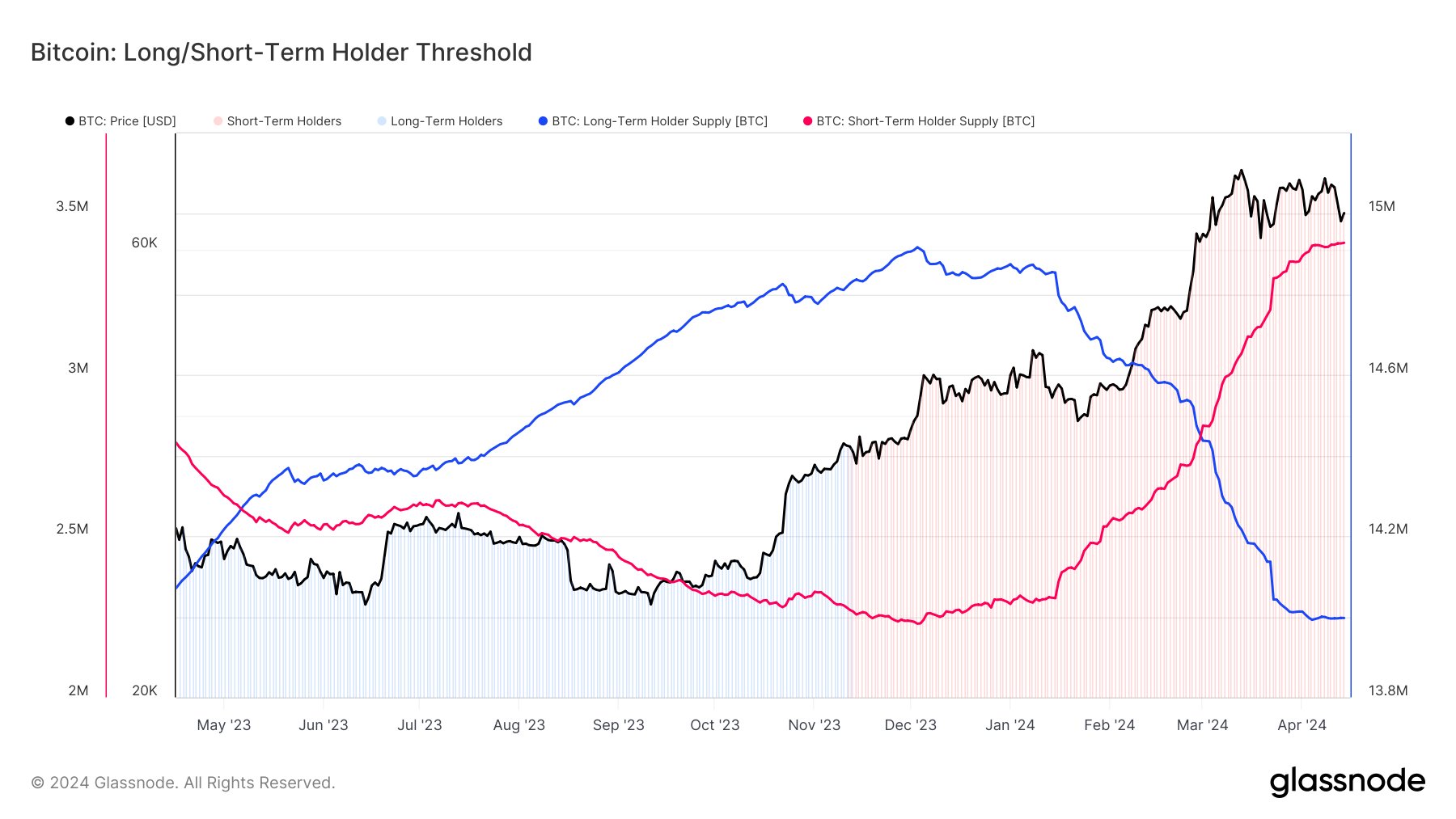

On-chain data shows the Bitcoin long-term holder selling pressure has been running out recently after an extended selloff from the group. Bitcoin Long-Term Holders Have Sold Huge In Past 4 Months As analyst James Van Straten explained in a post on X, the long-term holders have massively reduced distribution during the last ten days. The “long-term holders” (LTHs) here refer to the Bitcoin investors carrying their coins since more than 155 days ago. The LTHs comprise one of the two main divisions of the BTC sector, with the other cohort…

Day: April 16, 2024

Mad Viking Games ® Just Secures US-Trademark and Unveils Ashes of Idunn ® MetaVerse

PRESS RELEASE. Mad Viking Games ® proudly announces its official registration as a U.S. trademark by the United States Patent and Trademark Office (USPTO) confirmed on April 16 2024. This landmark achievement is not merely a legal formality but a strategic step forward, reinforcing Mad Viking Games’ position as a company integrating Norse mythology with […] Source CryptoX Portal

Monday’s Market Action Sees $36.7 Million Outflow From US Spot Bitcoin ETFs

On Monday, U.S. spot bitcoin exchange-traded funds (ETFs) experienced another round of outflows, shedding $36.7 million since the outflows on Friday. Additionally, after the close of Monday’s market, Grayscale’s Bitcoin Trust (GBTC) offloaded 2,524.1 bitcoins valued at $159.25 million. Blackrock’s IBIT and Fidelity’s FBTC Lead in Bitcoin Accumulation as GBTC Sells Off Since the trading […] Original

Urges Traders To Be Patient

While Bitcoin prices hover around 15% below their all-time highs, with some skeptics predicting more losses, one analyst on X expects the coin to bounce strongly, even breaking above all-time highs. Taking to X, the trader argues that Bitcoin has yet to breach the Golden Ratio Multiplier’s Cycle Top, currently sitting at $79,591. Supposedly, the analyst continues, this target price increases the longer it remains unchallenged. Bitcoin price action favors bulls | Source: Analyst on X Bitcoin Traders Need To Be Patient So far, BTC is trending lower and is technically within…

What Bitcoiners Are Saying About the Upcoming Bitcoin (BTC) Halving

The biggest difference between the 2020 halving and the 2024 halving is skyrocketing institutional demand. Prior to the previous halving, institutions were on the sidelines. The market was dominated by retail investors. Since then, the market dynamic has drastically shifted. As one example, MicroStrategy didn’t make its first BTC purchase until August 2020. As of April 2024, the company reportedly holds 214, 246 BTC (roughly $13.625 billion). Of the 21 million bitcoins that will ever exist, around 12.27% currently belong to publicly traded and private companies, ETFs and countries. Original

Is the Bitcoin (BTC) Price Rally Over? Reasons to Stay Bullish Despite Crypto Correction

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Arkham Releases Top 5 Crypto Rich List

Arkham Intelligence, an industry leader in on-chain data tracking, has released a list of the richest people in crypto according to their wallet balances. This list has been making the rounds in the crypto community due to the top 5 alone being worth billions of dollars. But perhaps, what is more interesting is how much of this money has now been deemed inaccessible. 3 Of The Top 5 Crypto Rich List Lost Forever Arkham took to X (formerly Twitter) to share the top 10 richest individuals in crypto ranked by…

Grayscale’s Bitcoin ETF fund has lost half of assets since launch

The volume of Bitcoins managed by Grayscale Bitcoin Trust has decreased by almost 50% since the conversion to a spot ETF. Unlike other issuers such as BlackRock or Fidelity, Grayscale’s investment vehicle launched on the New York Stock Exchange with approximately 619,220 BTC. According to Coinglass, the volume of cryptocurrency in Grayscale Bitcoin Trust (GBTC) had at its disposal as of April 16 has decreased to 311,621 BTC. Source: Coinglass Since January, the value of assets under management (AUM) has decreased by only 31% from $28.7 billion to $19.6 billion…

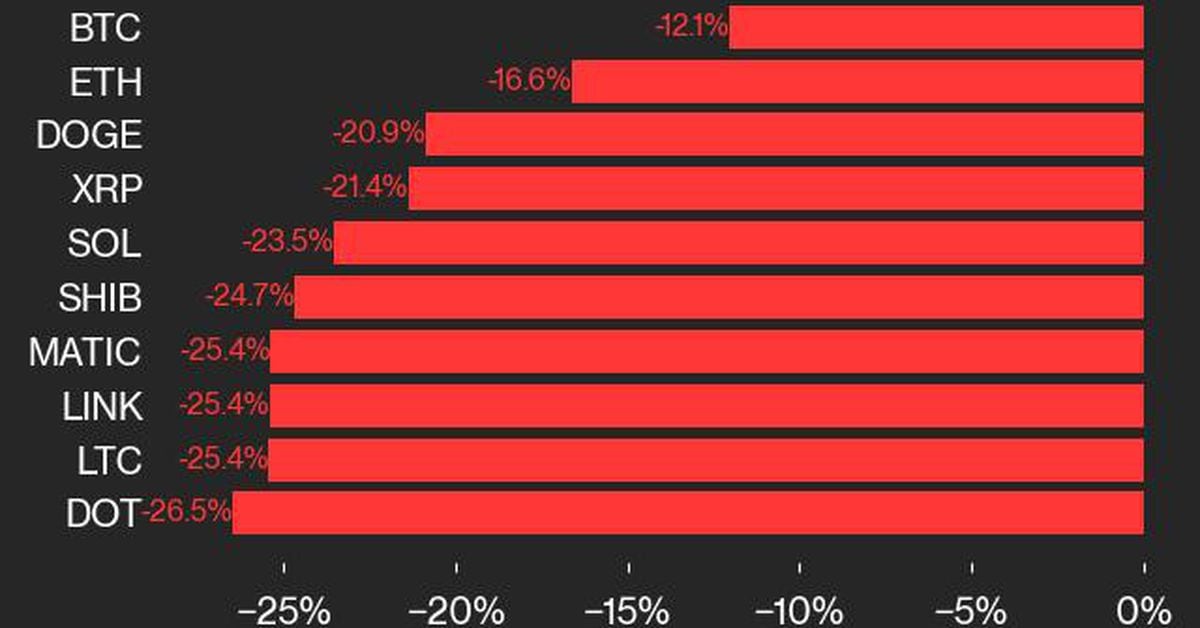

Bitcoin and Ethereum Show Relative Resilience Amid Widespread Losses: CoinDesk Indices Market Update

CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CMI comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. Source

Drift Foundation Announces 100 Million Token Airdrop for Solana-Based Dex Users

On April 16, 2024, the Drift Foundation, which supports the Solana-based decentralized exchange (dex) platform Drift, disclosed plans to distribute 100 million tokens to its users. The tokens will function as the platform’s governance coin, to be utilized by the community and the Drift decentralized autonomous organization (DAO). Solana-Based Dex Platform Drift to Distribute Governance […] Source BitcoincryptoexchangeExchanges CryptoX Portal