DeFi presented us the freedom to borrow finance, arrange loans, make deposits, and trade financial products without the need for any middlemen. But is it here to stay? Or maybe DeFi is just the next technology bubble? Decentralized finance (DeFi) has arrived, and considering the total value locked into DeFi rocketed from around $1 billion to nearly $10 billion in the space of three months, there’s every indication that it’s here to stay. However, the DeFi ecosystem has skyrocketed so rapidly that its power transcends just money – other assets…

Day: September 18, 2020

Blockchain Bites: Airdrops, Record Volumes, $1B BTC on Ethereum

There is now more than $1 billion worth of bitcoin on Ethereum, record-setting transaction volume is boosting Ethereum miners’ revenue and VeChain joins China’s food safety watchdog to build track and trace capabilities. Top shelf Token reflectionsUniswap’s decision to airdrop its new governance token was less about competing with its genetic clone SushiSwap, and more about building a community, CoinDesk’s Brady Dale reports. “I think it’s genius in every way,” Robert Leshner, Compound’s founder, said. “It brought a huge number of users into the fold.” Tokens were airdropped not just to liquidity…

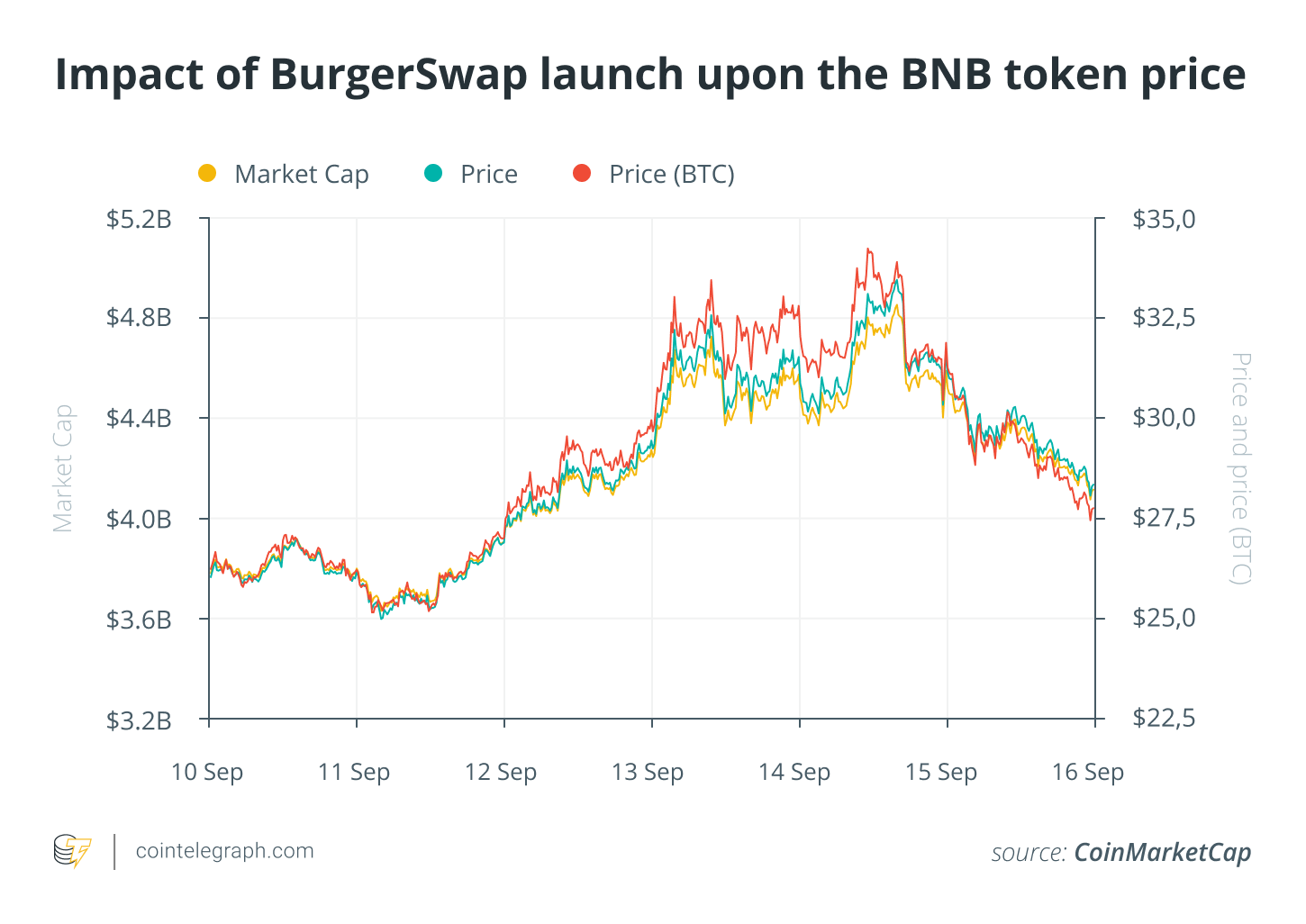

Why Binance Coin (BNB) Rose by 55% in 13 Days, Causing Demand to Soar

Binance Coin (BNB), the native token of Binance Chain and Binance Smart Chain (BSC), surged by 55% in 13 days. Some high-profile investors anticipated the strong performance of BNB following the release of BSC. The daily price chart of Binance Coin. Source: BNBUSDT on TradingView.com On September 12, Kelvin Koh at the Asia-based cryptocurrency investment firm Spartan Group, said BNB would likely rally due to staking. With the launch of Binance Smart Chain and the launch pool, it became possible for users to stake Binance Coin on Binance. That enables…

Top 6 DeFi Platform Options for Crypto Users to Grow Money

DeFi is continuously growing, however, only a few people in crypto world benefit from using such platforms. Here are Top-6 options that can be used to raise money in this way. Many crypto users have heard about DeFi and some of its better-known platform options. However, only a few crypto users are taking advantage of using these platforms. If they are looking for ways to make their crypto investments work for them it would be reasonable to consider DeFi platform options. Currently, Ethereum is the most well-established and largest, open-ended…

Firm Hoarding Its 2017 ‘Crypto Craze’ Documents

Nvidia’s representative noted that the plaintiff is a stakeholder of Nvidia and thus has an interest in the firm. Proceedings from the United States’ Delaware Court of Chancery on Sept. 17 have shown that American multinational technology company Nvidia Corporation (NASDAQ: NVDA) is unwilling to reveal its internal record documents during the 2017 crypto craze in its ongoing class-action lawsuit. Following allegations of misrepresenting facts and figures, Nvidia’s lawyers argued that the plaintiffs have failed to show a “credible basis” for why the company should be compelled to hand over…

Poloniex and KuCoin Partner to Accelerate Industry Innovation

Two exchanges, Poloniex and KuCoin, thatare known to be rivals on the market have taken a decision to become partners. They intend to co-invest in researching and to explore new industry opportunities together. Two of the industry’s best known exchanges have revealed they’ve entered into a partnership. Poloniex and KuCoin, once rivals for market share, are now partners intent on exploring synergies to grow their business and bolster innovation. While each platform will continue to plow its own furrow, opportunities for collaboration will be explored. Although exchange partnerships aren’t uncommon,…

BurgerSwap frying high — Binance offers up the latest dish on DeFi menu

The food-related craze for yield farming is showing no sign of abating. So far this year, the crypto space has been treated to Yam, Shrimp, Spaghetti, Cream, and of course, the most-talked-about dish of recent weeks — Sushi. Next up on the menu is BurgerSwap, the latest decentralized exchange that aims to improve upon Uniswap with a different incentive model and community governance. It’s essentially a clone of SushiSwap, with some variations and one significant difference. BurgerSwap is the first of its kind to be developed on the EVM-compatible Binance…

Blog: Data protection considerations and the NHS COVID-19 app

18 September 2020 Information Commissioner Elizabeth Denham talks about the regulatory work the ICO has been involved in regarding the England and Wales NHS COVID-19 app. One of the themes of the ICO’s recent work is the use of tech innovation to respond to the challenges prompted by COVID-19. As a regulator, we have an important role to play in those projects, both by enabling progress that can help society, and by protecting the people whose data – and trust – such projects rely on. Our engagement around the England…

Argentina’s Peso Plunges After Central Bank Tightens Foreign Exchange Controls: Citizens Discuss Bitcoin Adoption

The Argentine peso plunged by more than 10% shortly after the country’s central bank announced measures to tighten controls on the movement of foreign currency. The peso, which is officially pegged at 72 for every USD, touched new lows of 145 to the greenback on the black market. The latest plunge is seen as a further boost to bitcoin and other cryptocurrencies in a country that has been plagued by currency challenges for over a century. Still, in a statement released on its Spanish language website, the Board of the…

Snowflake IPO Left $3.8B on the Table, Largest Amount in 12 years

Since the 2008 Visa IPO, Snowflake has so far made the largest “money left on the table”. In its debut on Wednesday, the cloud-based data management firm Snowflake Inc (NYSE: SNOW) held the biggest IPO so far in 2020, where shares jumped 112%. Investors benefited from a $120-per-share offering price on their investments, which was much higher (about 41% higher) than the price market earlier this month. Earlier backers – such as Sutter Hill and Altimeter Capital – also benefited in a bigger way as they got several times out…