Cryptocurrency exchange and custodian Gemini announced on Thursday that its UK users, individual and institutional, will now be able to trade and store crypto using the Pound sterling (GBP). Source AcceptedAddsBritishFiatsGeminiPoundRegistrationUKwatchdog CryptoX Portal

Day: September 24, 2020

Key Reasons Why Bitcoin Could Nosedive Below $10,000 In Near-Term

Bitcoin price failed to correct higher and declined further below $10,200 against the US Dollar. BTC remains at a risk of more downsides below the $10,000 support. Bitcoin broke the $10,250 and $10,200 support levels to move further into a bearish zone. The price is now trading below $10,300 and the 100 hourly simple moving average. There was a break below a connecting bullish trend line with support near $10,440 on the hourly chart of the BTC/USD pair (data feed from Kraken). The pair is currently correcting higher, but the…

Bitcoin’s realized cap is now $43 billion above the 2017 all-time high

Crypto market data aggregator Glassnode has published data indicating that Bitcoin’s (BTC) realized capitalization has increased by more than 50% since tagging its all-time high of $20,000 at the end of 2017. The realized capitalization metric measures the value of each BTC when it was last moved on-chain, which enables analysts to estimate the aggregate cost-basis of market participants. However, coins on centralized exchanges are absent from the metric, indicating the data is probably more accurate in terms of the cost-basis of long-term investors rather than intra-day speculators. Bitcoin’s realized…

BCH Hash Watch: Majority of Miners Signal BCHN, Coinex Exchange Announces Futures

Bitcoin Cash proponents have recently noticed that the last 612 blocks or more than 61% of the last 1,000 blocks have been mined using BCHN, according to Coin Dance statistics. Moreover, data also shows that 82% of Bitcoin Cash hashpower is signaling BCHN, as the prominent miners Btc.com and Antpool have started signaling. BCH fans are patiently waiting as there’s 53 days left until the November 15th Bitcoin Cash upgrade. News.Bitcoin.com reported on September 1, on how there’s a high chance the BCH blockchain will bifurcate into two networks. At…

Bitcoin Fundamental Expert: “Clarity” Comes After “Rocky” Election Ends

An expert in Bitcoin fundamental analysis claims that although the cryptocurrency is bullish currently, things could get “rocky” until after the US Presidential Election concludes. But as soon as the winner is chosen, the “clarity” combined with the asset’s halving has in the past provides “solid” foundation for each new bull run to begin. Bitcoin Halving In The Past, Fundamentals Build On Bullish Base Bitcoin’s halving is now months behind us, and its time for the stock-to-flow model to prove itself, or fall victim to lengthening cycle theories. Thus far,…

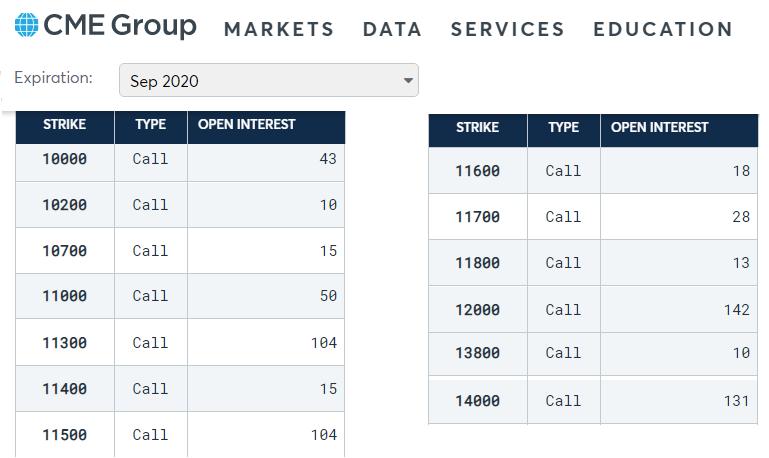

Bears reign as 86% of September’s $284M CME Bitcoin options are worthless

As of now, the $622 million total open interest for BTC futures expiry on Friday seems quite relevant. This Friday, a total of $100 million in CME Bitcoin (BTC) options are set to expire. 58% of these are call (buy) options, meaning buyers can acquire BTC futures at a fixed price. As the expiry draws near, call options 10% or higher above the current BTC price are deemed worthless. Therefore, there’s not much to gain in rolling over this position for October. September CME call options open interest (contracts). Source:…

Revealing crypto exchange’s physical location was not harmful, court rules

A federal judge has ruled that an employee who revealed the location of a major crypto exchange did not violate its trade secrets. According to court records filed Sept. 22, U.S. District Judge Maxine M. Chesney has dismissed a lawsuit filed by Payward Inc. — the owner of Kraken — against former employee Nathan Peter Runyon for misappropriating “trade secrets” by publicly disclosing the exchange’s physical address in San Francisco and accessing one of the company’s protected computers. The Judge ruled that Payward was not alleging Runyon used the address…

This US Dollar Fractal Predicts Bitcoin Is on the Verge of a Strong Surge

The common narrative shared over recent months is that Bitcoin is adversely affected by increases in the value of the U.S. dollar. Case in point: when the dollar began to spike in February and March, BTC began to tumble lower, as did the S&P 500 and the price of gold. More recently, when Bitcoin topped in August, the U.S. dollar was in the middle of a dead cat bounce. But over recent days and weeks, the two markets have begun to disconnect. Bitcoin has somewhat flatlined as the U.S. Dollar…

Chainlink Reaches Critical Support as Analysts Forecast a Strong Rebound

Chainlink’s price action has been quite grim as of late, with it facing unusual inflows of selling pressure as investors begin jumping ship. The mass exodus of capital away from the cryptocurrency has caused its price to decline from highs of $20.00 that were set just a matter of weeks ago, to lows of $7.80 tapped earlier today. This is a significant decline and indicates that the previously bullish altcoin’s macro market structure is beginning to degrade. It is important to note that LINK has seen parabolic advances and drawbacks…