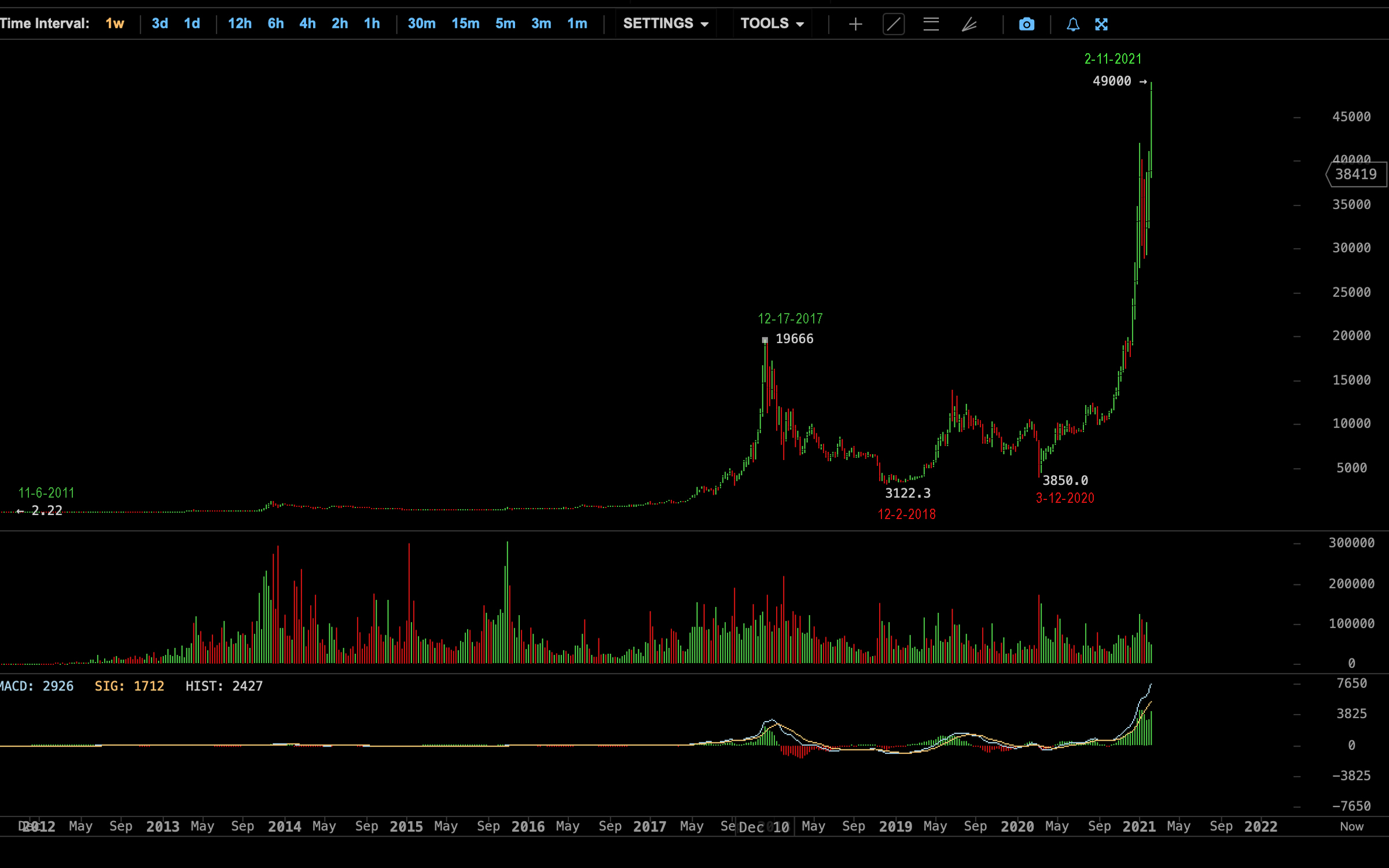

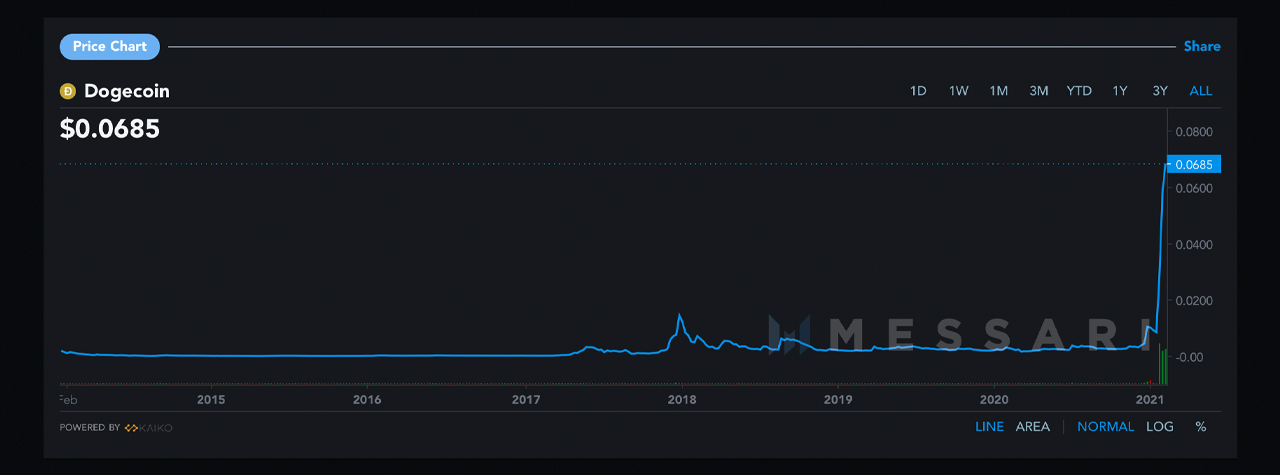

During the end of 2020 and into 2021, a great number of digital assets have seen significant gains and the bearish season that followed 2017 has turned its course. Bitcoin touched an all-time price high on February 11, 2021, reaching $49k per coin and three-month stats show bitcoin is up 198%. Despite the phenomenal 90-day gains, numerous alternative crypto assets have seen much larger increases. The infamous dogecoin, for instance, has spiked 2,322% during the last three months.

Crypto Asset Market Performances in 2021

Bitcoin and the crypto economy has steadily surpassed the $1 trillion valuation mark and on Friday, February 12, 2021, the crypto market capitalization of all the coins in existence is worth $1.41 trillion. The day prior, bitcoin (BTC) reached another all-time high (ATH) on Thursday touching approximately $49,000 per unit.

BTC has seen some significant gains this year, and the crypto asset has increased 149.16% since the ATH in 2017. Bitcoin has captured 198% in gains during the last 90 days and bitcoin’s dominance index is 61.1% on Friday. This means that even though BTC has jumped massively in value, alternative crypto assets have seen bigger price increases.

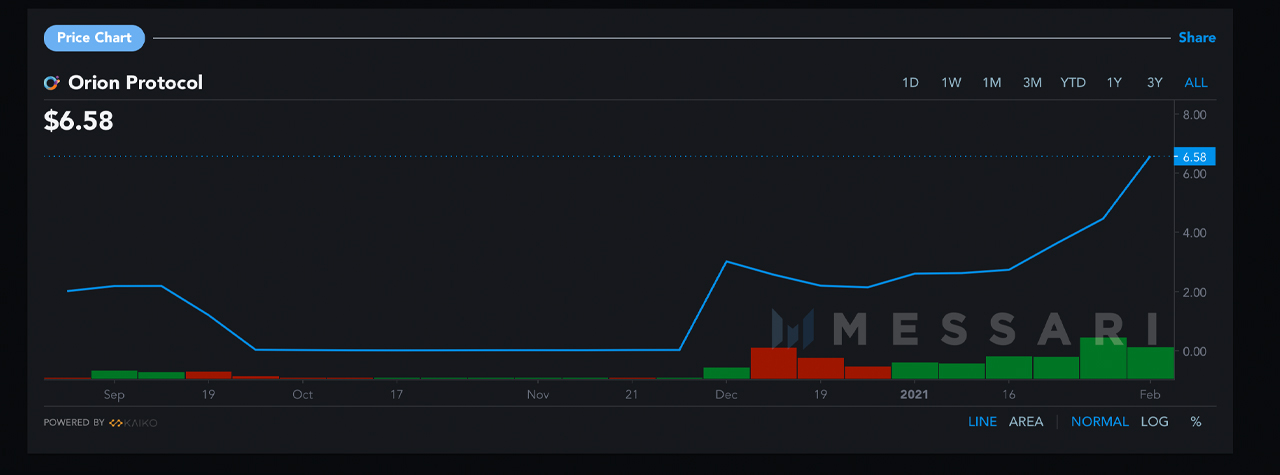

As mentioned above, dogecoin (DOGE) has seen incredible gains during the last three months jumping 2,322.09% in value during that time frame. DOGE is the second biggest gainer over the last 90 days, but the orion protocol token (ORN) has increased by a whopping 50,641.88% to date.

It would be difficult for any crypto assets to match ORN’s jump, but there’s a slew of other alternative assets that have seen very large 90-day gains. Below the meme-token dogecoin is telcoin (TEL), which has gained 2,281.63% in 90 days.

A number of other notable token assets climbing the ranks include sushiswap (SUSHI 1,446.24%), avalanche (AVAX 1,285.09%), and cardano (ADA 1,226.06%). The biggest losers during the last three months include coins like aced (ACED -98.85%), wavesgo (WGO -84.75%), and digitex futures (DGTX -79.86%).

As far as the changes versus the U.S. dollar from 2020 until now, bitcoin (BTC) has gained 301.46%. The biggest top ten positioned token that has seen the largest USD gains since the start of 2020 is ethereum (ETH) which has jumped 463.55% since then.

But during the course of 2020 up until now, a number of other coins have seen way bigger gains. For example, messari.io data shows since the start of 2020, game stars (GST) increased by 68,928.03%, and the token zap (ZAP) has gained 5,716.86%.

Some coins have lost over 90% of their values since 2020, as tokens like jibrel network (JNT), thore cash (TCH), educare (EKT), omnitude (ECOM), and ors group (ORS) has lost between -94.98% to -98.49% in value.

Analysts Expect ‘More Uptake as a Result of Mainstream Attention’

The crypto economy jumped in value significantly after Elon Musk’s Tesla revealed it had purchased $1.5 billion in bitcoin (BTC). Additionally, Musk has been discussing the meme-based crypto-asset dogecoin (DOGE) on a regular basis.

Optimistic news that proponents are also discussing is Mastercard’s recent crypto support announcement, Jay Z, Lil Wayne, and Jack Dorsey donating 500 BTC to fund bitcoin development teams in Africa and India. Moreover, the oldest financial institution in America BNY Mellon will be offering cryptocurrency services.

“A game-changing week for cryptos’, David Mercer, CEO of LMAX Group told news.Bitcoin.com. “Musk has just ripped up the old roadmap for corporate treasurers everywhere. Financial institutions are now preparing to follow their clients. We’re starting to see institutions drive disruption, which is the start of an exciting journey. What’s undeniable is that cryptos are now becoming an accepted destination.”

Broctagon Fintech Group feels the same way, as the CEO Don Guo also discussed all the positive announcements this week.

“BNY Mellon’s and Mastercard’s introduction to the cryptocurrency space, following the recent Tesla news, signals another price boom for bitcoin,” the Broctagon Fintech Group executive wrote. “Such a big institutional endorsement will propel digital assets even further into the main stage this year, and we expect further uptake as a result of the mainstream attention.”

What do you think about the past three months of crypto-asset price changes? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tesla, BNY Mellon, Mastercard, City of Miami, Messari.io, Bitcoinwisdom.io,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.