Liquidity Book V2.1 will make it more efficient for depositors to add tokens to Trader Joe’s liquidity pools and also improve the on-chain trading experience, Blue said. Trader Joe has three implementations: on Arbitrum, BNB Chain and Avalanche, its biggest. Source

Month: March 2023

National Futures Association adds rules for members handling digital assets

The National Futures Association (NFA), the United States self-regulatory organization for derivatives markets, has issued a new compliance rule addressing members’ conduct. The new rule complements requirements issued in 2018. The NFA has “well over 100” members that engage in activities with digital asset commodities, but no way to address fraud or misconduct committed by those members, the organization explained to secretary of the Commodity Futures Trading Commission (CFTC) Christopher Kirkpatrick in a Feb. 28 letter as it submitted the proposed new rule for approval. The new rule is modelled…

Bitcoin’s Average and Median-Sized Network Fees Rose 40% Higher in March – Bitcoin News

In March 2023, Bitcoin’s average and median-sized fees jumped more than 40% higher after rising 122% in 10 days during the first week of February. The fees have followed the Ordinal inscription trend as more than 662,000 inscriptions reside on the Bitcoin blockchain, and 150 bitcoin worth $4.2 million have been added to fees. Bitcoin Fees Surge in March, More Than 50,000 Unconfirmed Transactions in the Mempool As of 2:30 p.m. (ET) on March 31, 2023, according to statistics from mempool.space, there are roughly 54,000 unconfirmed Bitcoin transactions. Bitcoin fees…

A spotlight on Binance, Galaxy Digital swings to profit, China’s blockchain push

Regulators in the United States have a fresh target on their radar: Binance. The Commodity Futures Trading Commission (CFTC) has sued the world’s biggest crypto exchange by trading volume for regulatory violations. Accusations range from insider trading to concealing office locations around the world to evade authorities’ oversight. Binance denies the claims, suggesting another court battle between crypto firms and U.S. regulators is just around the corner. On another front, Binance’s U.S. arm must wait to close its $1 billion deal for Voyager Digital’s assets until the Department of Justice…

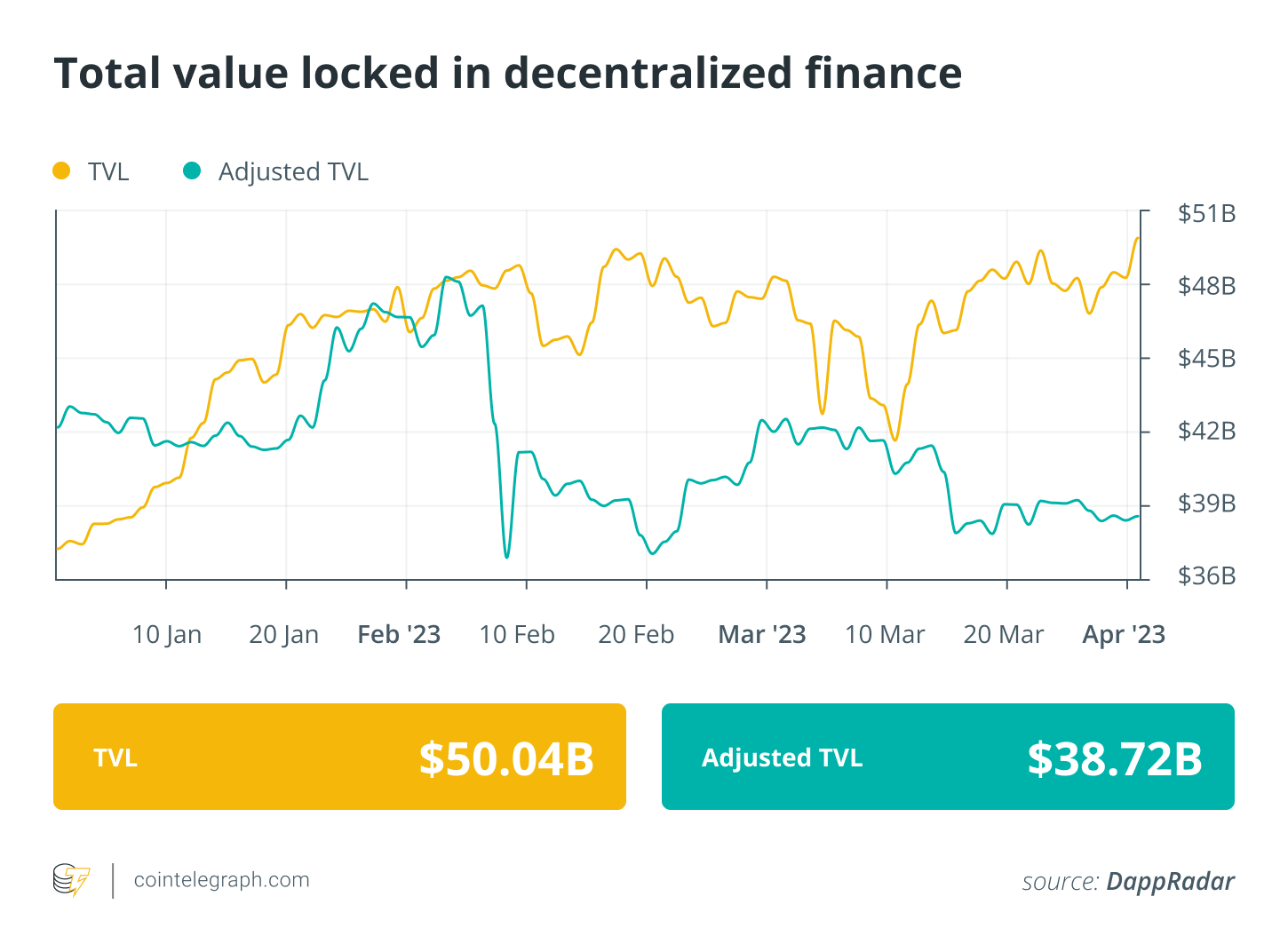

European DeFi startups saw a 120% increase in VC funding in 2022: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The ongoing downturn in the crypto market hasn’t stopped European venture capital (VC) firms from investing in DeFi projects. A new report revealed that European DeFi startups saw a 120% increase in VC funding last year. The Euler Finance saga continued to dominate headlines, with the exploiter returning a significant chunk of the $190 million in stolen funds. The exploiter has returned over 58,000…

Crypto Exchange Aggregator 1inch Proposes Diluting Some Insiders’ Voting Power

In a community call on Friday that CoinDesk attended, Jordan Reindl, a member of 1inch’s community and governance team, proposed the protocol dilute the voting power of insiders who have received their full allotment of v1inch vesting tokens, a derivative token redeemable for 1inch. Conversely, v1inch tokens that remain locked up for two years or longer would have 100% of their voting weight, the proposal said. Source

Why did 12K Bitcoin margin longs close at Bitfinex, and why didn’t it impact BTC price?

Since May 2022, the Bitcoin (BTC) margin markets on the Bitfinex exchange have been plagued by an unusually high open interest of over $2.7 billion. This information alone should raise a red flag, especially in light of Bitcoin’s price decline from $39,000 to less than $25,000 during the same period. Traders seeking to leverage their cryptocurrency position had borrowed over 105,000 Bitcoin. Currently, the cause of this anomaly is unknown, as well as the number of entities involved in the trade. Cheap borrowing favors high demand Bitfinex’s sub-0.1% annual rate…

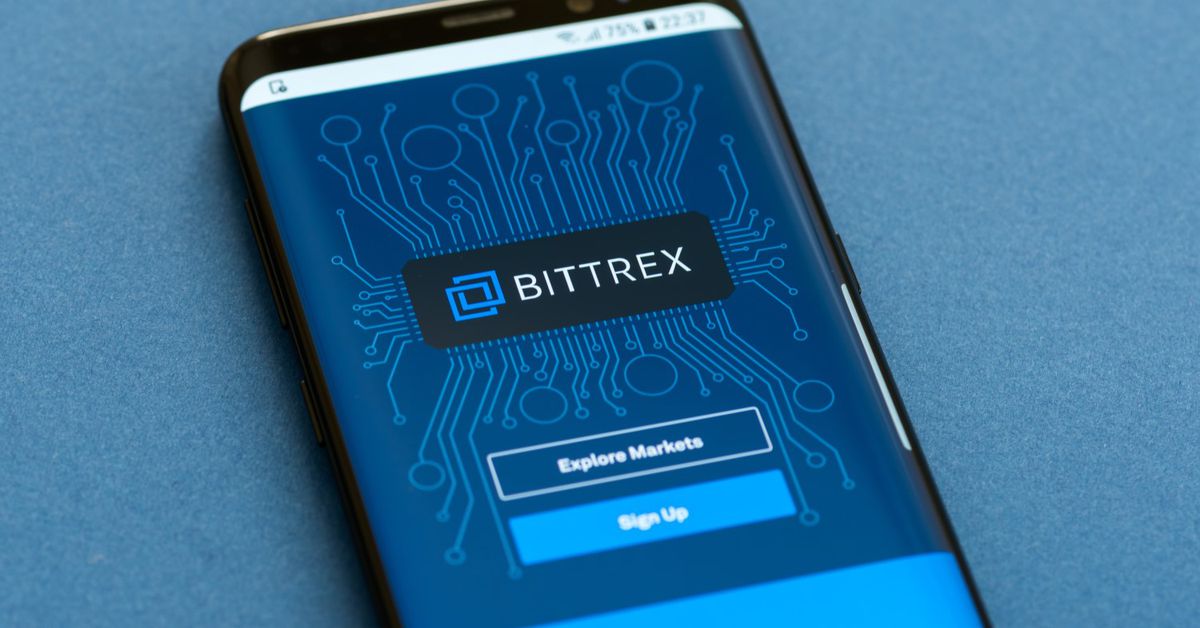

Crypto Exchange Bittrex to Wind Down U.S. Operations Next Month

“It’s just not economically viable for us to continue to operate in the current U.S. regulatory and economic environment,” said Bittrex co-founder and CEO Ritchie Lai in the statement. “Regulatory requirements are often unclear and enforced without appropriate discussion or input, resulting in an uneven competitive landscape,” he continued. “Operating in the U.S. is no longer feasible.” Source

Net losses from crypto theft down sharply in Q1 2023 at $322M: Report

Crypto hackers and scammers made off with $452 million in the first quarter of 2023, according to a report released by antivirus and app provider De.Fi. But that is good and bad news, as losses were down from $1.3 billion in the first quarter of 2022. The recovery rate was down too, however. According to the report, nearly half of the losses this quarter ($215 million) took place in the first three weeks of March. The Euler Finance and Bonq DAO exploits were the quarter’s loss leaders at $196 million…

How Will NFTs Be Taxed? Understanding the IRS’ New Proposed Guidelines

There are a few specific cases where this look-through analysis will come in handy already. For instance, the fractionalized NFT platform Otis sells NFTs linked to physical assets like rare books and trading cards, or companies like the BlockBar, a Web3 company focused on NFTs linked to real-life rare wines and liquor. In these scenarios, an NFT may serve a similar purpose as a title or property deed, explains Fuller. The IRS is not necessarily interested in taxing the NFT as an asset in and of itself, when really it’s…