October has been a strong month for cryptocurrencies like bitcoin but a number of decentralized finance (defi) tokens have seen higher double-digit gains this past week. Moreover, non-fungible token (NFT) sales have picked up and after the total-value locked (TVL) in defi crossed $200 billion on October 5, two weeks later another $22 billion has been added to the TVL. Defi Network Tokens Polkadot, Polygon, Binance Coin, Stacks Outperform Bitcoin’s Weekly Gains Bitcoin (BTC) has been doing extremely well and BTC dominance has increased to 45.3% during the last week.…

Day: October 18, 2021

Crypto Learns to Play the DC Influence Game

Facing a head-spinning array of new legislative and regulatory action out of Washington, D.C., the crypto industry is reacting the way any sector flush with cash would: It’s throwing money at the problem. Established trade associations are bulking up their lobbying operations, and individual firms seeking more bespoke treatment are hiring their own representatives from D.C.’s enormous pool of Congress-whisperers and regulator-persuaders. The crypto industry is late to the game. With the exception of a few well-established trade groups, and some firms that saw the importance of having a seat…

Bitfury CEO confirms IPO considerations are part of expansion plans

Bitfury, one of the world’s largest companies in the blockchain industry, is mulling a potential initial public offering, or IPO, as part of the company’s global growth plans, the company’s CEO confirmed to Cointelegraph. “As Bitfury and its portfolio of companies continue their global expansion in the digital assets space, Bitfury will be considering an IPO as part of its broader expansion and growth plans,” Bitfury co-founder and CEO Valery Vavilov said. According to the executive, Bitfury has not yet determined when and on what exchange the company is willing…

Price analysis 10/18: BTC, ETH, BNB, ADA, XRP, SOL, DOT, DOGE, LUNA, UNI

Altcoins are selling off ahead of this week’s Bitcoin ETF launch, perhaps a sign that traders are anxious about this historic listing. ProShares Bitcoin Strategy ETF will enter the history books on Oct. 19 when it starts trading on the New York Stock Exchange under the ticker BITO. Market participants are likely to watch the volumes on the ETF closely to gauge the amount of participation from institutional investors. If the response is tepid for a few days, short-term traders may be tempted to book profits, but the bullish momentum may…

The NFT Market Is Already Centralized

One of the problems non-fungible tokens (NFTs) purport to solve is the idea of “platform risk.” Buy an in-game add-on for a video game and your purchase really exists only on the publisher’s platform; files are hosted on company servers until the game is retired, at which point everything vanishes into the ether. By contrast, NFTs interact directly with a blockchain, which means each computer in the network retains a complete record of what’s actually going on with the files. If one front-end interface crumbles, the thinking goes, another can…

Bitcoin Price Smashes Record For Highest Weekly Candle Close Ever

Bitcoin price is back at levels from earlier in the year, but has yet to set a new all-time high. Last night’s weekly candle close still came with a new broken record for price: the highest weekly candle close in the cryptocurrency’s history. Will the bullish weekly close lead to new highs? If so, will this be the culmination of the bull run? And if not, does that mean a bear market instead? A new record has been set | Source: BTCUSD on TradingView.com Bitcoin Price Sets New Record For…

Crypto Is Too Big for Partisan Politics

Every major American issue seems to get sucked into the “red vs. blue” political dichotomy these days, and now it is cryptocurrency’s turn in the barrel. Following somewhat tense recent testimony between U.S. Securities and Exchange Commission Chairman Gary Gensler and the Senate Banking Committee, Politico confidently declared “Crypto becomes partisan.” While Capitol Hill fireworks might make it seem that way, the reality is that crypto doesn’t have a natural partisan bent – it is a universal tool that has the potential to benefit everyone in every community. Kristin Smith…

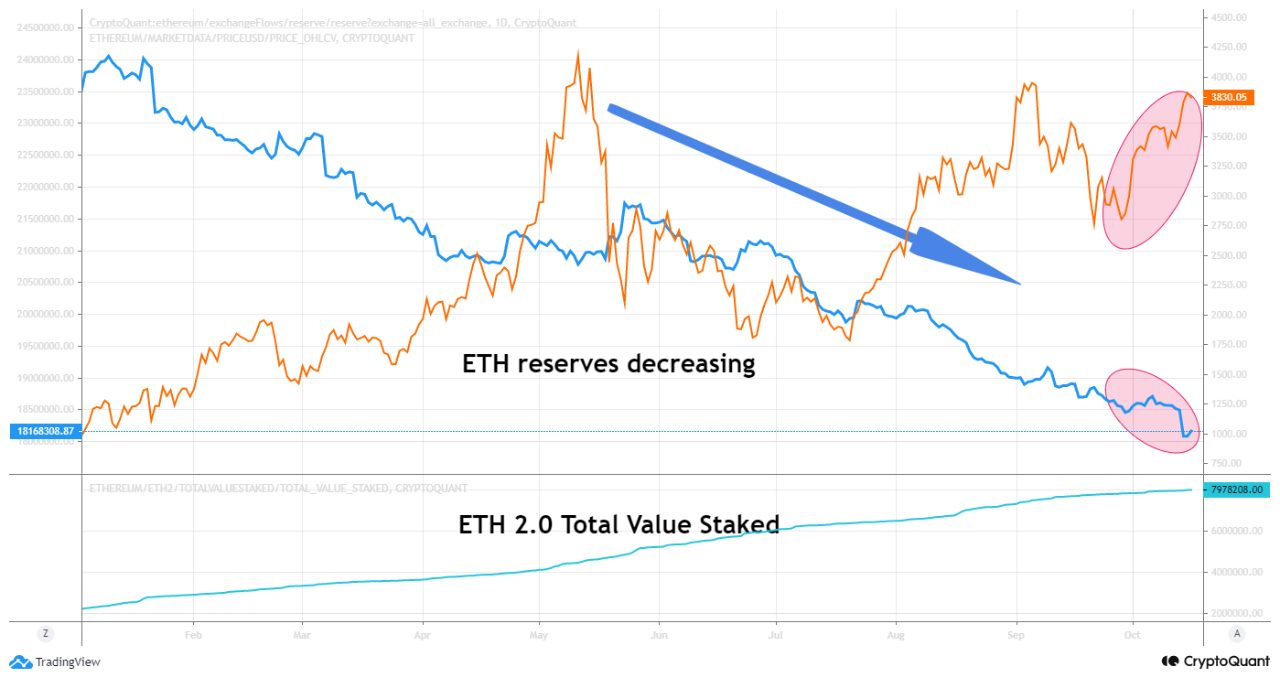

Ethereum Supply Shock Grows As Reserves Decrease, ETH 2.0 Contract Increases

The Ethereum supply shock has been growing as exchange reserves continue to decrease and value staked in ETH 2.0 contract rises. Ethereum Supply Shock: Exchange Reserves Go On Decreasing While ETH 2.0 Staking Contract Grows In Value As pointed out by a CryptoQuant post, ETH exchange reserves have been decreasing while the coins locked in the staking contract have been rising. The “all exchanges reserve” is an Ethereum indicator that highlights the total number of coins stored in wallets of all exchanges. When the value of this metric goes up,…

Guggenheim’s Minerd Predicted Bitcoin at $15K and $400K. Now He’s Bowing Out Entirely

Guggenheim Chief Investment Officer Scott Minerd says he’s no longer invested in bitcoin after he predicted earlier this year that the cryptocurrency could hit $600,000. “The one thing I learned as a bond trader years ago, when you don’t understand what’s happening, get out of the market,” Minerd said in an interview on CNBC from the Milken Conference in Los Angeles. “So discipline tells me now I don’t fully understand this.” He pointed out how if someone had invested in $1,000 in the shiba inu in February, they would have…

Crypto Titan Grayscale To Apply for Spot Bitcoin Exchange Traded Fund: Report

Digital asset management giant Grayscale is reportedly planning to apply for a spot Bitcoin (BTC) exchange-traded fund (ETF). According to CNBC, the firm is set to file the application with the U.S. Securities and Exchange (SEC) in the coming days. Citing a person familiar with the matter, CNBC says Grayscale expressed its intention to convert its Bitcoin investment product GBTC into a spot ETF as the race for the Bitcoin futures-based ETF heats up. Unlike Bitcoin futures ETF, which would be linked to derivative contracts tied to BTC, a…