“So far, bitcoin has moved in lockstep with liquidity,” Dessislava Ianeva, research analyst at crypto data firm Kaiko, told CoinDesk. Ianeva noted that quantitative tightening (QT), which usually happens when the central bank looks to reduce its balance sheet, “was partially offset by the Treasury spending its cash at the Fed and Bank Term Funding Program, but that push is now exhausted.” Original

Day: May 30, 2023

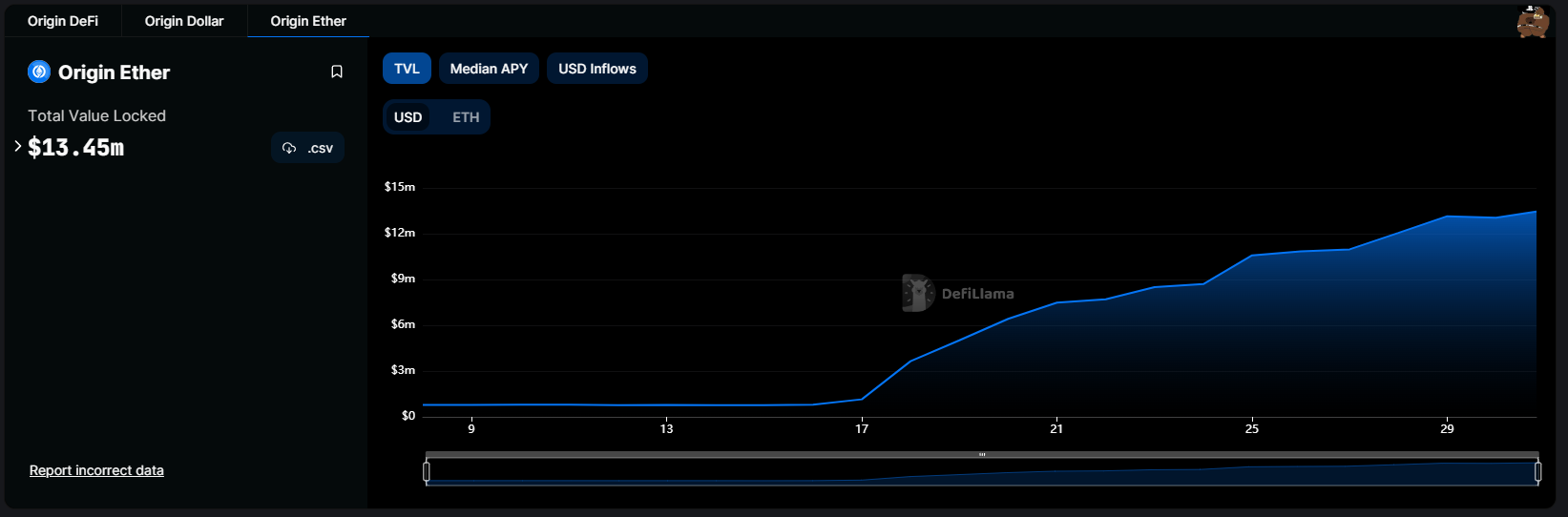

Yield farming app accumulates $12M TVL 2 weeks after launch

A new yield farming app called Origin Ether has accumulated over $12 million in total value locked (TVL) just 14 days after launch, according to data from blockchain analytics platform DefiLlama. TVL is a metric that measures the dollar value of assets inside an app’s smart contracts. Origin Ether total value locked, May 9-30. Source: DefiLlama The app was launched on May 16, according to a representative from the development team. DefiLlama data shows the app already had $793,000 locked inside its contracts before the launch, which team members or…

Nansen lays off 30% of its workforce

Blockchain analytics platform Nansen has announced the trimming of its workforce by 30%. On May 30, the Nansen CEO Alex Svanevik disclosed on Twitter that the company had to make an “extremely difficult decision to reduce the size of the Nansen team.” Full statement: pic.twitter.com/cxSTtZBiZU — Alex Svanevik (@ASvanevik) May 30, 2023 Svanevik gave two major reasons for the reduction in Nansen’s workforce. The first was the company’s rapid scaling during its initial years of operation, which “led the organization to taking on surface area that’s not truly part of…

Researchers propose new scheme to help courts test deanonymized blockchain data

A team of researchers from Friedrich-Alexander-Universität Erlangen-Nürnberg recently published a paper detailing methods investigators and courts can use to determine the validity of deanonymized data on the Bitcoin (BTC) blockchain. The team’s preprint paper, “Argumentation Schemes for Blockchain Deanonymization,” lays out a blueprint for conducting, verifying and presenting investigations into crimes involving cryptocurrency transactions. While the paper focuses on the German and United States legal systems, the authors state that the findings should be generally applicable. Bitcoin-related crime investigations revolve around the deanonymization of suspected criminals, a process made more challenging…

US CFTC issues letter on digital asset derivatives, clearing compliance in 3 areas

The United States Commodity Futures Trading Commission (CFTC) has issued a staff advisory letter to registered derivatives clearing organizations (DCOs) and DCO applicants, reminding them of the risks associated with expanding the scope of their activities. The letter from the CFTC Division of Clearing and Risk (DCR) specifically addressed digital assets. Staff advisory letters can remind addressees of their legal obligations or provide clarity on those obligations. The “DCR expects DCOs and applicants to actively identify new, evolving, or unique risks and implement risk mitigation measures,” it said, continuing: “Over…

AI experts sign doc comparing risk of ‘extinction from AI’ to pandemics, nuclear war

Dozens of artificial intelligence (AI) experts, including the CEOs of OpenAI, Google DeepMind and Anthropic, recently signed an open statement published by the Center for AI Safety (CAIS). We just put out a statement: “Mitigating the risk of extinction from AI should be a global priority alongside other societal-scale risks such as pandemics and nuclear war.” Signatories include Hinton, Bengio, Altman, Hassabis, Song, etc.https://t.co/N9f6hs4bpa (1/6) — Dan Hendrycks (@DanHendrycks) May 30, 2023 The statement contains a single sentence: “Mitigating the risk of extinction from AI should be a global priority…

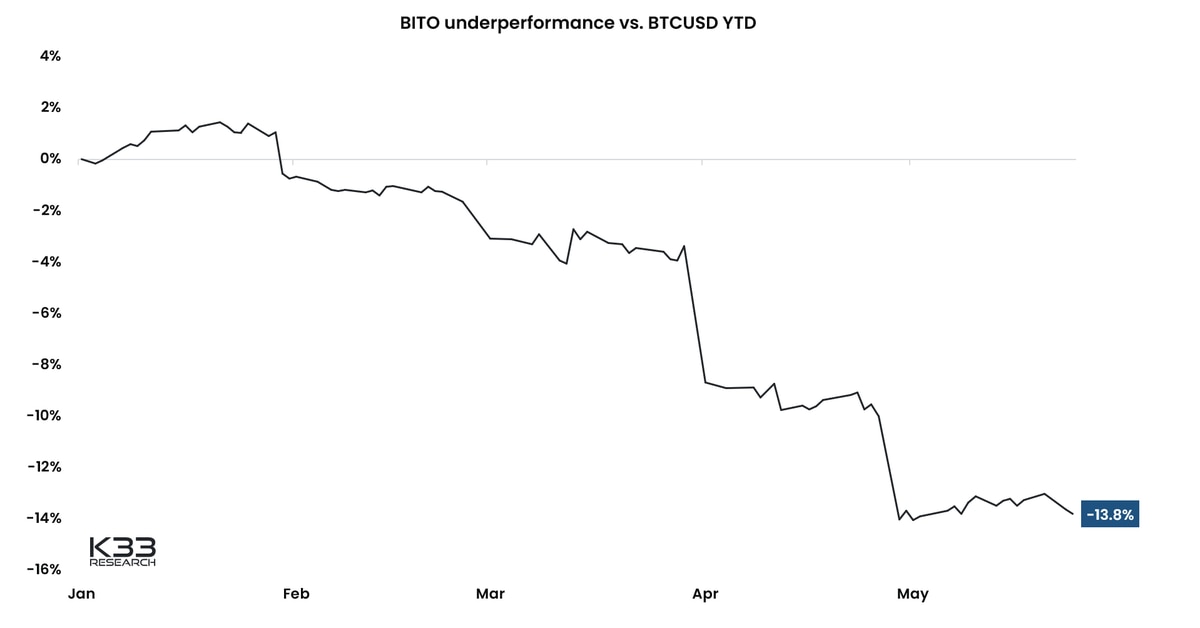

ProShares’ Bitcoin Strategy ETF BITO Underperforms BTC Price by 13.8% This Year: K33 Research

The underperformance stems from the costs associated with the fund’s structure. BITO does not purchase tokens, instead it holds BTC futures contracts on the Chicago Mercantile Exchange (CME). The fund must roll over the contracts every month as they expire, making it vulnerable to the price difference between terms. If next month’s contract trades at a premium to the nearest expiry – a phenomenon called contango and typical during a bull market – over a sustainable period, the fund will compound losses due to the “contango bleed.” Source

Crypto exchange Bybit exits Canada, citing ‘recent regulatory development’

Cryptocurrency exchange Bybit has announced it will be pausing its products and services to residents and nationals of Canada following certain developments in the regulatory space. In a May 30 blog post, Bybit said it will not accept account opening applications from Canadians starting on May 31. Current users of the crypto exchange will have until July 31 to make deposits and “increase any of their existing positions” before these services are phased out, with other positions liquidated after Sept. 30. Bybit did not offer any explanation for the market…

Some SBF charges will be dropped if Bahamas objects, U.S. prosecutors say

United States prosecutors will drop some of the charges against former FTX CEO Sam Bankman-Fried if the Bahamas government objects to them, according to a document filed on May 29 in the U.S. District Court for the Southern District of New York. And the charges against Sam Bankman-Fried are beginning to disappear… h/t @DecentFiJC pic.twitter.com/JEIF0uR31i — @amuse (@amuse) May 30, 2023 The document was filed in response to a May 8 defense motion that had attempted to dismiss some of Bankman-Fried’s charges. The defense had argued on May 8 that…

Bitcoin on-chain and options data hint at a decisive move in BTC price

Bitcoin’s volatility has dropped to historically low levels thanks to macroeconomic uncertainty and low market liquidity. However, on-chain and options market data allude to incoming volatility in June. The Bitcoin Volatility Index, which measures the daily fluctuations in Bitcoin’s (BTC) price, shows that the 30-day volatility in Bitcoin’s price was 1.52%, which is less than half of the yearly averages across Bitcoin’s history, with values usually above 4%. According to Glassnode, the expectation of volatility is a “logical conclusion” based on the fact that low volatility levels were only seen for 19.3%…