XRP’s sharp downturn happened as bitcoin (BTC) and ether (ETH), the two leading cryptocurrencies by market capitalization, lost key price levels Wednesday afternoon after the Federal Reserve’s latest interest rate decision. Despite the Fed pausing its rate hike campaign after 14 months, an event most traders thought would be bullish for prices, BTC and ETH dropped below $25,000 and $1,700, respectively, to 3-month lows. Source

Day: June 14, 2023

French financial markets ombudsman reports jump in crypto-related mediations

Progress can have its drawbacks, as the French stock market regulator, the nongovernmental Autorité des marchés financiers (AMF), has noticed. According to the AMF ombudsman, digital asset-related mediations rose sharply in 2022, as did the number of registered digital asset service providers (DASPs). In its newly released 2022 annual report, the AMF ombudsman included a section dedicated to digital assets for the first time. It noted that, while the total number of cases received by the ombudsman decreased from 1,964 in 2021 to 1,900 in 2022, mediation requests relating to…

Aave proposal to freeze alleged Curve founder’s loans draws controversy

A June 12 AAVE (AAVE) proposal aimed at preventing a particular account from accumulating more debt has led to controversy, with some participants arguing that the proposal violates the principle of censorship-resistance or “neutrality” in decentralized finance, or DeFi. Some participants believe that the account is owned by Curve (CRV) founder Michael Egorov. Cointelegraph was not able to independently confirm who the account’s owner is. Uhh seems like Curve’s founder has a $110m leverage position against his $CRV stack across all Defi. If not repaid at some point (spoil: it…

Requiring DEXes to register with SEC like other exchanges is ‘impossible’, says Coinbase CLO

Paul Grewal, chief legal officer of United States-based cryptocurrency firm Coinbase, has pushed back against a proposed rule change from the Securities and Exchange Commission (SEC) which could change the definition of an exchange and how digital assets are regulated. In a June 14 Twitter thread, Grewal said the SEC proposal “tries to fit a square peg in a round hole” and was “too flawed on process and substance to move forward”. He was referring to the SEC extending the comment period for a proposed rule change in the Securities…

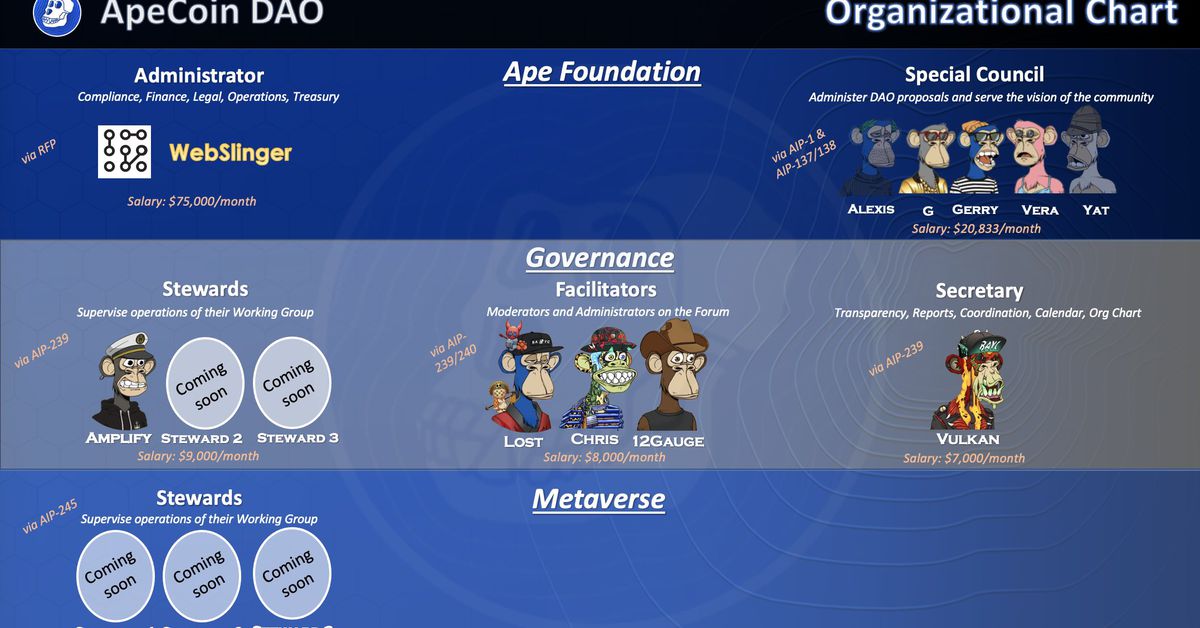

Debate Over ApeCoin DAO Special Council Salaries Spreads on Twitter

But last week, Twitter users began to question the DAO’s leadership compensation after Vulkan, who serves as the ApeCoin secretary, posted an organizational chart of the ApeCoin DAO leadership system. Notably, the tweet also listed monthly salaries for each of the roles, which include: $7,000 for the secretary, $8,000 for governance facilitators, $9,000 for working group stewards, $20,833 for Special Council members and $75,000 for WebSlinger, a Cayman Islands administrator for the Ape Foundation that handles legal and compliance matters. Source

Bitcoin’s Lack of Layer 2s Is a Blessing in Disguise

Crypto’s first layer 2 solutions were born out of the need to scale layer 1s properly rather than creating hard forks of the base layer blockchains. And ever since, L2s have typically been marketed as the solution to scaling, faster transactions, lower fees and precursors for mainstream adoption of crypto. However, truly efficient, secure and stable scaling solutions in crypto are hard to come by. Original

AI Crypto Tokens Lose Steam as Post-Nvidia Earnings Hype Wears Off

Render (RNDR) token has risen as a “unique case,” said an analyst. Source

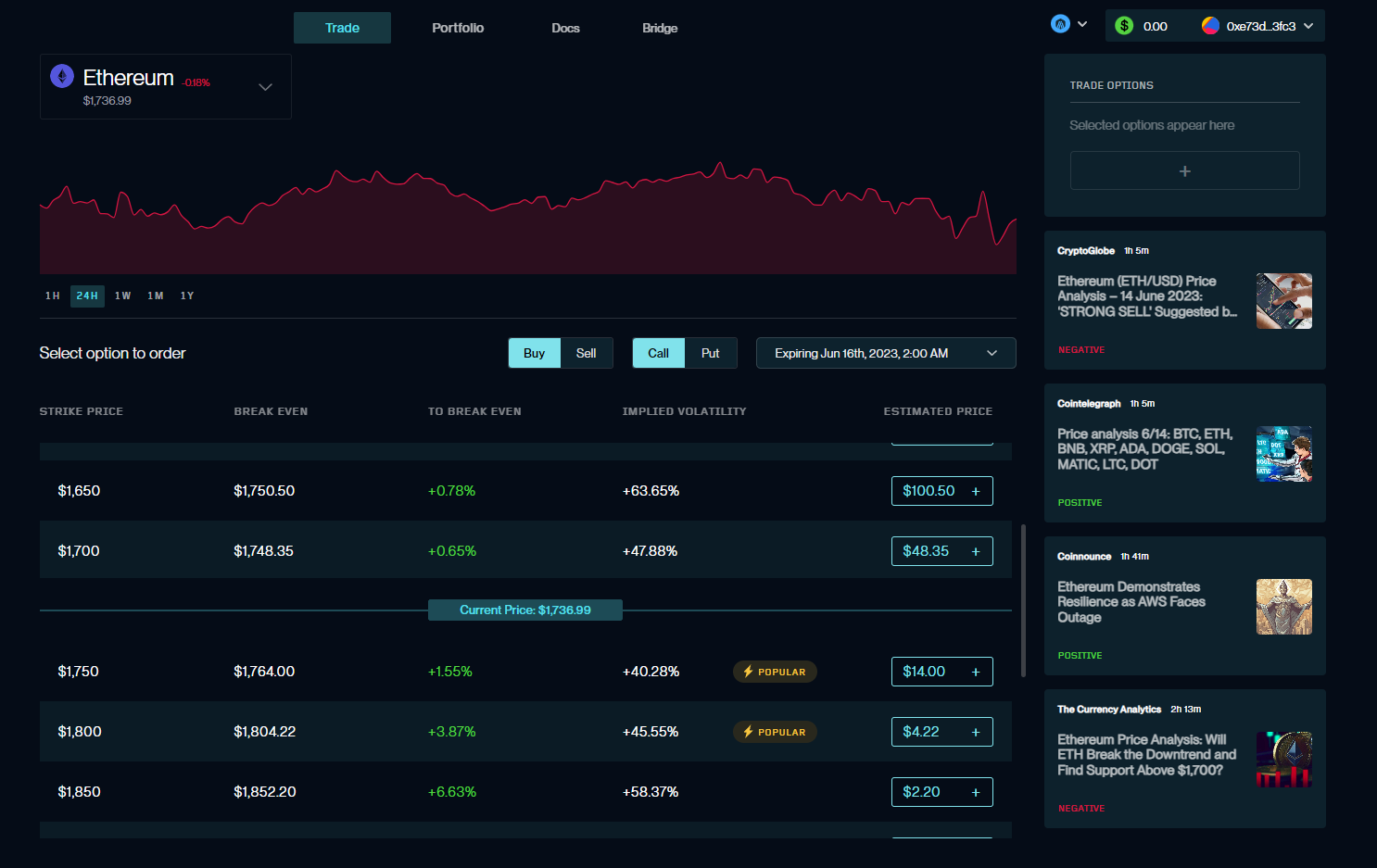

DeFi options platform uses social logins, margin trading to draw in liquidity

A DeFi options platform launched that uses social logins and undercollateralized trading to draw in liquidity providers, according to a June 15 announcement . The protocol, called “Synquote,” is capable of handling large trades with much less slippage than previous options platforms, the team claimed. Synquote user interface. Source: Synquote According to the announcement, Synquote did over $25 million of notional volume in its beta period, which began on March 17. The largest trade during this period was for $1 million in notional volume, which was executed without any detectable…

Apple Rejects Bitcoin Wallet Zeus a Day After Threatening to Delist Damus

The tech giant cited transmission of a virtual currency without necessary licenses and permissions as the primary reason for the app’s rejection, according to Zeus’ founder. Original

CBDC ‘human rights’ tracker revealed at Oslo Freedom Forum

The nonprofit Human Rights Foundation (HRF) has launched a central bank digital currency (CBDC) tracker, the organization announced at the same Oslo Freedom House event it hosts. The online tracker has published educational materials and a tip line. It is expected to become fully functional by year-end. The tracker came out of an eight-month fellowship at the HRF that was announced in January. The fellowship was awarded to Cato Institute policy analyst Nick Anthony, researcher Janine Romer, and podcaster Matthew Mezinskis. The Cato Institute is an ardent opponent of CBDCs.…