Development of SUAVE, as the project is codenamed, has been going on for a year. Source

Day: October 14, 2022

Bitcoin Is Macro, but Not ‘Correlated’ in the Way You Think

Bitcoin is a macro asset in that it is now part of the global market. But not all macro assets are highly correlated. As fear subsides (which it will, one day), given the distinct value propositions of equities and crypto, we are likely to see correlations head back to lower levels, supporting the narrative of an “alternative” macro asset. Even before then, as the dust settles on the recent crypto crashes, as the outlook for global equities continues to get worse and as the risk of holding dollars shifts higher,…

SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

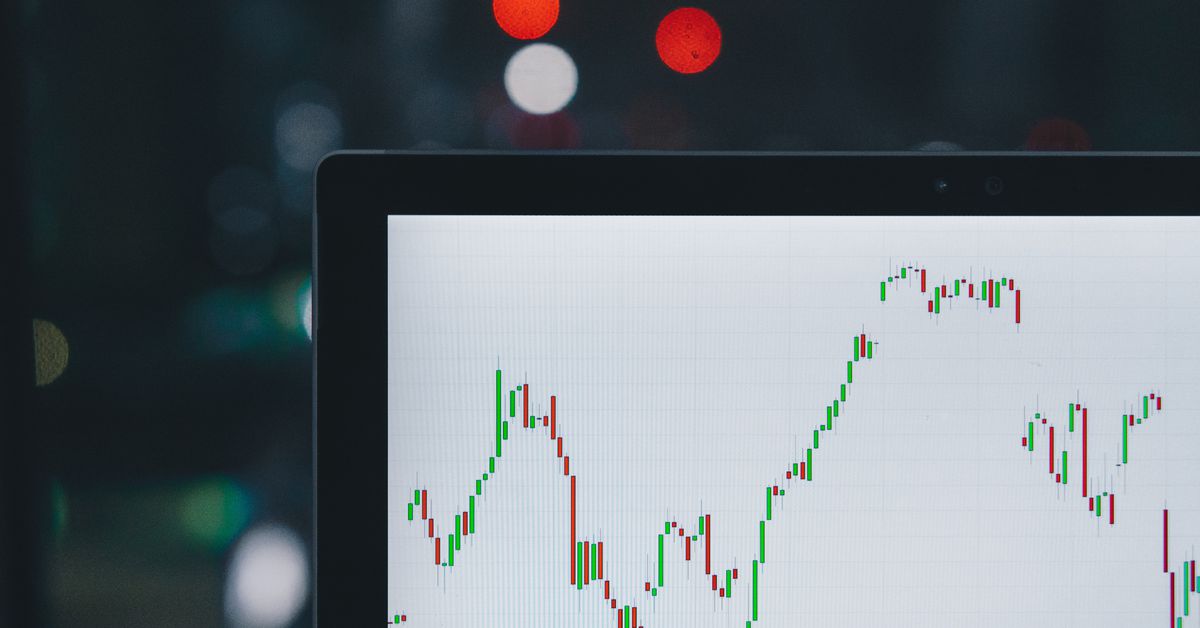

The United States Consumer Price Index (CPI) increased 8.2% annually in September, beating economists’ expectations of an 8.1% rise. The CPI print lived up to its hype and caused a sharp, but short-term increase in volatile risk assets. The S&P 500 oscillated inside its widest trading range since 2020 and Bitcoin (BTC) also witnessed a large intraday range of more than $1,323 on Oct. 13. However, Bitcoin still could not shake out of the $18,125 to $20,500 range in which it has been for the past several days. Daily cryptocurrency…

Deploy Solidity Smart Contracts with Ganache Personal Blockchain

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Full Web3 course: Learn how to deploy and test your Solidity smart contracts on a personal Ethereum blockchain with Ganache 2021. Perfect for decentralized app (dapp) programming! ● Truffle version: 5.4.11 Yearly Unlimited Membership 💚 90% OFF ONLY ON YOUTUBE ● $4.99: HTML, CSS & JavaScript ● $9.99 Level: Make 6 games in the Unreal Engine ● $29.99 Level: Build The Legend of Zenda Game ● $39.99 Level: The Deep Learning Masterclass ● $49.99 Level: Build a Battle Royale! (50 Hours) ●…

La empresa de trading de criptomonedas NYDIG despide alrededor del 33% de su personal

Además, los despidos coinciden con cambios en la dirigencia. A principios de octubre, la empresa anunció que el CEO Robert Gutmann y el presidente Yan Zhao dejarían sus puestos y volverían a Stone Ridge Holdings Group, la empresa matriz de NYDIG. Tejas Shah y Nate Conrad asumirán los puestos de CEO y presidente, respectivamente. Source

Clixpesa Is Bringing Traditional Kenyan Investing Techniques to Web3

“When we look at the financial products that are offered now, such as loans, savings, and insurance, these things are complicated since traditional financial institutions are creating them,” Kachisa said. “The Kenyan community is deterred from these services because they aren’t being explained or implemented in a simplified way that a normal person can understand.” Source

Exchange Giant Coinbase Lists Major Ethereum Rival, Spurring Short Price Explosion

Top US-based crypto exchange Coinbase is adding Ethereum challenger Hedera (HBAR) to its roster of supported digital assets. Coinbase says that the token of the most widely-used enterprise grade public network for decentralized applications is already live on its platforms. “Hedera (HBAR) is now live on Coinbase.com and in the Coinbase iOS and Android apps. Coinbase customers can log in to buy, sell, convert, send, receive or store this asset.” The second largest crypto exchange platform by trading volume is rolling out support for HBAR amid growing use cases for…

Crypto Boutique Law Firm Roche Freedman Removed From Class Action Against Tether – Bitcoin News

After a Manhattan federal judge blasted Roche Freedman LLP founding partner Kyle Roche’s public statements, the judge has removed the crypto boutique law firm from the market manipulation lawsuit against Tether and Bitfinex. The recent hearing has shown that U.S. district judge, Katherine Polk Failla, believes the litigation process could be derailed. She further stressed that “the metaphorical baggage” Roche Freedman carries “is not in the best interests of the class.” Judge Boots Roche Freedman From Class Action Lawsuit Against Tether and Bitfinex At the end of August, the Roche…

$43T bank enters crypto — Probably nothing, right?

As crypto traders debate whether Bitcoin (BTC) is going to $25,000 or $15,000 first, the world’s largest financial institutions are laying the groundwork for mass adoption. The proverbial floodgates are unlikely to open before the United States provides a clear regulatory framework for crypto, but regulators and industry insiders are confident that guidance could come in 2023 at the earliest. In the meantime, megabanks like BNY Mellon, whose roots date back to 1784, are entering the space. This week’s Crypto Biz chronicles BNY Mellon’s foray into digital assets, JPMorgan’s ongoing…

SEC Chairman Says CFTC Should Get More Power to Oversee Stablecoins: Report

Gensler pointed out that the CFTC does not have direct authority to write rules for the firms that issue stablecoins. Source