A 177-year-old bank in Switzerland has enabled cryptocurrency trading within its services, with expectations to expand. Bordier & Cie SCmA added bitcoin and other cryptos to its list of services by partnering with a well-known domestic crypto player. Bordier Customers Can Also Buy and Hold Other Cryptos According to the announcement, the Swiss bank, founded in 1844, argued that a surge in demand from their clients encouraged them to include cryptocurrencies. Bordier & Cie SCmA management believes that they needed to diversify into “alternative asset classes such as digital assets.”…

Day: February 26, 2021

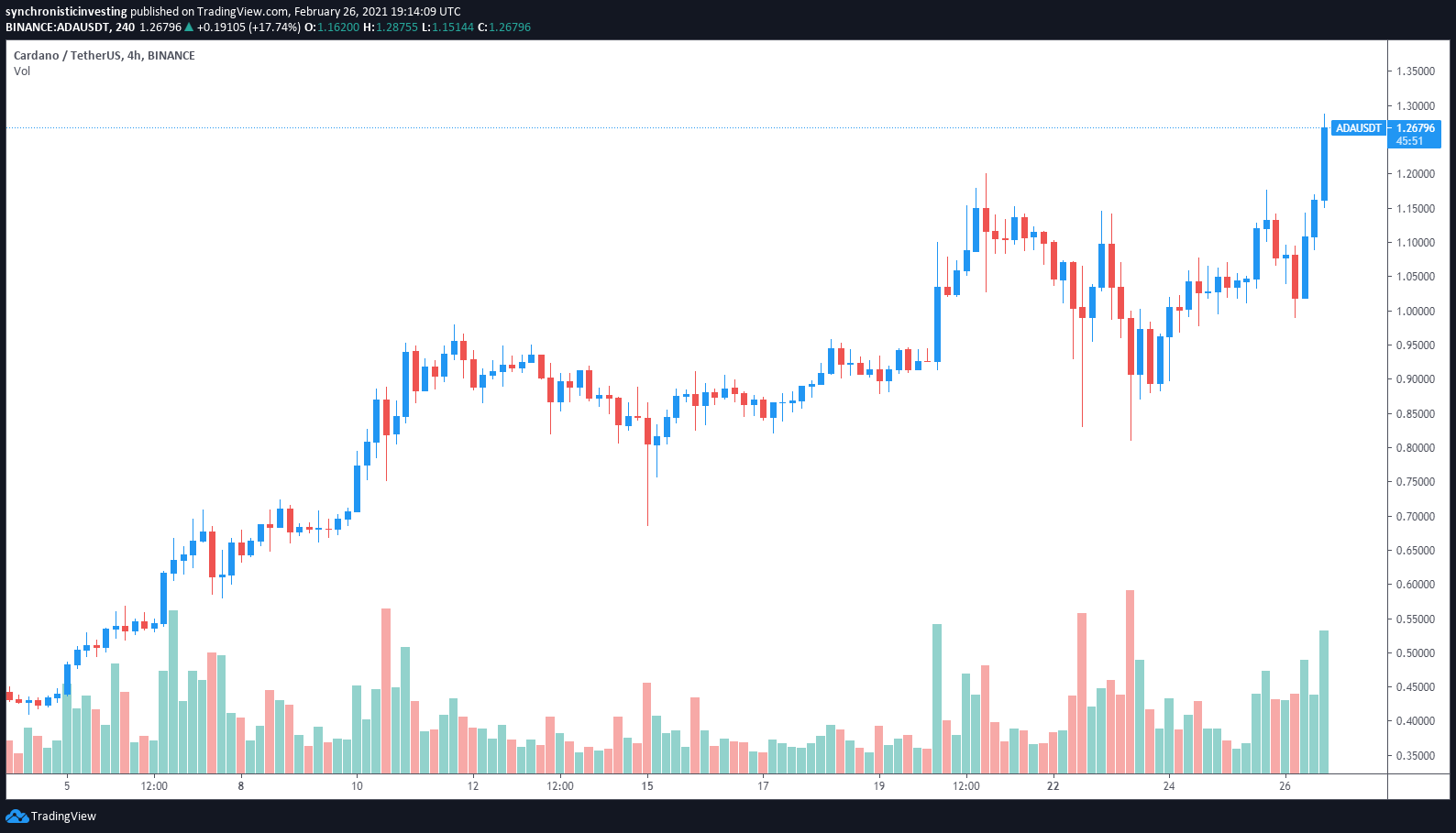

Cardano is now a top-three cryptocurrency as ADA price soars 27% in 24 hours

Cardano (ADA) received a fresh wave of optimism and buying volume on Feb. 26 that pushed the price of ADA to a new all-time high of $1.29, making Cardano the third-ranked cryptocurrency by market capitalization. Data from Cointelegraph Markets and TradingView shows that ADA surged 27% from a low of $0.98 during the early trading hours on Feb. 26 to its new high at $1.29 on record trading volume. ADA/USDT 4-hour chart. Source: TradingView Momentum for the project has been building throughout the month of February following the integration of…

Dan Morehead: The Next Phase of the Crypto Bull Market (w/ Raoul Pal)

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Dan Morehead, CEO and founder of Pantera Capital, joins Real Vision CEO Raoul Pal to discuss the current macro setup and its relationship to crypto as well as why this crypto bull market is different from the last and what the potential benefits could be from incoming regulations. Morehead explains what the focus at Pantera Capital has been over the past several months, including what he expects to outperform in the crypto sector. He also describes how he sees the crypto ecosystem…

JPMorgan Strategists Suggests Investors Allocate 1% Into Bitcoin

Strategists at U.S. investment banking giant JPMorgan suggested that investors should consider allocating a small percentage of their portfolio to bitcoin. The strategists’ comments come amid an increase in bitcoin adoption by institutional investors. Strategists Say Bitcoin is a Hedge According to Bloomberg on Thursday (Feb. 25, 2021), strategists Joyce Chang and Amy Ho in a recent note to clients stated that investors should diversify their investment portfolio by including bitcoin. Chang and Ho in their note suggested that investors allocate one percent of their portfolio to bitcoin and other…

Expanding my BITCOIN MINING COMPANY in ROBLOX

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Become an Official Fool: Support me and enter my Star code “SENIAC” when you buy Robux at Subscribe: Second Channel: Twitch: Discord: Facebook: Twitter: Instagram: Seniac Store: ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Galaxy Digital co-president explains two things deterring institutional crypto buying

In recent months, companies such as MicroStrategy and Tesla have picked up sizable positions in Bitcoin. This trend has not yet become the norm for most companies, however. Damien Vanderwilt, co-president of Galaxy Digital, believes security and taxes may be acting as deterrents for crypto investing. “When we think about the conversations we have with corporates, and institutional clients, and any part of those constituencies considering investing in the sector, the first order problem is safety and are the assets that they’re buying going to be safe and available and…

Price analysis 2/26: BTC, ETH, ADA, BNB, DOT, XRP, LTC, LINK, BCH, XLM

Bitcoin and most major altcoins remain rangebound with the exception of Cardano. Every bull market witnesses periodic pullbacks, where the weaker hands sell anticipating a top and the stronger hands accumulate for the long term. Data from Coinbase Pro shows two large Bitcoin (BTC) outflows this week, suggesting that institutions are likely continueing to buy the current dip. Comparing historical data, on-chain analytics resource Whalemap, recently said that previous macro tops in Bitcoin in 2017 and 2019 coincided with thousands of large Bitcoin transactions worth $5-7 million. However, the researchers…

Delphi Digital launches Labs wing to bolster portfolio company development

Why wait for one of your investments to release a new feature when you can just build it yourself? Delphi Digital’s newly-announced expansion aims to do just that. The cryptocurrency investment, media, and research company is now adding a Labs department which will be focused on contributing to Venture portfolio company development. 0/ We’re happy to announce the next stage in @Delphi_Digital‘s evolution: Delphi Labs Our goal with Delphi Labs is simple: to become the leading contributor helping to build out the decentralized futurehttps://t.co/DEmgfPORmQ — Delphi Digital (@Delphi_Digital) February 26, 2021…

Komodo launches AtomicDEX beta bringing atomic swaps to Ethereum and Bitcoin

The Komodo project launched on Friday the public beta of its latest product, AtomicDEX. The platform seeks to enable trustless atomic swaps between different blockchains, currently connecting Ethereum and its tokens to blockchains like Bitcoin, Litecoin and Dogecoin. Using atomic swaps allows users to trade directly with the native tokens. Someone buying Ether (ETH) with Bitcoin (BTC) would just exchange ownership of the respective coins on their blockchains, without having to use intermediary tokenized representations. The integration comes within a dedicated multiblockchain wallet built by Komodo, which includes the atomic swap…

Fetch.ai spinoff launches decentralized commodities exchange

Mettalex, a spinoff project of Fetch.ai, announced Friday that it has officially launched a decentralized exchange for commodities trading, offering another compelling use case in how blockchain technology was disrupting traditional finance. The new exchange aims to disrupt the commodities market through blockchain applications and other emerging technologies, such as machine learning and IoT. Mettalex has been designed to improve upon existing automated market makers and blockchain oracles. The company says its automated market markers act as a party to all trades and ensure that the platform is fully collateralized.…