Fitch’s downgrade of U.S. debt this week is a warning to American policymakers and r underscores why Bitcoin and other open monetary systems matter. Source

Day: August 4, 2023

Curve-Vyper exploit: The whole story so far

Curve Finance pools were targeted by hackers in a reentrancy attack on July 30, sending shockwaves across the DeFi ecosystem. Cointelegraph compiled the week’s events. The decentralized finance (DeFi) ecosystem has experienced a challenging week after a seismic security incident led to over $61 million being stolen from Curve Finance’s pools, leaving several protocols facing broader contagion risks. This attack exposed vulnerabilities across DeFi projects and sparked efforts to recover stolen funds over the past few days. As the community navigates the aftermath of this exploit, Cointelegraph compiled the week’s…

Coinbase earnings show the company is now much more than just an exchange

Coinbase, a leading U.S. cryptocurrency exchange, shared its 2Q results on August 3. Despite showing a net loss, some positives emerged, like a 13% cut in operating expenses from the last quarter and a 3% boost in its cash reserves to $5.5 billion. Coinbase key financial metrics, USD million. Source: Coinbase However, the exchange took a hit with a $97 million net loss, worse than its previous quarter, and saw a 32% drop in its adjusted EBITDA to $194 million in 2Q. Services and USDC stablecoin impact growth One downside…

CRV exposure risk throws a curveball at the DeFi ecosystem: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week. The $47 million Curve Finance exploit on July 30 had a domino effect on the DeFi ecosystem, mainly due to the $100 million loan taken out by the Curve founder against the platform’s native Curve DAO (CRV) token. Several lending protocols have rushed in with new governance proposals to minimize CRV exposure risks as the token price fluctuates. On Aug. 3, the…

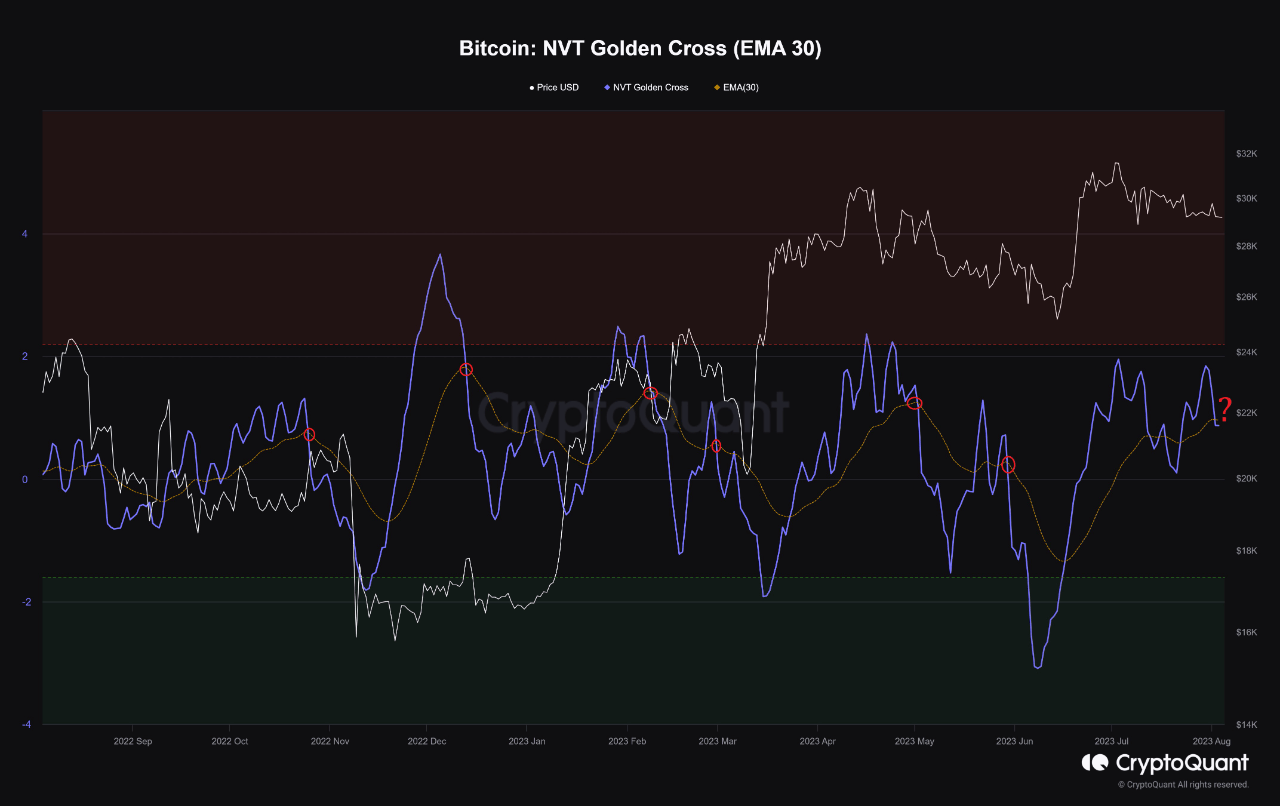

Bitcoin NVT Shows Bearish Crossover, Price Drop Incoming?

On-chain data shows the Bitcoin Network Value To Transactions (NVT) ratio has formed a bearish crossover, a sign that a decline may be imminent. Bitcoin NVT Ratio Has Formed A Historical Bearish Crossover The “NVT ratio” is an indicator that measures the ratio between the Bitcoin market cap and transaction volume. In simple terms, what this metric tells us is whether the asset’s price (the market cap) is fairly valued compared to the network’s ability to transact coins (the transaction volume). When the ratio has a value above 1, it…

Crypto asset investment in Latvia declines by 50% over past year, per central bank

The number of people buying crypto assets in Latvia is declining, Latvijas Banka said in its 2023 “Financial Stability Report.” The central bank attributed the falling interest in crypto to negative sentiment linked to fraud and insolvency among major market participants, “unwise” investments that have already been made, crypto’s links to money laundering and “the increasing link of crypto-asset companies to the supervised financial sector participants.” Basing its findings on payment card usage, the bank said 4% of the population had bought crypto assets in February 2023, compared with 8%…

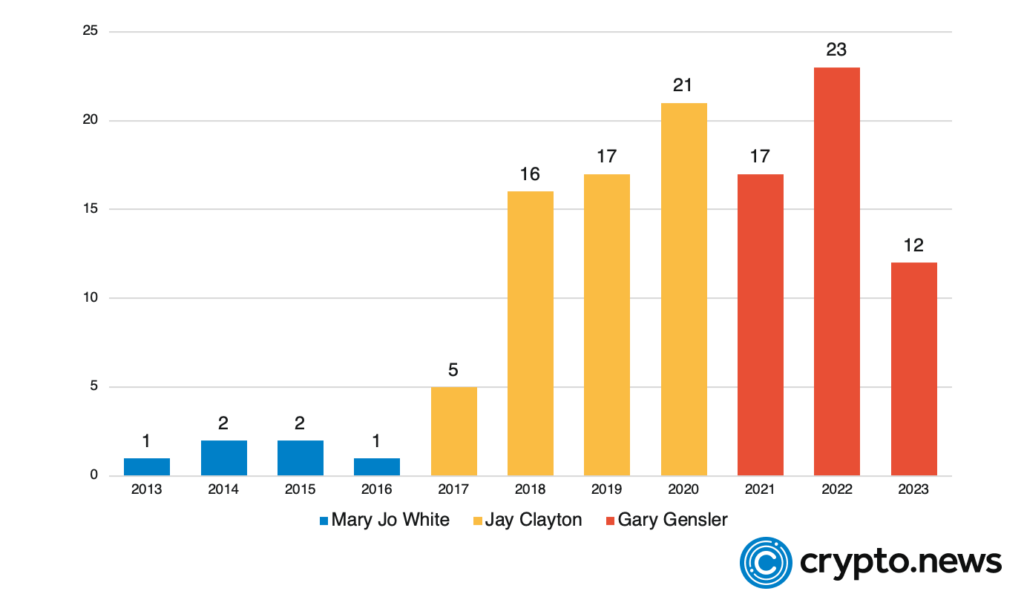

Tracing the impact of SEC chairmen

From its early days, the crypto sector has grappled with regulation. We analyzed how the U.S. Securities and Exchange Commission (SEC) and its successive chairs have shaped crypto’s regulatory landscape over the years. The U.S. Securities and Exchange CommissionSEC has had a less than friendly relationship with crypto, with its current chair Gary Gensler seen as the poster child for this perceived animosity. But how did Gensler’s predecessors relate to the crypto industry? How did policies enacted under their tenures eventually shape the current regulatory environment? By delving into these…

Comedian Adam DeVine Brings Crypto to the House Party in Ad for Crypto Exchange BitGet

“Working with comedians, such as Adam, will allow us to lower the knowledge barrier, making crypto and Web3 more fun and accessible to attract more youth, who will ultimately be the key builder to bring our society forward, to a more crypto-friendly future.” Gracy Chen, the managing director of Bitget, said in the press release. Source

Price analysis 8/4: BTC, ETH, BNB, XRP, DOGE, ADA, SOL, MATIC, LTC, DOT

Bitcoin continues to range trade, and altcoin traders are starting to view BTC’s price consolidation as a positive sign for the rest of the crypto market. Bitcoin continues to frustrate traders who have been predicting a breakout on either side, but investors should keep a close watch because the longer the time spent inside the range, the stronger the eventual breakout from it. The July jobs report released on Aug. 4 was a mixed bag. Hence, it could not shake Bitcoin (BTC) from its range. The report showed the addition of 187,000…

Bank Of Canada Study Shows Crypto Ownership In The Country Fell In The Last 2 Years

A recent study by the Bank of Canada (BoC) has shown a decline in the ownership of cryptocurrencies over the two years. The BoC has attributed this decline in crypto ownership to ecosystem collapses, regulatory hurdles, and price depreciation. Bitcoin’s Decline Most Notable According to the Bitcoin Omnibus Survey, Bitcoin’s ownership across the country dipped to 10% at the end of last year. This decline has been attributed to various factors, including the significant drop from its all-time high due to the current market conditions, especially since Bitcoin’s price crashed…