Computer chip manufacturer Nvidia briefly joined the exclusive club of companies with a $1 trillion market capitalization as market demand for artificial intelligence (AI) tech reached a crescendo. The milestone was hit on May 30 in the United States morning trading hours by the computer chip and graphics card manufacturer with its shares hitting a daily high of over $418 according to Google Finance. Nvidia shares closed the day at just over $401 and the firm currently has a market cap of $992 million. NVIDIA stock price over the last…

Month: May 2023

BRC-721E new standard for NFT migration from ETH to BTC

A new token standard, BRC-721E, has been introduced, designed to facilitate the migration of NFTs from Ethereum to Bitcoin. A novel token standard, known as BRC-721E, has recently been unveiled to enhance the versatility of bitcoin ordinals. This development is designed to simplify the transfer of NFTs from the Ethereum blockchain to the Bitcoin blockchain. Essentially, the BRC-721E protocol facilitates the conversion of ethereum’s ERC-721 NFTs into ordinals, unique units that can embed text, images, and code onto a solitary satoshi. The inception of BRC-721E is a collective endeavor by…

TON Foundation introduces new liquidity mining rewards program

The TON Foundation, a non-profit association dedicated to advancing The Open Network (TON), has unveiled a liquidity mining rewards campaign designed to incentivize users from other chains to join the TON ecosystem. With rewards of up to $720,000 in toncoin (TON), the campaign aims to seed liquidity for the core digital tokens within the TON ecosystem and will run from June 5 to June 30. Bringing together DEX protocols The launch of a liquidity mining rewards campaign comes after the introduction of a two-way bridge facilitating the transfer of ERC-20…

Bitcoin BTC Price Edges Below $28K as Investors Eye US Debt Ceiling Progress

“So far, bitcoin has moved in lockstep with liquidity,” Dessislava Ianeva, research analyst at crypto data firm Kaiko, told CoinDesk. Ianeva noted that quantitative tightening (QT), which usually happens when the central bank looks to reduce its balance sheet, “was partially offset by the Treasury spending its cash at the Fed and Bank Term Funding Program, but that push is now exhausted.” Original

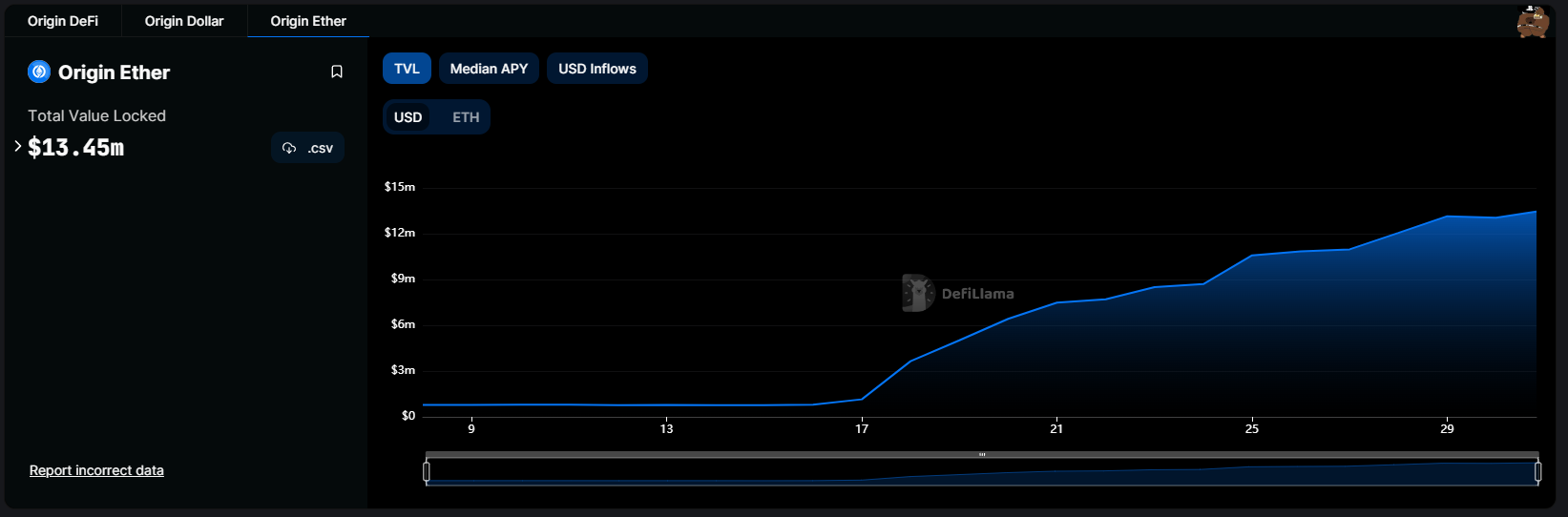

Yield farming app accumulates $12M TVL 2 weeks after launch

A new yield farming app called Origin Ether has accumulated over $12 million in total value locked (TVL) just 14 days after launch, according to data from blockchain analytics platform DefiLlama. TVL is a metric that measures the dollar value of assets inside an app’s smart contracts. Origin Ether total value locked, May 9-30. Source: DefiLlama The app was launched on May 16, according to a representative from the development team. DefiLlama data shows the app already had $793,000 locked inside its contracts before the launch, which team members or…

Nansen lays off 30% of its workforce

Blockchain analytics platform Nansen has announced the trimming of its workforce by 30%. On May 30, the Nansen CEO Alex Svanevik disclosed on Twitter that the company had to make an “extremely difficult decision to reduce the size of the Nansen team.” Full statement: pic.twitter.com/cxSTtZBiZU — Alex Svanevik (@ASvanevik) May 30, 2023 Svanevik gave two major reasons for the reduction in Nansen’s workforce. The first was the company’s rapid scaling during its initial years of operation, which “led the organization to taking on surface area that’s not truly part of…

Researchers propose new scheme to help courts test deanonymized blockchain data

A team of researchers from Friedrich-Alexander-Universität Erlangen-Nürnberg recently published a paper detailing methods investigators and courts can use to determine the validity of deanonymized data on the Bitcoin (BTC) blockchain. The team’s preprint paper, “Argumentation Schemes for Blockchain Deanonymization,” lays out a blueprint for conducting, verifying and presenting investigations into crimes involving cryptocurrency transactions. While the paper focuses on the German and United States legal systems, the authors state that the findings should be generally applicable. Bitcoin-related crime investigations revolve around the deanonymization of suspected criminals, a process made more challenging…

US CFTC issues letter on digital asset derivatives, clearing compliance in 3 areas

The United States Commodity Futures Trading Commission (CFTC) has issued a staff advisory letter to registered derivatives clearing organizations (DCOs) and DCO applicants, reminding them of the risks associated with expanding the scope of their activities. The letter from the CFTC Division of Clearing and Risk (DCR) specifically addressed digital assets. Staff advisory letters can remind addressees of their legal obligations or provide clarity on those obligations. The “DCR expects DCOs and applicants to actively identify new, evolving, or unique risks and implement risk mitigation measures,” it said, continuing: “Over…

AI experts sign doc comparing risk of ‘extinction from AI’ to pandemics, nuclear war

Dozens of artificial intelligence (AI) experts, including the CEOs of OpenAI, Google DeepMind and Anthropic, recently signed an open statement published by the Center for AI Safety (CAIS). We just put out a statement: “Mitigating the risk of extinction from AI should be a global priority alongside other societal-scale risks such as pandemics and nuclear war.” Signatories include Hinton, Bengio, Altman, Hassabis, Song, etc.https://t.co/N9f6hs4bpa (1/6) — Dan Hendrycks (@DanHendrycks) May 30, 2023 The statement contains a single sentence: “Mitigating the risk of extinction from AI should be a global priority…

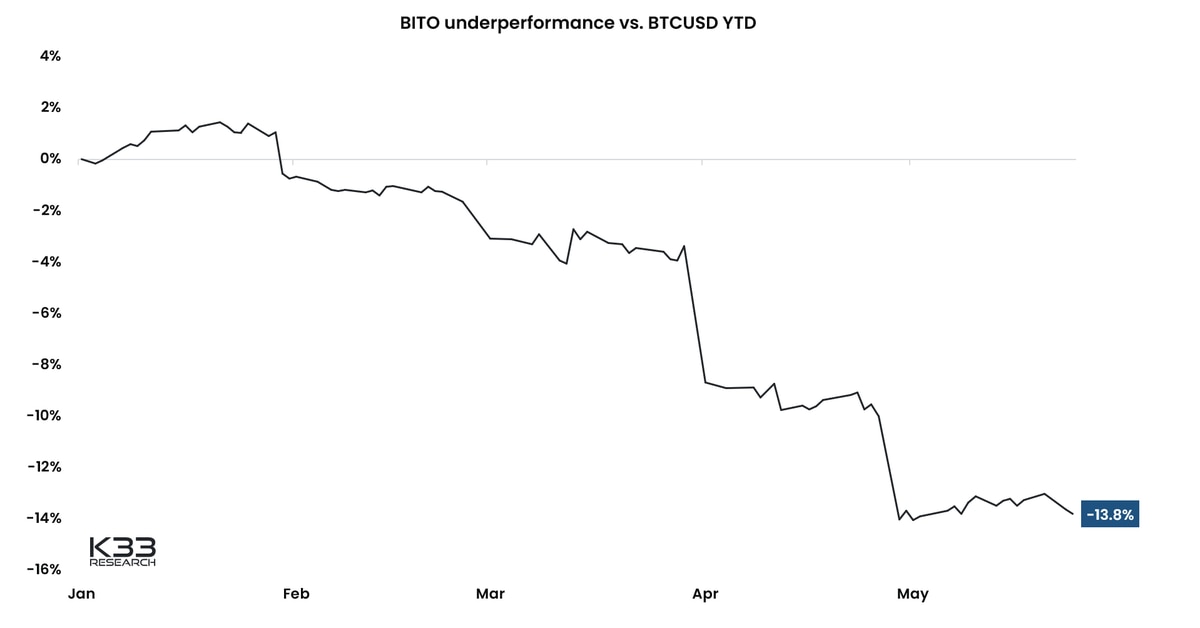

ProShares’ Bitcoin Strategy ETF BITO Underperforms BTC Price by 13.8% This Year: K33 Research

The underperformance stems from the costs associated with the fund’s structure. BITO does not purchase tokens, instead it holds BTC futures contracts on the Chicago Mercantile Exchange (CME). The fund must roll over the contracts every month as they expire, making it vulnerable to the price difference between terms. If next month’s contract trades at a premium to the nearest expiry – a phenomenon called contango and typical during a bull market – over a sustainable period, the fund will compound losses due to the “contango bleed.” Source