DePIN projects collectively have tokens worth tens of billions of dollars. But how much revenue are they, as a group, generating? Something like $15 million a year, said Rob Hadick, a general partner at Dragonfly, a crypto venture capital fund. “Most of the protocols aren’t constrained by supply, but by a lack of demand,” he said in an interview. Source

Day: April 16, 2024

Analyst Points To Possible 30% Bitcoin Correction, Calls For Caution

Popular cryptocurrency expert Cold Blooded Shiller has made a grim prediction that Bitcoin may be on the verge of a significant correction and could crash as low as 30%, given the current heightened volatility in the market. Bitcoin Could Be Poised For 30% Pullback Cold Blooded Shiller believes it is important to note that Bitcoin is holding up and now showing much more strength, regardless of the different factors influencing the nascent sector, such as ETFs, fundamentals, and Halving. Given that pullbacks of 30% are historically common for BTC, Shiller…

Bitcoin Depot Thrives Amid Cryptocurrency Volatility

Bitcoin Depot, the largest Bitcoin ATM operator in the United States, has demonstrated remarkable resilience in its revenues despite the volatile nature of cryptocurrency prices. According to its recently filed 10-K annual report on April 15, the company disclosed revenues of $689 million in 2023 and $647 million in 2022, indicating a strong performance unaffected by Bitcoin’s price fluctuations. Bitcoin Depot’s Robust Revenue Amid Market Volatility Despite the tumultuous movements in cryptocurrency prices, Bitcoin Depot has maintained steady revenue growth, showcasing its stability amidst market turbulence. Even during periods of…

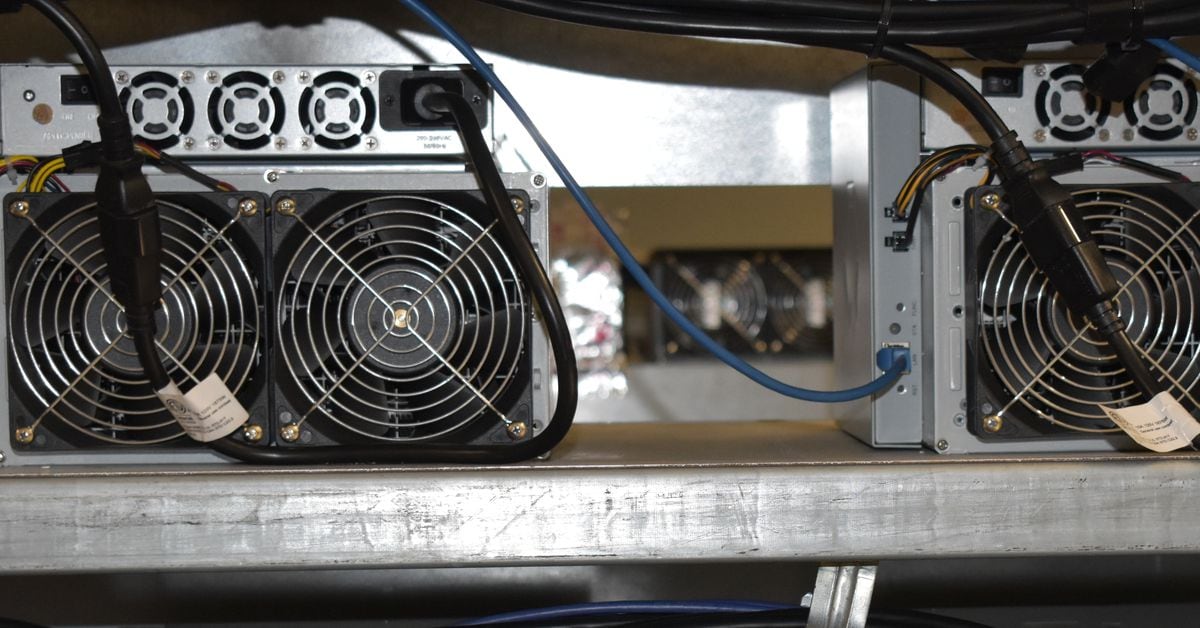

Bitcoin Miners Must Optimize to Survive

Bitcoin miners who have not optimized their existing infrastructure, built their own high-performing data center team, developed their own software stack, and managed their power contracts effectively will face a difficult period after the halving. They will be highly vulnerable to larger players who have the infrastructure to dramatically improve their operations. As a result, the bitcoin mining industry will likely see consolidation as miners with access to more capital continue to expand their operations opportunistically. To remain competitive, it is even more important for smaller miners to prioritize efficient,…

What the History of Linux Says About the Long Road to Decentralized Storage Adoption

We may not need to reuse OpenStack directly, but we need to build something similarly usable (and similarly reliable, which is the difficult part). We will have to blend our home-grown incentive structures with Web2 and cloud hyperscaler monitoring, compliance and security technologies in order to succeed. We need to design hybrid centralized/decentralized SLAs (service level agreements — the contracts between you and a cloud storage provider). We need to secure it with a buffet of reliability incentives, security attestations, zero-knowledge proofs, fully homomorphic encryption, computation fraud proofs, governance protocols…

Miners Race to Discover Block 840,000 as Bitcoin Halving Nears

Many enthusiasts in the Bitcoin community were anticipating the next halving to coincide with Saturday, April 20, 2024, but the latest data suggest it will likely occur a day earlier, on April 19. Despite a recent uptick in mining difficulty, miners have managed to maintain a high hashrate, resulting in block times dropping below the […] Original

Why is Bitcoin down from its March high?

Bitcoin recently dropped from its March peak, influenced by a stronger U.S. dollar and geopolitical issues. What should we expect next? Bitcoin (BTC) has seen a sharp decline in its price, trading at around $63,000 levels as of Apr. 16. This comes after it reached an all-time high of $73,750 on Mar. 14, marking a 15% pullback from its peak. BTC one-month price chart | Source: CoinMarketCap The surge to the all-time high was largely propelled by the approval of spot Bitcoin ETFs by the U.S. SEC in January 2024.…

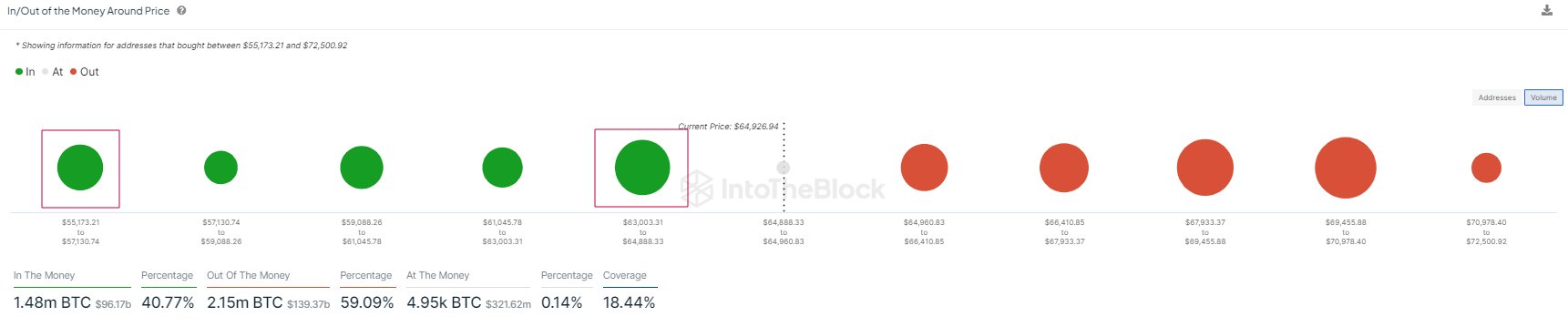

Bitcoin Has Next Major Demand Zone At $56,000: Brace For Impact?

On-chain data shows the next major Bitcoin demand zone is around $56,000, a level BTC might end up revisiting if the decline continues. Bitcoin Has Next Major On-Chain Support Around $56,000 According to data from the market intelligence platform IntoTheBlock, BTC’s recent drawdown has meant that it may end up having to rely on the price range around $56,000 for support. In on-chain analysis, a level’s potential as support or resistance is based on the total number of coins that the investors last acquired there. Below is a chart that…

‘Real-World Implementations of Both AI and Web3’ Fuel AI Tokens’ Rally, Says Daniel He

With socialfi platforms, financial incentives serve not only as a reward mechanism for content creators but also “fundamentally transform the engagement model for all users,” Daniel He, the CEO of the artificial intelligence (AI)-powered socialfi platform, Republik, said. He believes that by offering incentives for user engagement beyond liking or commenting, socialfi platforms have a […] Source CryptoX Portal

U.S. Senator expresses CBDC concerns, supports Bitcoin

U.S. Senator Marsha Blackburn highlighted the personal privacy and government surveillance risks of Central Bank Digital Currencies and Bitcoin. In recent remarks at the Bitcoin Policy Summit, the Tennessee Republican expressed strong concerns about Central Bank Digital Currencies (CBDCs), labeling them as potential spy tools for government oversight. “Central Bank Digital Currencies are essentially a way for the government to have a peephole into everyone’s personal finances,” Blackburn said. She argued that such digital currencies could enable unprecedented access to individual financial transactions, thereby increasing the potential for governmental control…