Top Stories This Week US lawmakers file ‘SEC Stabilization Act’ to fire Gary Gensler United States Representative Warren Davidson has introduced the “SEC Stabilization Act” into the House of Representatives. One of the bill’s main provisions is to fire Securities and Exchange Commission (SEC) Chair Gary Gensler. The bill would remove Gensler from office and redistribute power between the SEC chair and commissioners. It would also add a sixth commissioner to the agency, disallow any party from holding a majority on the commission and create an executive director position. The…

Day: June 17, 2023

BUSD falls to fourth position among stablecoins

The dollar-pegged Binance USD (BUSD) stablecoin sits now at the fourth position in market capitalization among other stablecoins following a dip of over $1 billion in the past 30 days, data from CoinMarketCap shows. As of writing, BUSD market cap stands at $4.30 billion, down 29% from $5.54 billion on May 18. The stablecoin has been in a downward trend since December last year, when its market cap topped $23 billion. Top stablecoins by market capitalization on June 17. Source: CoinMarketCap The decline in BUSD market cap parallels major developments…

Top US Crypto Exchange Coinbase Partners With Jack Dorsey’s Self-Custody Wallet Bitkey

Top US crypto exchange Coinbase plans to integrate Bitkey, a self-custody wallet developed by Jack Dorsey’s fintech company, Block. In a recent announcement, Coinbase says it has entered a global partnership with Bitkey in an effort to foster the growth of self-custody usage. Dorsey, the billionaire co-founder and former CEO of Twitter, plugged the new partnership online. “Buy Bitcoin from an exchange and move it to a hardware key you control.” News of the partnership comes in the wake of Bitkey’s announcement to open applications for its beta program that…

The Great Battle of Asset Classification – Blockchain News, Opinion, TV and Jobs

Guest post by Giovanni Populo The SEC has charged two major cryptocurrency exchanges: Binance and Coinbase. A common charge between both exchanges is that they offered unregistered securities on their platforms. 1.1 Security vs. Commodity Securities and commodities are financial assets, differentiated by their features/characteristics, as well as legal rulings that set precedents for future references. While securities represent an investment with an expectation of profit, commodities are basic goods with value derived from their inherent properties and usefulness. A security is a financial asset that represents an investment and has an…

US court approves SEC-Binance.US agreement

United States Judge Amy Berman Jackson approved on June 17 an agreement between Binance.US, Binance, and the Securities and Exchange Commission (SEC), dismissing a previous temporary restraining order (TRO) that would freeze all Binance.US assets. Judge Jackson said on June 14 she would prefer the parties reach an agreement on their own rather than have her rule. The sides reportedly reached an agreement on June 16. “We are pleased to inform you that the Court did not grant the SEC’s request for a TRO and freeze of assets on our…

Robinhood retail crypto market share versus Coinbase rising

In recent crypto market shifts, retail investors may be migrating from Coinbase Global Inc. to Robinhood Markets Inc., according to an analysis by Mizuho Securities’ Dan Dolev. In an unexpected development in the crypto trading sphere, retail investors utilizing Coinbase Global Inc.’s services are shifting their operations to Robinhood Markets Inc., posits Mizuho Securities analyst Dan Dolev. Through his interpretation of April’s data, Dolev theorizes that Robinhood could take a larger portion of the retail crypto transaction market from Coinbase. Robinhood has gained notable popularity among home-based stock traders, raising its profile in the…

Binance partners with The Weeknd, to introduce metaverse experience

Despite regulatory hurdles from the SEC, Binance is forging ahead with a new initiative—a digital metaverse tied to The Weeknd’s “After Hours Til Dawn” tour. Binance, currently facing legal action from the SEC, has announced plans to launch a new digital metaverse focused on entertainment. The project is a collaboration with Canadian musician The Weeknd, who is also embarking on a tour called “After Hours Til Dawn”. The metaverse project has been in development since June 2022. From 10 am ET, regardless of whether they’ve bought concert tickets, fans, and…

Bank of England’s Project Rosalind results out, digital pound plans in progress

The Bank of England (BOE) has made progress towards launching its digital currency after conducting a year-long investigation that highlighted the numerous opportunities presented by digital currency technology. BoE, digital pound, and Project Rosalind In collaboration with the Bank for International Settlements (BIS), the BoE initiated Project Rosalind to explore the potential advantages and feasibility of a central bank digital currency (CBDC). On June 16, the BIS unveiled the first part of the trial’s findings, indicating that a CBDC could facilitate faster individual payments, enable businesses to develop innovative financial…

DigiToads P2E game is what Axie Infinity players have been waiting

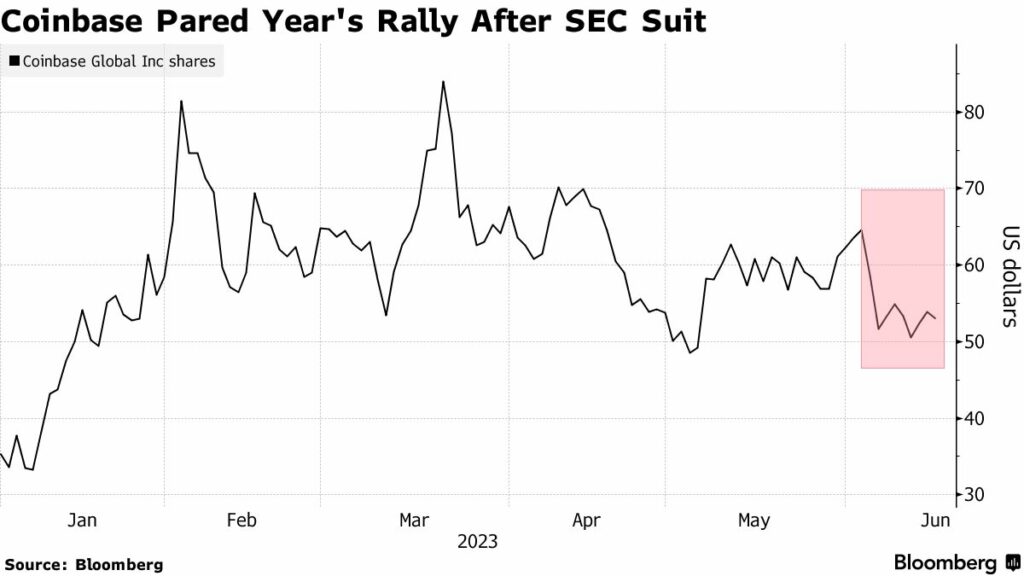

The cryptocurrency exchange, Coinbase, has been accused by the Securities and Exchange Commission (SEC) of violating federal securities laws. This news has caused uncertainty within the community, especially since a similar lawsuit was filed against Binance the day before. The news has impacted the market, with COIN share prices dropping by 20% in pre-market trading. Among the tokens implicated in the lawsuit was Axie Infinity, a play-to-earn platform currently under pressure and selling off. This shift in investor sentiment is why investors, gamers, stakers, and traders are examining DigiToads (TOADS), a…

Coinbase demands SEC respond to rulemaking petition

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied Coinbase is moving to gain an advantage in its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). The crypto exchange has responded to the commission’s request for an additional 120 days to reply to its rulemaking petition by filing a solid response in the U.S. Court of Appeals for the Third Circuit. Paul Grewal, Coinbase’s Chief Legal Officer, announced the filing, emphasizing that the crypto exchange cannot wait until next week’s deadline to…