MakerDAO has voted not to compensate victims of the “Black Thursday” flash crash, a former Pantera partner is launching a new crypto-focused hedge fund and bitcoin may be headed to the doldrums as the U.S. dollar rises. Top shelf Decentralized governanceMakerDAO will not compensate victims of March 12’s “Black Thursday” flash crash that left some of the decentralized finance (DeFi) platform’s investors out $8.33 million, according to a vote that closed Tuesday. Large MKR holders dominated the vote as only 38 unique votes (8.74% of MKR holders) were cast, CryptoX’s Will Foxley…

Day: September 24, 2020

Bitcoin may see relief rally to $11K after Dollar Strength Index soars

The price of Bitcoin (BTC) has been stagnating in recent weeks, as it couldn’t break above $11,000 and couldn’t drop below $10,000, the ultimate sign of a continued range-bound structure. Such a range-bound and sideways structure could strengthen some relief on the markets, as the altcoins — especially the DeFi sector — have seen massive selloffs in recent weeks. However, what’s next for Bitcoin as the futures expiration day is tomorrow, which most likely will cause short-term volatility? Bitcoin is still waiting to fill the CME gap as the downtrend…

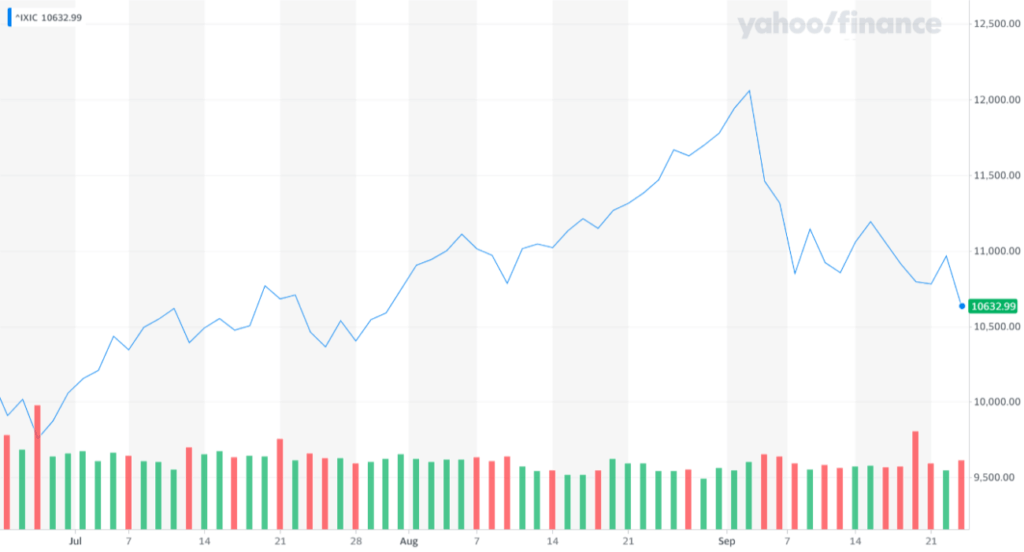

Even the Fed’s Desperate Reassurance Isn’t Saving the Nasdaq Correction

Fed Vice Chair Richard Clarida said the central bank would retain low interest rates and let inflation run higher than 2% at times. The Fed’s reassurance isn’t helping the Nasdaq, which has declined by 11.8% since September 2. Investors remain rattled by the pandemic-induced correction despite the Fed’s dovish stance. Federal Reserve Vice Chairman Richard Clarida reaffirmed the central bank’s stance on keeping interest rates at record lows. The Fed’s reassurance doesn’t appear to be soothing investors as the Nasdaq Composite continues to plunge. Tech-heavy stock indices have recorded the…

BitGo Is Bringing DeFi-Friendly Wrapped Bitcoin to the Tron Blockchain

Tron, the blockchain launched in 2017 by former Ripple devotee Justin Sun, has entered a strategic alliance with custody specialists BitGo. The partnership will bring wrapped bitcoin (WBTC) and BitGo’s newly-minted Wrapped Ether into the Tron ecosystem as TRC-20 tokens. (Both are ERC-20 tokens backed 1:1 by bitcoin and ether, respectively, and held at BitGo Trust, a qualified custodian in the U.S.) The introduction of WBTC and Wrapped Ether are to help fuel the incipient decentralized finance (DeFi) ecosystem on Tron. WBTC has been a key driver in the growth…

Cryptocurrency: Tips on Trading Picks

Read this article to learn more about cryptocurrencies and trading as we’ll share our top tips. The cryptocurrency market is decentralized, meaning it is not backed by a central authority like a government or a central bank. It first appeared in 2009 after the introduction of Bitcoin, and it runs across a network of computers as cryptocurrencies are stored on the blockchain and exist only as a digital record. Today, there are multiple cryptocurrency markets as the industry continues to grow and more individuals are opting for crypto payments because they are…

Bitcoin Continues Bearish, Ethereum Breaks below Key Support

The flagship cryptocurrency continued on a downswing on Tuesday. The BTC/USD pair started the trading day with a moderate decline toward $10,400 off the open at $10,537. Later on, the price recovered the loss, having bounced up to $10,560 at midday, but being pressured by a local resistance level on the hourly chart, the price slipped lower under the bear sentiment and below the local at around $10,440 in the evening hours of the day. Near 21:00 UTC Bitcoin slipped to $10,150, where the 0.618 Fibonacci level is positioned, but…

Fed Releases Workplan for Updating Payment Systems amid Coronavirus

In a bid to deliver the best to compete with the Chinese model and possibly retain the dollar global reserve currency status, the Fed is working closely with other institutions. The Fed through the Federal Reserve Bank of Cleveland released a detailed work plan indicating how it anticipates seeing the payment systems updated amid the coronavirus pandemic. According to Loretta J. Mester, President and CEO of the Federal Reserve Bank of Cleveland, who spoke during the 20th Anniversary Chicago Payments Symposium, there are plans to digitize the dollar through the…

ByteDance Applies for Tech Export License in China

ByteDance is now in talks with Oracle Corporation and Walmart Inc over the acquisition of TikTok. Approval of both the U.S. and Chinese governments is necessary. TikTok parent company ByteDance has reportedly applied for a tech export license in China. The company submitted the application following China’s revision of its list of technologies subject to export bans or restrictions. While ByteDance is waiting for the decision of Beijing’s municipal commerce bureau over the tech export license, there are rumors about the connection between the application and the ongoing deal over TikTok’s…

WeWork China Sells Majority Stake to Trustbridge Partners

As WeWork China continues to cut costs globally, Trustbridge Partners has invested $200 million to own a majority stake in the company. As a result of the investment, a Trustbridge Partners’ executive becomes CEO. WeWork recently sold the majority stake in its China business to a group led by investment firm Trustbridge Partners. The new sale is one of the office space provider’s efforts to cut global costs. Though WeWork now has a minority stake in its Chinese business, it will continue to receive an annual license fee. WeWork China…

Robinhood Raises $660M via Series G Funding

Robinhood will use the raised capital to support its core product and enhance the customer experience. Per the Robinhood spokeswoman announcement on September 23, the latest funding surge out of the Series G funding round has raised the corporation valuation of the fintech to $11.7 billion. In August, D1 Capital Partners, New York-based hedge fund, had invested $200m in Robinhood – according to the company’s announcement. Therefore, the latest funding is just an extension of the first Series G round. Ribbit Capital, Andreessen Horowitz, 9Yards Capital, Sequoia, and DST Global…