According to data sourced from user @beetle from Dune Dashboard, nonfungible tokens (NFT) marketplace Blur has facilitated 8,820 Ether (ETH), or roughly $16.37 million, in loans through its perpetual NFT lending protocol Blend one day after launch. On May 1, Blur introduced Blend as a novel protocol for pledging NFTs for loans, which was developed in conjunction with venture capital firm Paradigm. Together, the Azuki, Wrapped CryptoPunks, and Milady NFT collections represent the largest collateral, with over 8,000 ETH worth in market value pledged. The top Blur lender, who has…

Day: May 2, 2023

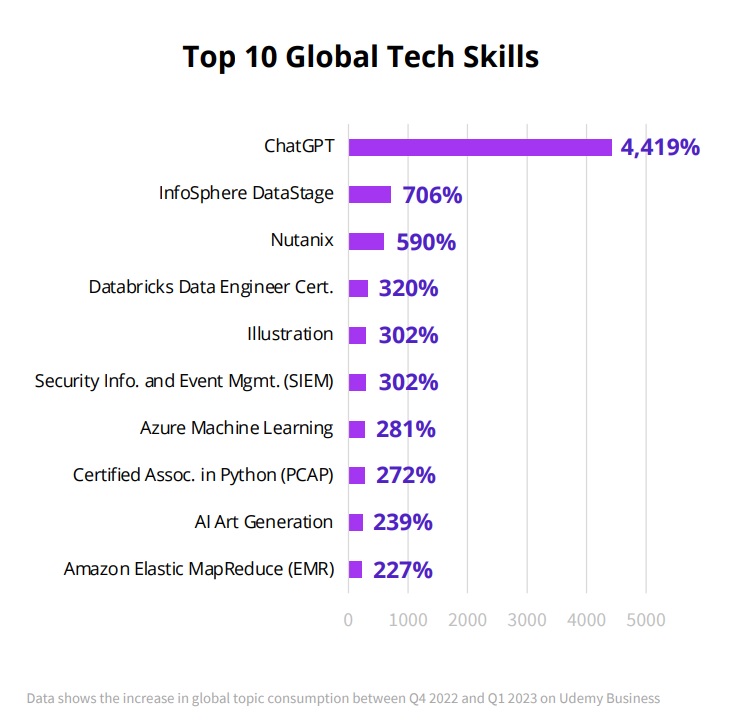

Student interest in ChatGPT skills on Udemy increased by 4,419% since 2022: Report

Udemy’s Global Workplace Learning Index for Q1 2023 indicates that ChatGPT, financial services, and courses aimed at developing students’ business teaching skills have experienced a massive uptick in interest from the site’s reported 49 million users. This likely comes as no surprise as we’re currently experiencing what Wired recently described as a “Wet Hot AI Chatbot Summer,” coming on the heels of OpenAI’s launch of ChatGPT. According to Udemy, topic consumption — the number of users taking courses featuring skills specific to ChatGPT — has risen 4,419%. Screenshot of Udemy…

Coinbase Grew Quickly by Working With U.S. Regulators. Will It Expand Even More by Disregarding the SEC?

But the new vertical is also a sign of the exchange’s increasingly global perspective. Although Coinbase has operated across Europe and parts of Asia, Africa and Latin America for years, it has recently become more vocal about building internationally. In an April blog post, the exchange said it has begun talking with financial regulators in Abu Dhabi (which is building a crypto/fintech tech sandbox) while Armstrong, following a conversation with the U.K.’s Economic Secretary and City Minister, Andrew Griffith, said the country is “moving fast on sensible crypto regulation.” Source

US debt crisis may trigger 70% surge in bitcoin price says YouTuber

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied The U.S. Treasury Secretary, Janet Yellen, has recently warned of the catastrophic consequences the U.S. could face if the country hits the debt ceiling without lifting it. In his recent video CryptosRUs explains that failure to do so could lead to bankruptcy and an unprecedented financial crisis. Despite this, there is growing opposition to raising the debt ceiling due to concerns about rising inflation and irresponsible money printing in recent years. As the Federal Open Market…

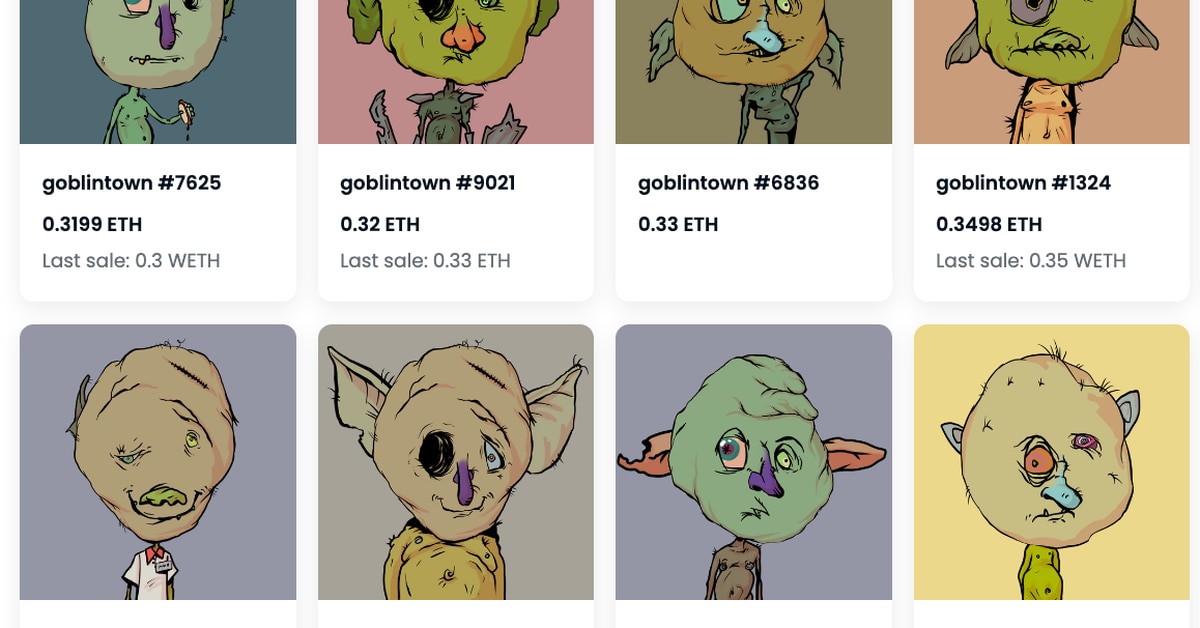

Goblintown Launches Second Collection Big Inc

Big Inc, a 15,000-unit sequel to the Goblintown collection, has not publicly released a date or time for the mint. The collection is looking for “the worst traders in NFT land,” a spokesperson from Truth Labs told CoinDesk, and will prioritize collectors based on their “rekt activity,” or poor trades in the space. Source

Bank failures pump bitcoin price in weak financial markets

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied As regional bank failures rattle the financial markets, bitcoin’s price surges to the $28,500 level, showcasing its resilience and growing appeal as a safe haven for investors. The financial world is experiencing a seismic shift as a series of regional bank failures have sent shockwaves through the markets. Amid this turmoil, the price of bitcoin has surged, climbing from $28,000 to $28,500 in a matter of hours. Investors are increasingly turning to cryptocurrencies, with many viewing…

Pacwest Stock Plummets Over 35% Following Release of Q1 Earnings Report Amidst Turmoil in Banking Industry – Bitcoin News

Following the acquisition of First Republic Bank by JPMorgan Chase, several regional banks such as Pacwest and Western Alliance experienced a significant drop in their stock prices. On Tuesday afternoon, all four major U.S. benchmark stock indexes are in decline as regional bank stocks hit new lows. Banking Industry on Edge as Pacwest Shares Sink Causing Trading Halt Pacwest, a regional bank based in Beverly Hills, California, is facing challenges after the release of its 2023 first quarter earnings report. Following the publication of the earnings, the bank’s stock price…

The average person’s wealth will be ‘completely destroyed by inflation,’ says Arthur Hayes

The majority of people will have their wealth progressively eaten away by the devaluation of money, according to Arthur Hayes, the co-founder and former CEO of crypto derivatives exchange BitMEX. According to Hayes, due to the huge amount of public debt accumulated by the world’s largest economies, governments will have no choice but “inflating it away” through money printing. Thus, the only way to escape the progressive destruction of fiat wealth is by acquiring assets outside the traditional financial system, such as crypto, the purchasing power of which doesn’t fall…

SEC Hits Crypto Exchange Coinme With $4,000,000 in Fines for Alleged Securities Fraud

The U.S. Securities and Exchange Commission (SEC) is settling securities fraud allegations levied against the Seattle-based company Coinme Inc. for $4 million in penalties. According to an SEC announcement, the US securities regulator accuses Coinme, its subsidiary Up Global and Neil Bergquist, the CEO of both entities, of violating securities law for selling the digital asset UpToken (UP). The SEC also accuses Bergquist and Up Global of making false and misleading statements regarding the demand for UpToken and the amount raised in the initial coin offering (ICO). The terms of…

Coinbase officers, board members face suit over alleged insider trading during listing

A Coinbase shareholder has filed a stockholder derivative complaint against some of the company’s executives and board members, claiming they profited from inside information during the company’s public listing. CEO Brian Armstrong and well-known venture capitalists are among the defendants. A stockholder derivative complaint is a suit filed against a company on behalf of its stockholders. Coinbase shareholder Adam Grabski filed the suit in the Delaware Court of Chancery on May 1. Grabski bought Coinbase shares on the first day of the crypto exchange’s public listing. According to a redacted…