Alternative investment firm Colchis Capital has partnered with Bison Trails, a key infrastructure provider to Provenance blockchain, to enhance its real estate asset management services, demonstrating yet another promising use case for distributed ledger technology. Through the partnership, Bison Trails will provide the San Francisco-based Colchis Capital with node infrastructure that can be used to enhance its investment strategies, the companies announced on Tuesday. The partnership is centered around the Provenance blockchain, which has the potential to bring more efficiency and transparency to real estate investment management, which forms the…

Day: October 5, 2021

US lawmaker proposes safe harbor for digital tokens in new bill

North Carolina House Representative Patrick McHenry has proposed a bill which would amend one of the laws governing the Securities and Exchange Commission to provide a safe harbor for certain token projects. In a draft of the “Clarity for Digital Tokens Act of 2021” provided by the House Committee on Financial Services, McHenry suggested amending the Securities Act of 1933 to establish a safe harbor for token development teams. He proposed letting projects offer tokens without registering for up to three years, during which time teams would be given the…

Crypto Miners Marathon Digital, Hut 8 Rally as Bitcoin Tops $50,000 — CoinDesk

MicroStrategy Inc., often seen as a proxy for bitcoin, climbed 4.3%, while crypto exchange Coinbase Global, Inc. gained 3% and Robinhood Markets, Inc., where many users trade crypto, rose 2.8%. The wider S&P 500 index and the Nasdaq composite were also in the green on Tuesday. Source

US Bank Launches Crypto Custody With NYDIG Backing — CoinDesk

“Our fund and institutional custody clients have accelerated their plans to offer cryptocurrency and, in response, we made it a priority to accelerate our ability to offer custody services,” Gunjan Kedia, vice chair of U.S. Bank Wealth Management and Investment Services, said in a press release. Source

DeSo Launches $50M Fund for Decentralized Social Ecosystem — CoinDesk

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. @2021 CoinDesk English Source

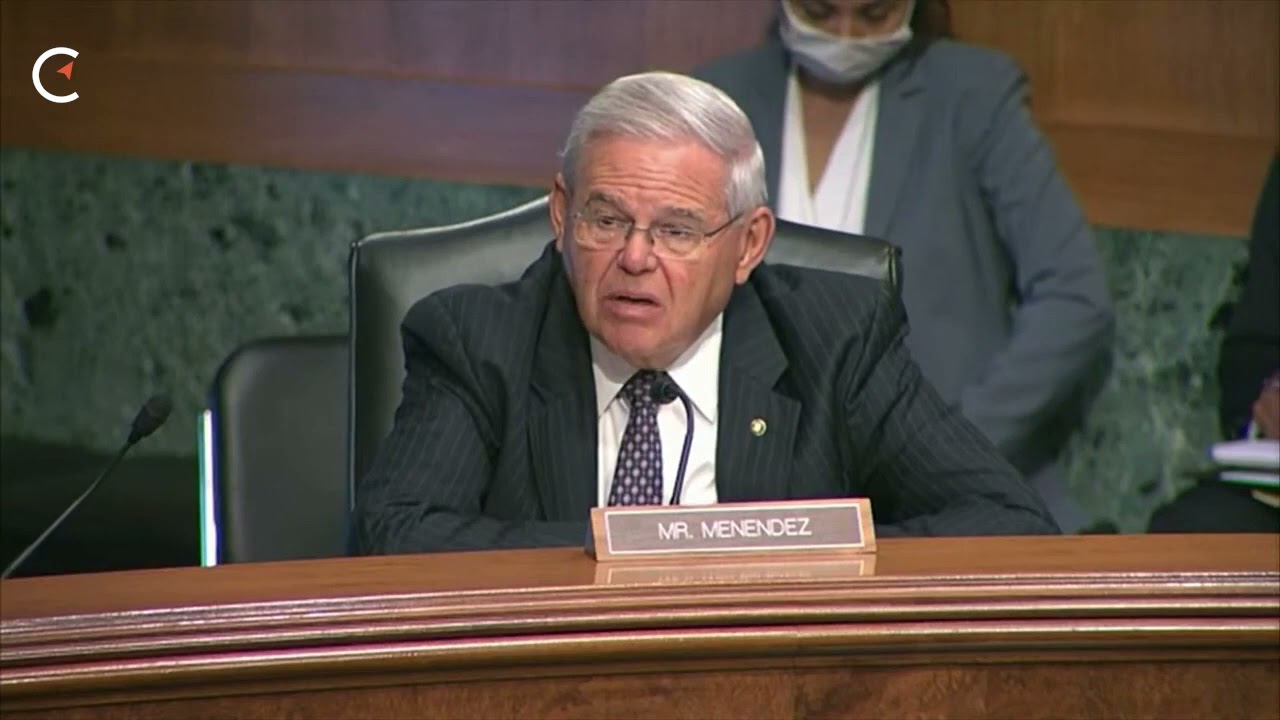

Does Iran use Bitcoin mining to evade sanctions? | Senate Banking Committee Hearing | July 27, 2021

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io This is a clip from a US Senate hearing on the utility and interworkings of cryptocurrencies. In this video, the Senate Banking Committee asks the question of whether Iran uses Bitcoin mining to evade sanctions from the US. Watch the full hearing: ——————————————– 🔎 Learn more about cryptocurrency mining! 💻 Every week, Compass sends a memo to over 14,000 professional miners and investors with the most important news and data in cryptocurrency mining. ✍️ Get the free newsletter in your inbox too:…

110 countries are ‘at some stage’ of CBDC development

International Monetary Fund, or IMF, managing director Kristalina Georgieva said more than half of all central banks in the world are exploring how to launch digital currencies. Speaking at a virtual conference hosted by Bocconi University on Oct. 5, Georgieva said the IMF was looking at central bank digital currencies, or CBDCs, and digital currencies as a whole from the perspective of macroeconomic stability. She said the technology had given people the opportunity to effect “seamless, and less costly” transfers, and called CBDCs the most reliable form of digital currency…

Q3 2021 Quarterly Review – CoinDesk Research — CoinDesk

CryptoX – Cryptocurrency Analysis and News Portal CoinDesk Research presents its latest quarterly report for Q3 2021 which outlines the trends driving the digital asset markets, focusing on Bitcoin, Ethereum, DeFi and more. In all, assets performed generally well, scaling projects on Bitcoin and Ethereum thrived, institutions started paying even more attention and politicians flexed their regulatory muscle. Oct 5, 2021 at 1:00 p.m. UTC Updated Oct 5, 2021 at 4:49 p.m. UTC Original Source The post Q3 2021 Quarterly Review – CoinDesk Research — CoinDesk appeared first on CryptoX.…

Q3 2021 Quarterly Review – CoinDesk Research — CoinDesk

CoinDesk Research presents its latest quarterly report for Q3 2021 which outlines the trends driving the digital asset markets, focusing on Bitcoin, Ethereum, DeFi and more. In all, assets performed generally well, scaling projects on Bitcoin and Ethereum thrived, institutions started paying even more attention and politicians flexed their regulatory muscle. Oct 5, 2021 at 1:00 p.m. UTC Updated Oct 5, 2021 at 4:49 p.m. UTC Source

America’s fifth-largest bank launches crypto custody service — Report

U.S. Bank, the fifth-largest retail bank in the United States, announced Tuesday that it is launching a cryptocurrency custody service for institutional investors, potentially setting the stage for wider mainstream acceptance of digital assets. As CNBC reported, U.S. Bank has partnered with New York Digital Investment Group, or NYDIG, to provide custody services for Bitcoin (BTC), Bitcoin Cash (BCH) and Litecoin (LTC). Gunjan Kedia, a senior executive at U.S. Bank’s wealth management and investment division, told CNBC that support for other cryptocurrencies like Ether (ETH) will be rolled out over…