Bitcoin price (BTC) is currently in a sort of stasis, unexcitedly trading in the expected range and over the past 48-hours dropping to the former rising wedge trendline at $7,150 and again to the $7,200 support before rebounding to the low $7,400 region.

Crypto market daily price chart. Source: Coin360

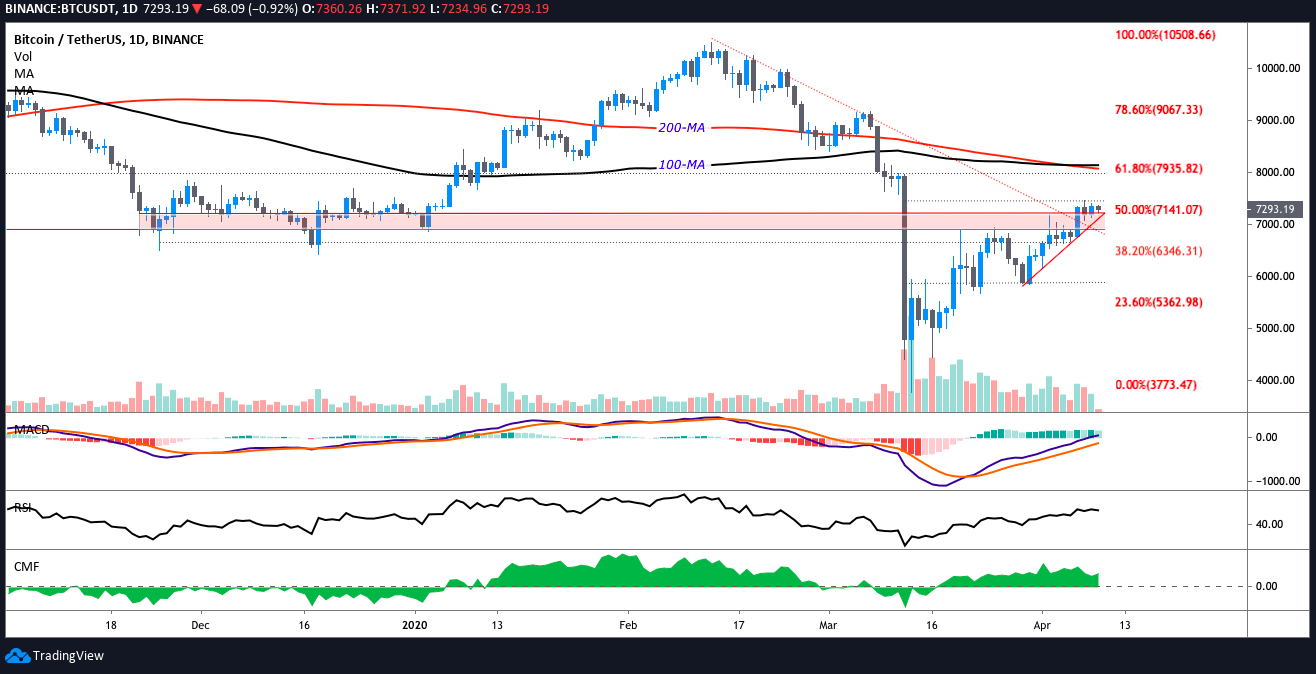

For the time being, the price is consolidating within the $7,200 to $7,460 range. The next thing bulls will be looking for is for BTC price to push above the recent high to set a higher-high above $7,663 before launching a move toward $7,992, where the 61.8% Fibonacci retracement currently resides.

BTC USDT daily chart. Source: TradingView

Anyone taking a quick glance at crypto Twitter will notice analysts calling for traders to go short from $8,000-$8,100 as the 100 and 200 day-MA are in this zone and expected to function as stiff resistance levels.

This is possibly due to the fact that since March 13 Bitcoin price has gained approximately 95%. But before any of this can be achieved Bitcoin needs to turn the $7,350 to $7,400 region to support.

For the time being, traders continue to buy on the dips and a glance at exchange order books show traders are quite interested in buying at prices below $7,200.

BTC USDT 4-hour chart. Source: TradingView

The 4-hour timeframe shows that while the price consolidates, the volume is tapering off and this is a hint that Bitcoin is beginning to lose momentum. The moving average convergence divergence histogram has also turned negative and the relative strength index has dropped slightly below 60. The ailing volume and sideways price action also increase the chance of BTC/USD falling below the $7,200 support to $6,900, then $6,750.

Bitcoin price is now facing a few outcomes, with the bias currently tilted towards bears. Simply put, an increase in purchasing volume is needed to break through the current range and rise toward the 61.8% Fibonacci retracement at $7,992.

The alternate scenario involves Bitcoin losing the $7,200 support and as the price drops to retest lower supports investors will have no choice but to see if the interest currently represented in the orderbook manifests into buying at key support levels to prevent a drop to $5,800.

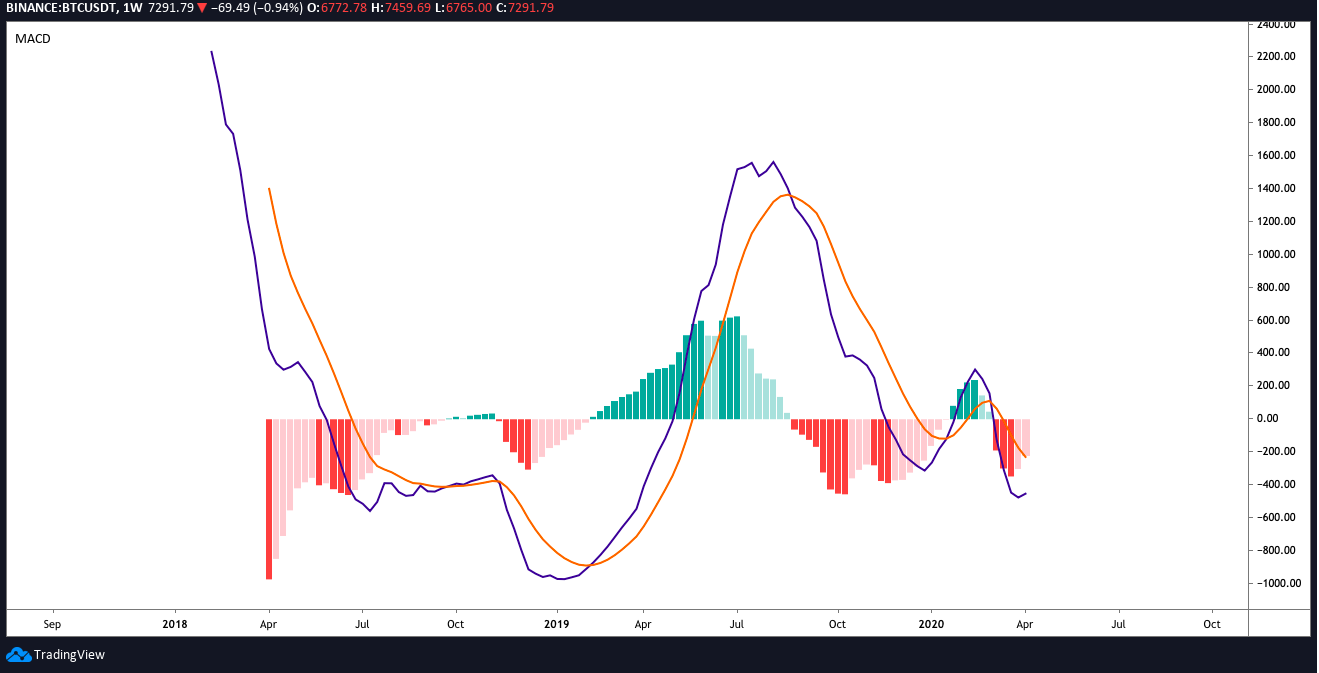

When in doubt, zoom out…but remember the MACD is a lagging indicator

3 day BTC USDT MACD chart. Source: TradingView

Taking a look at the higher time frames gives some encouragement. On the 3-day chart, investors will notice that the MACD line is about to pull above the signal line and the histogram is just now printing a green bar above 0.

Weekly BTC USDT MACD chart. Source: TradingView

On the weekly timeframe, the MACD is slowly beginning to curve up toward the signal line and although the histogram remains negative, the color of the candles has shifted from red to pink. The weekly RSI is also rising above 46 but it is not yet in bullish territory.

More importantly, we can see that the price is drawing closer to an important pivot point and the same can be said for $8,100.

BTC USDT 1-week chart. Source: TradingView

In summary, at the moment there’s not much chop to trade for day traders as the risk seems greater than the reward right now. Traders will likely wait for one of the following three scenarios:

- A breakout above $7,500 with the expectation of $8,000-$8,500 being reached.

- Waiting for the price to climb to the 61.8 level ($8,000) to open a short position.

- Going short now or waiting for the price to drop below $6,900 with a target at $5,800.

Another thing worth remembering is that Bitcoin’s halving is about 35 days away but with the coronavirus pandemic and current state of global economic affairs it’s possible that the halving will be something of a disappointment — particularly, when it comes to short-term price action — just like the Bitcoin Cash halving was on Wednesday.

Whatever trade you choose, be sure to use a stop-loss.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.