Many investors don’t understand crypto and think it has no place in their portfolios. But an increasing number of investors are curious about crypto and want exposure (especially those who are younger, well-educated and with higher incomes). We’re in the midst of the greatest wealth transfer in our lifetime, and as those assets get passed, the inheritors are likely to ditch their parents’ financial advisor and invest some of their newfound wealth in crypto. Accordingly, financial advisors need to adapt, lest they become irrelevant. Source

Day: October 7, 2021

Dapper Labs Taps Chainalysis to Fight NFT Money Laundering — CoinDesk

“NFTs are one of the most exciting spaces in cryptocurrency, but they will only be successful in the long term if we can ensure a safe environment for our customers,” said Naeem Bawla, associate director of Compliance at Dapper Labs, in a press release. “We’re thrilled to partner with Chainalysis to keep potential bad actors off our platform, combat money laundering, and at the same time, stay on top of the quickly evolving local and global regulatory and compliance space.” Source

El Salvador’s State-Owned Banco Hipotecario Taps Four Crypto Startups for Blockchain Products

The adoption of bitcoin as legal tender in El Salvador has forced the local financial system to adapt. Staring down these changes, Banco Hipotecario, a national commercial bank in El Salvador, has started working with four companies that will develop blockchain products they say will increase financial inclusion for the bank’s customers. The bank started working with an alliance formed by TESOBE, the company behind the Open Bank Project, and API3, a decentralized autonomous organization that provides data feeds to blockchain-based smart contracts. The alliance also includes decentralized digital asset…

Revolution, Macro and Micro: Three Ways to Look at a Bitcoin Investment

Investment in cryptocurrencies is all the rage, and bitcoin is clearly the biggest – it has the largest market capitalization, the most infrastructure, the longest track record and is the most decentralized. In previous columns, I’ve stressed the conversations you, as an advisor, will need to have with clients, and how different they are from any conversations you’ve previously had to have about financial planning. Now, we get to talk about three different ways to look at an investment in bitcoin for you and/or your clients: bitcoin as the revolution,…

Stader Labs completes $4M funding raise to expand crypto staking

Stader Labs, a cryptocurrency staking management platform, has today announced a $4 million financing round to accelerate development across multiple blockchains including Ethereum, Near and Polkadot, as well as broadening its marketing campaigns. The funding raise was conducted by Pantera Capital, with participation from a prominent number of venture capital funds, blockchain foundations and angel investors, including Coinbase Ventures, True Ventures, Hypershare, TerraForm Labs and the Solana Foundation. Stader Labs aggregates decentralized finance (DeFi) protocols and applications into a simplified staking solution for delegators in a bid to maximize their…

El Salvador’s State-Owned Banco Hipotecario Taps Four Crypto Startups for Blockchain Solutions

The adoption of bitcoin as legal tender in El Salvador has forced the local financial system to adapt. Staring down these changes, Banco Hipotecario, a national commercial bank in El Salvador, has started working with four companies that will develop blockchain solutions they say will increase financial inclusion for the bank’s customers. The bank started working with an alliance formed by TESOBE, the company behind the Open Bank Project, and API3, a decentralized autonomous organization that provides data feeds to blockchain-based smart contracts. The alliance also includes decentralized digital asset…

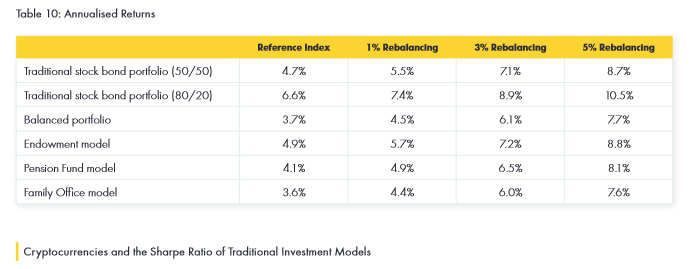

Crypto exposure has positive impact on investment portfolios, study shows

Allocating funds to crypto investment positions has been shown to have a positive impact on the performance of diversified investment portfolios. According to a research study by crypto asset management outfits Iconic Funds and Cryptology Asset Group, the ability of crypto investments to positively impact the performance of investment portfolios cuts across several asset allocation models. Crypto’s ability to improve the profitability of diversified investment portfolios comes despite its volatility, especially the recent market crash that occurred in May. The research study titled “Cryptocurrencies and the Sharpe Ratio of Traditional…

Top 5 Free Bitcoin Cloud Mining Sites || No Investment | World's Best Crypto Earning Sites 2021

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io About: #Techy_Myths is a YouTube channel, where you will find Tricks, And latest updates about Computer system and Trading of cryptocurrencies … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Nigerians Optimistic CBDC Will Improve Payments and Help Promote Cryptocurrencies – Fintech Bitcoin News

Nigerians are hopeful the planned central bank digital currency (CBDC), also known as the e-naira, is going to enhance cross-border payments and make it “easier for the naira to be widely used and accepted.” E-Naira Launch a Boon for Cryptos In fact, according to a VOA report, some Nigerian blockchain experts like Janet Kaatyo believe the e-naira launch will work in favor of cryptocurrencies. Prior to the Central Bank of Nigeria (CBN)’s February directive, cryptocurrency usage and trading in Nigeria had surged due in part to pandemic-related movement restrictions. However,…

Day trading your favorite sports team – Cointelegraph Magazine

With the pandemic separating fans from their stadiums and sports clubs from their revenues, fan tokens are now big players in the game, helping teams generate revenue and bringing fans together again. Though stadium seats in some countries have been filled with paper cut-outs of fans to present a well-intentioned yet creepy facade of normality during the pandemic, the distance between the teams and their followers has grown farther apart. One solution is found in sports fan tokens. Through fan tokens, many fans are able to feel a more direct…