Altcoin prices crumbled after the United States Securities and Exchange Commission (SEC) announced lawsuits against Binance and Coinbase at the start of the week. Apart from the action against the two biggest crypto exchanges, investors seem to be nervous because the SEC labeled 23 cryptocurrencies as securities in the two lawsuits. That brings the total number of cryptocurrencies termed as securities by the SEC to 67. Among the mayhem, a minor positive is that Bitcoin (BTC) and Ether (ETH) have held out relatively well. This suggests that institutional investors are…

Day: June 11, 2023

Djed reserve ratio drops to 300% amid dumping ADA prices

The reserve ratio of Djed, an algorithmic stablecoin designed for the Cardano ecosystem by Input Output Global (IOG), has fallen to 300%, real-time data on June 11 shows. The drop is amid dumping cardano (ADA) prices. Djed reserve ratio drops to 300% Djed is a stablecoin issued by COTI, and by default, Djed is supposed to be collateralized by between 400% and 800%, according to the issuer. With the turbulence facing the cryptocurrency market and falling ADA prices, the collateralization ratio of Djed is now at 3X; below the ideal 4X…

Solana, Polygon challenge US SEC’s classification of SOL and MATIC as securities

The Solana Foundation and Polygon Labs are among the latest entities to push back against the U.S. Securities and Exchange Commission’s (SEC) classification of their respective tokens as securities. Solana Foundation and Polygon Labs push back against the SEC Both organizations have expressed their disagreement with the regulatory body’s assessment, emphasizing their commitment to operating outside the scope of U.S. markets. The Solana Foundation, which oversees the development of the Solana blockchain, expressed its willingness to cooperate with regulators to bring clarity to the emerging industry. The Solana Foundation disagrees…

SOL is not a security, says the Solana Foundation

The Solana Foundation took to Twitter to address for the first time the U.S. Securities and Exchange Commission’s classification of its native token, Solana (SOL), as a security. “The Solana Foundation disagrees with the characterization of SOL as a security,” reads a statement from June 10, noting that it welcomes the engagement of policymakers to achieve legal clarity in the digital assets space. Solana’s native and utility token was publicly launched in March 2020. SOL holders stake the token in order to validate transactions through its consensus mechanism. The token…

Google Bard predicts Tether and Tradecurve to dominate crypto

Artificial intelligence (AI) is becoming the cornerstone of modern technological advancements, especially in natural language processing. There has been a significant shift in how investors analyze the future value of cryptocurrencies. Google Bard has been a notable example of an AI chatbot that provides solid results that can aid their analysis. Bard signifies a leap forward in the AI-language model and connects advanced computational methods with conversational proficiency. Today, we will ask it to predict the future of Tether and Tradecurve. >>Buy TCRV tokens now<< Google Bard’s prediction on Tether…

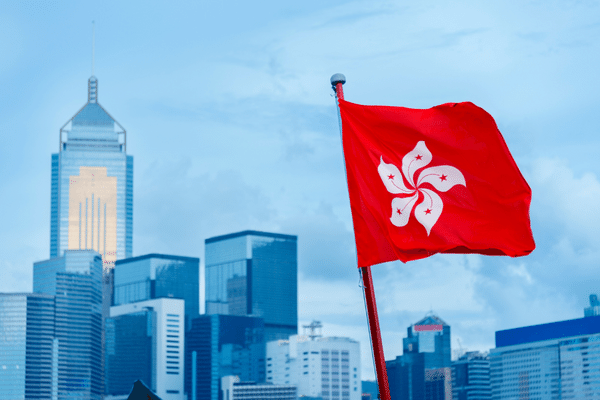

Hong Kong Legislator Invite Coinbase and Crypto Exchanges, Embracing Progressive Crypto Stance

Hong Kong Legislative Council member Johnny Ng has extended an invitation to Coinbase and other global virtual asset trading operators to establish operations in the region, showcasing the city’s progressive approach towards cryptocurrencies. In a tweet, Ng expressed his support and offered assistance to these industry players, while also hinting at potential stock listing opportunities. This move comes at a time when several major cryptocurrency exchanges, including Binance and Coinbase, have faced lawsuits from the United States Securities and Exchange Commission. While Western countries remain cautious about cryptocurrencies, Hong Kong…

Bitcoin and global crypto market falls after US SEC sued Binance and Coinbase

During a week marked by heightened regulatory scrutiny, the cryptocurrency industry experienced a significant milestone as the United States Securities and Exchange Commission (SEC) filed charges against Binance and Coinbase. Against the backdrop of a broader regulatory push, the SEC categorized numerous crypto assets as securities in these lawsuits. The market responded to this development with a notable impact, as altcoins posted significant declines, with some retesting 2022 lows. SEC sues Binance, Changpeng Zhao This week, the United States Securities and Exchange Commission (SEC) took legal action against Binance, one of the…

Users withdraw over $392 million from Binance within 24 hours

In a recent series of tweets, Changpeng Zhao (CZ), the CEO of Binance, revealed that the cryptocurrency exchange experienced a substantial net withdrawal amounting to approximately $392 million within a span of 24 hours. This revelation sheds light on the cash movement within the exchange during a turbulent period following the U.S. Securities and Exchange Commission’s legal action against Binance and Coinbase, which created substantial ripples across the cryptocurrency industry earlier this week. Such developments within the cryptocurrency industry often attract attention and speculation, as market participants closely monitor the…

InQubeta is among 3 AI crypto projects investors can explore in 2023

As the broader cryptocurrency market experiences a correction, some investors consider AI-based cryptocurrencies as potential alternatives. The AI market has demonstrated promise recently, prompting investors to seek opportunities to enhance their portfolios. Consequently, they are conducting analyses of high-potential projects within the industry. InQubeta (QUBE) is an AI crypto whose presale is ongoing. Although it is in its beta stage, the project has sold over 80% of the QUBE tokens allocated to this stage, raising over $340,000. Additionally, the graph (GRT) and numeraire (NMR) are AI-based projects that merit examination.…

Ethereum and digitoads can rally as analysts predict bitcoin to reach $30,000 in June 2023

The final weeks of 2022 were characterized by volatility and uncertainty in the crypto market. According to forecasts, the first quarter of 2023 was expected to be weak, potentially leading to further losses. However, contrary to expectations, the first three months of 2023 saw crypto assets recover. During this period, bitcoin dominated, surpassing the $22,000 resistance level in January and recording a 36% increase. However, it is essential to note that Bitcoin still faces notable challenges that require attention. Despite initial expectations, Bitcoin has yet to transform into a widespread…