With bitcoin at risk of falling to four figures and new guidance from the OCC, CoinDesk’s Markets Daily is back for your latest crypto news roundup! Bitcoin risks falling into four figures on a continued sell-off in equities and rebounding U.S. dollar. A digital euro for retail payments would “ensure that sovereign money remains at the core of European payment systems,” according to Legarde. The U.S. OCC has published fresh guidance, officially clarifying national banks can provide services to stablecoin issuers in the U.S. In a case involving the ownership…

Day: September 22, 2020

Bentley Systems Increases IPO Price Range to Raise $225 Million

Software development company Bentley Systems has revised its share price to between $19 and $21 per share as it is going to raise $225 million in IPO. On Tuesday, Bentley Systems Inc reviewed the price range target for its upcoming initial public offering (IPO). With the new price target, the company’s valuation could increase to $5.49 billion. On the 15th of September, the company published a press release to announce its IPO. According to the report, Bentley Systems would be offering 10,750,000 shares of its Class B common stock. At that time,…

Bitcoin-on-Ethereum Token tBTC Relaunches Following Buggy Debut in May

A decentralized way to copy bitcoin (BTC) over to Ethereum is relaunching today after a smart-contract bug sunk the project in May. Called tBTC, the Thesis-built protocol was first announced in April, and is now ready for a fresh start. BTC holders who want to use Ethereum but worry about censorship risk with BitGo’s WBTC are invited to deposit BTC and mint TBTC tokens. Putting bitcoin on Ethereum gives the godfather cryptocurrency access to the yields of decentralized finance (DeFi) and has taken off in earnest since tBTC’s aborted launch.…

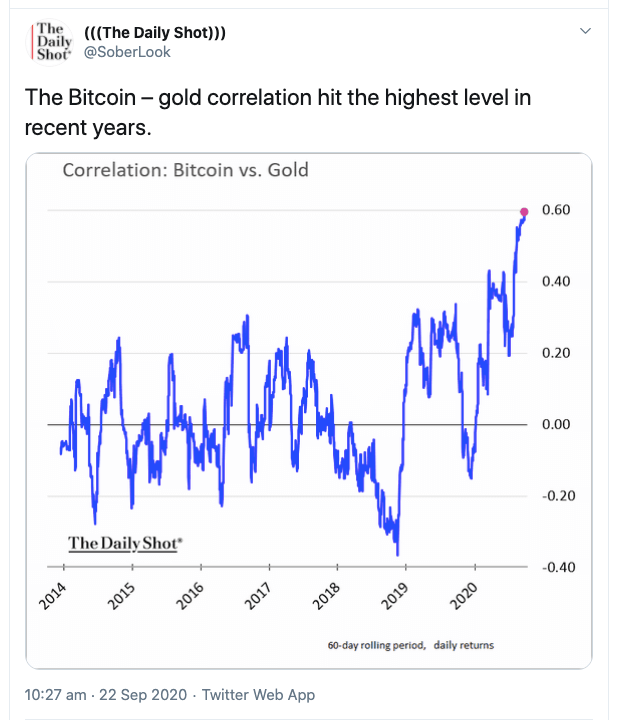

Bitcoin-Gold Correlation Hits Record High as Institutions Buy Crypto

The bitcoin-gold correlation has hit record levels, according to data from The Daily Shot, CoinMetrics, and skew. The correlation is being driven by economic and stock market turbulence, with institutional investors increasingly treating bitcoin as a haven hedge against inflation. Correspondence between gold and bitcoin prices will last for as long as the global economy continues to suffer Covid-19 fallout. The bitcoin-gold correlation has hit its highest level on record, according to data from financial newsletter The Daily Shot. The level now stands at 0.6, with data from other sources…

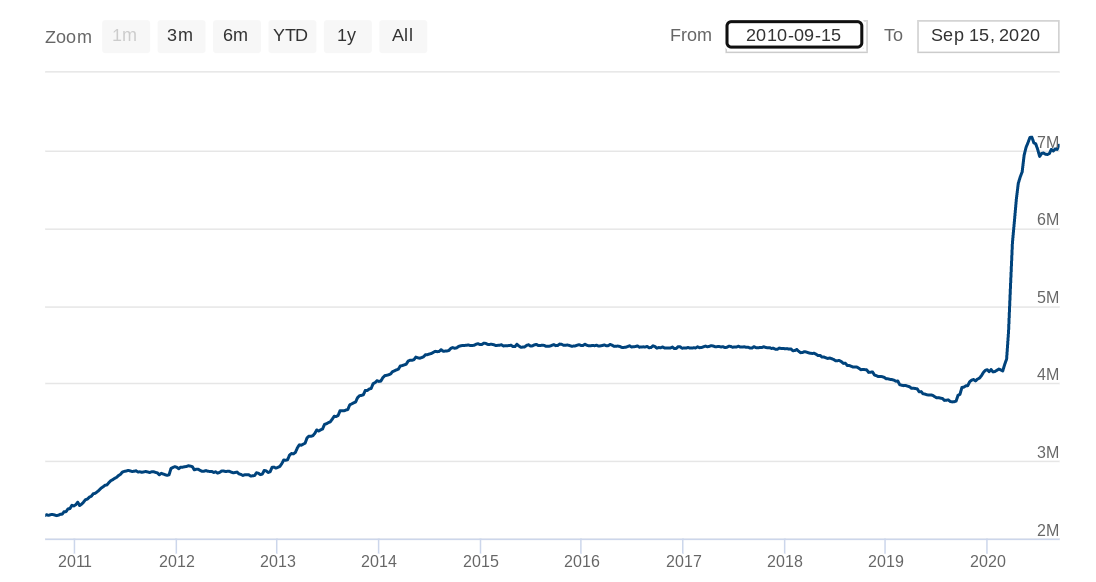

Pi – Is it worth all the hype?

Since its launch on March 14, 2019, more than 7 million people have hopped on the crypto bandwagon backed by a team of Stanford PhDs. But would a coin allegedly mined on your phone make you rich in the long run? By the time you finish reading this piece, you should be able to find out what the hype is all about. The official app says that Pi is not ‘free money’; its success depends on the collective contribution of its members and that it gives everyday people greater access…

Airbus (AIR) Stock Dips 2% as Uncertainty Surrounds Firm’s Job Cut Plan

Airbus CEO Guillaume Faury has disclosed that the company may pursue job cuts. AIR stock is down today, trading at around 63 EUR. Netherlands -ased aircraft manufacturer Airbus SE (EPA: AIR) has lost about 2% of its stock value as the company reiterated through its Chief Executive Officer Guillaume Faury that the company cannot ascertain there would not be compulsory lay-offs as it fights to cut costs following the recovery from the first wave of the coronavirus pandemic. As reported by Reuters, Faury made this known while speaking to French…

Earth needs Bitcoin as economy hits ‘debt saturation point’ — Keiser

The world now has so much debt that, for the first time ever, it is impossible to add more, says Max Keiser. On the latest edition of his Keiser Report TV show on Sep. 22, the RT host warned that central banks were responsible for global debt reaching a new “inflection point.” Keiser on debt: “We’re at saturation point” Together with co-host Stacy Herbert, Keiser referred to comments from Singapore’s central bank, the Monetary Authority of Singapore (MAS), which last week warned that copying economic recovery methods after World War…

Digital Euro Will Not Replace Cash, Will Provide Alternative to Cryptos

Christine Lagarde said that fiat is still going to play important role in the future of finance even though the ECB has not taken its decision on the CBDC for the region. The president of the European Central Bank (ECB) Christine Lagarde has stated that any CBDC developed by the EU would not be a replacement for fiat. The bank’s president spoke on the digital euro this during the Franco-German Parliamentary Assembly on September 21. Lagarde said that the EU apex bank has been studying operational challenges associated with a…

EY May Witness Client Defections Following Wirecard Woes

EY subsidiary in Germany has been Wirecard’s trusted auditor and with KfW accounting records under scrutiny by the German government the bank has indicated its readiness to drop EY in order to avoid conflict of interest. Ernst and Young Global Limited (EY), one of the world’s big four accounting firms may be experiencing a strain in its business relations in Germany following its role in the Wirecard AG (ETR: WDI) scandal. As seen on The Straits Times, KfW, Germany’s third-largest bank by assets, may drop Ernst & Young as its…

First Mover: Bitcoin’s Latest Sell-Off Gets Crypto Traders Mulling Election Chaos

In seeking to explain Monday’s sell-off across traditional markets and cryptocurrencies, the digital-asset firm QCP Capital rattled off a list of seven major market events that occurred in Septembers past, from the 1929 stock-market crash to the Lehman Brothers bankruptcy in 2008. There might be some deep human connection with the fall equinox — when the days turn shorter than nights in the northern hemisphere and summer turns to fall, according to the firm. “The human nervous system typically undergoes major measurable perturbations” during this period, QCP wrote Monday in its daily market update. …