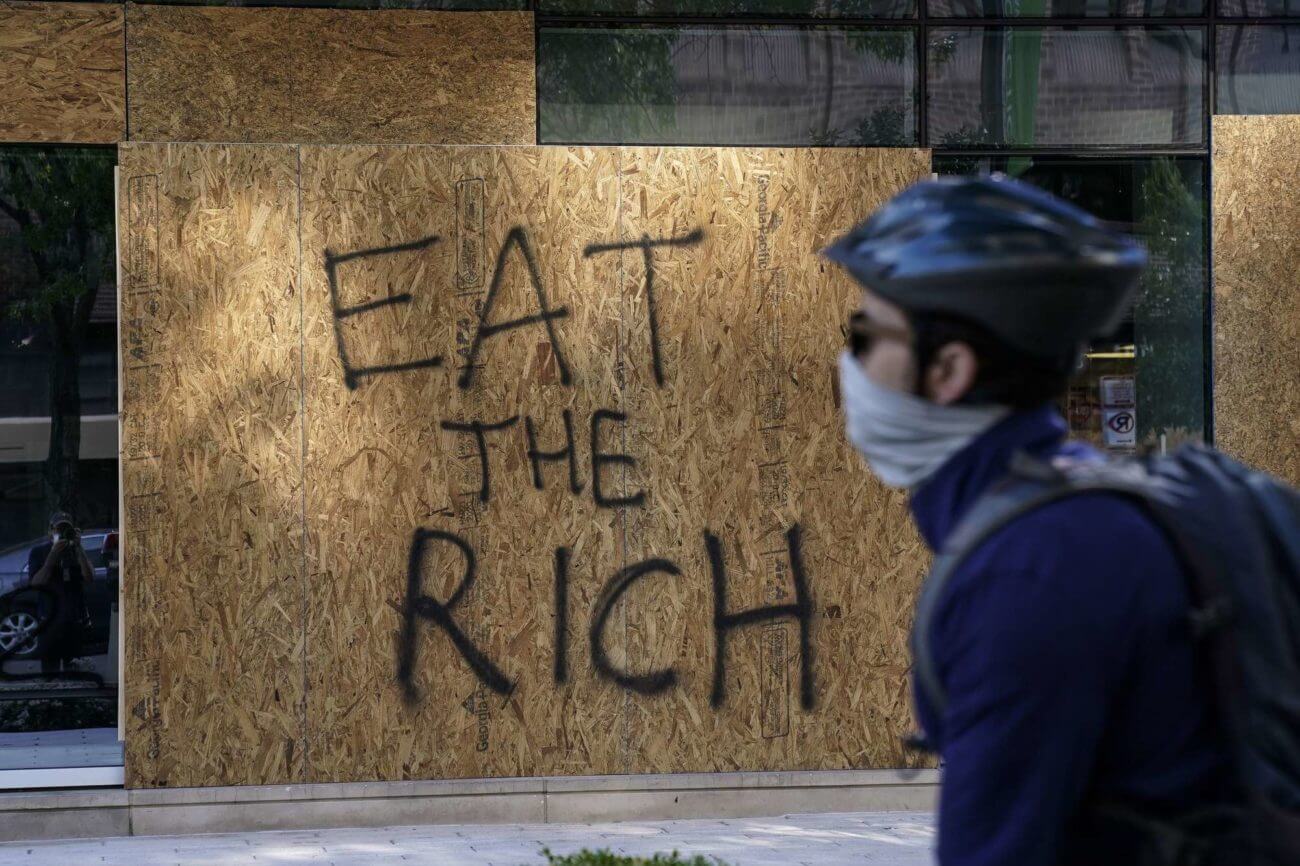

Why the George Floyd Riots Could Upend the Stock Market Recovery

The death of George Floyd ignited nationwide protests, which have been accompanied by more violent riots. Historically, riots of this scope indicate a shifting sentiment that eventually shows up in the economy and the stock market. This could be an ominous warning for the stock market recovery. America is burning. As the country emerges from pandemic lockdowns, riots have broken out in cities across the country to protest the death of George Floyd. That wasn’t the first racially charged death of the year either. Back in February, Ahmaud Arbery was…

The Dow Is About to Make Another Massive Move. The Question Is: Where?

CNBC’s 2020 Global CFO Survey reveals an extremely bearish outlook on the U.S. stock market, with more than half of respondents calling for the Dow to return below 19,000. The CFO outlook contradicts new forecasts from Goldman Sachs and Bank of America, whose models predict higher stock valuations. Stocks are coming off their second straight monthly advance. The Dow and broader U.S. stock market ended May with a second straight monthly gain, as investors continued to bet on a full economic reopening in the second half of the year. But…

WOW😱 2020-No Investment New Fast Bitcoin Cloud Mining Site Make Money Online

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io WOW😱 2020-No Investment New Fast Bitcoin Cloud Mining Site Make Money Online Please Subscribe My Channel More Earning Video Update share this video Site Link: //////////////////////////////////////////////////////////////////////////////////////////////////////// WOW😱 2020-No Investment Free Bitcoin Mining Site + Earn Every Day Free Bitcoins Make Money Online 1000 Subscribers + 4000 WatchTime | Promote Your Youtube Channel Free | Grow Youtube Channel Fast 😱OMG 0.1 Bitcoin Free !! New Free Site Launched With Proof Big Chance Win 1 BTC How To Earn Money 300$ Weekly YouTube Watch…

Blockchain Bites: Chase Class Action, 30 Words for Censorship and a Bitcoin Bug

Chase Bank has settled a class action lawsuit brought by defendants who claim the J.P. Morgan subsidiary overcharged credit card fees for crypto purchases. Meanwhile, a new report shows that a million “timelocked” bitcoin transactions are open to a hypothetical exploit, while CoinKite has unveiled a new way to recharge hardware wallets. You’re reading Blockchain Bites, the daily roundup of the most pivotal stories in blockchain and crypto news, and why they’re significant. You can subscribe to this and all of CoinDesk’s newsletters here. Top Shelf Chase Class ActionChase Bank has agreed…

Bitcoin Is a Big Opportunity for Investors in the Debt-Fueled Roaring Twenties

David G Leibowitz is Global Macro Portfolio Manager, CIO Lebo Capital Management, and co-founder of LeboBTC Ledger Group. I started my 39-year career as a Wall Street trader in the summer of 1981, watching the end (or the beginning, depending on your point of view) of the debt super-cycle, as Fed Chair Paul Volker raised the Federal Funds rate to 20% to cripple the 1970s energy-led inflationary spiral. Central bank actions – the raising and lowering of interest rates to fuel lagging economies or tame overly strong ones – were…