By CCN: Many who trade and invest in bitcoin and other cryptocurrencies share the ultimate goal of maximizing gains in the incoming bull cycle. To achieve this end, market participants employ a myriad of tactics including scalping, swing trading, breakout trading, and even day trading. While these strategies can work, it is important to understand that only 6% of the people who try to be professional traders make the cut.

Unless you’re already a pro, you’re better off using an easier and virtually stress-free trading approach known as position trading. In this article, we reveal the three reasons why position trading is your best bet in this bitcoin bull market.

Position Trading Maximizes Gains for Assets with a History of Unleashing Astronomical Profits

As a position trader, you hold onto your positions for months or even years until your target price is met. You do not care about the daily swings or even a brief period of correction. This strategy is perfect if you want to supercharge your wealth by investing in bitcoin.

Historically, every bitcoin bull market has seen the cryptocurrency generate astronomical returns. These are the leaps made by the cryptocurrency in every bull cycle:

- 2011 – 2012: 312,000% surge

- 2012 – 2013: 13,000% surge

- 2013: 2,200% surge

- 2015 – 2017: 11,000% surge

History is telling us that in the incoming bull market, bitcoin can meteorically rise by as little as 2,200% or as high as 312,000%. Using the 2018 bear market bottom of $3,250, bitcoin has the potential to skyrocket to as little as $74,750 (2,200%). On the other side of the range, the cryptocurrency can climb as high as $10,143,250 (312,000%).

Bitcoin’s potential to generate massive gains in a relatively short period of time makes it a perfect candidate for position trading. The simple buy and hold strategy all the way to the top will help you maximize profits.

Position Trading Reduces the Need for In-Depth Technical Analysis

Technical analysis is not only time-consuming but also requires a certain degree of expertise to effectively time the market. Hence, if you don’t have the time or the skills, better stick to position trading.

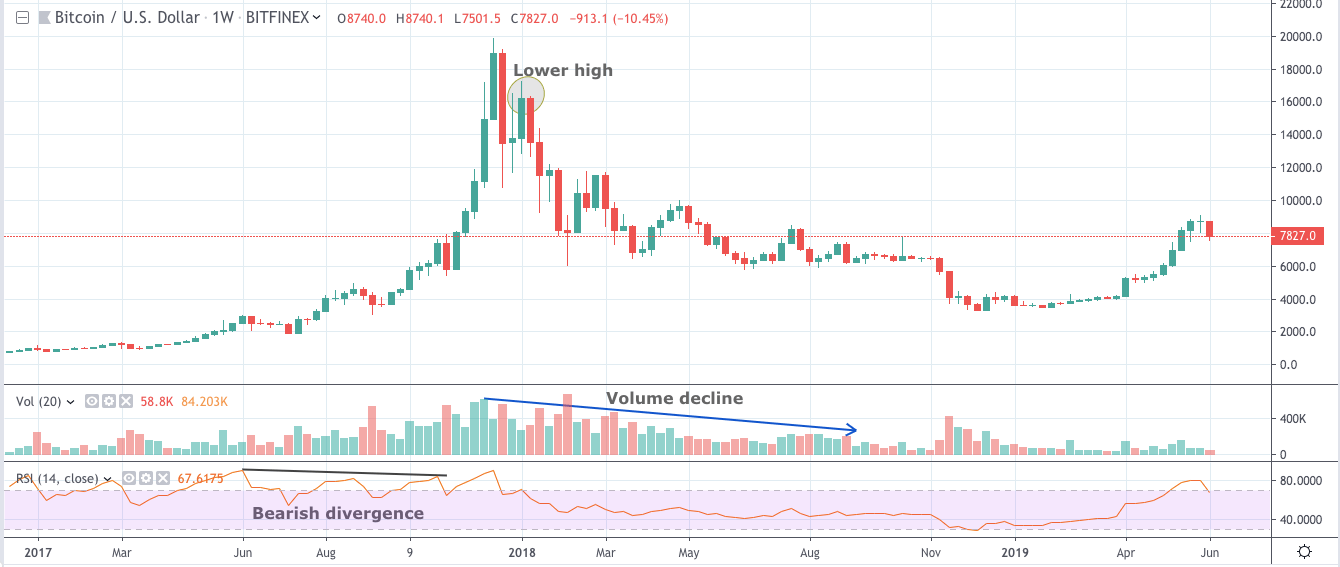

With this strategy, all you have to watch out for are signs of bullish exhaustion on the longer timeframe. For instance, a lower high on the weekly chart coupled with bearish technical indicators such as a bearish divergence and decreasing volume are red flags. They might indicate the end of the bull run.

As a position trader, keep an eye out for these signals. They often precede a market reversal.

Position Trading Eliminates Emotional Distractions

If you’re only looking at signs of long-term bullish exhaustion, there won’t be any need for you to stress out on the cryptocurrency’s daily price fluctuation. Bitcoin is still an immature market and it can be very volatile. That’s why most retail traders can’t handle the emotions triggered by huge swings in either direction.

With position trading, market swings do not distract you. You sit comfortably waiting for bullish exhaustion or for your target price.

Bottom Line

Bitcoin’s history of posting astronomical gains make position trading the best strategy for retail traders. The approach frees you from doing in-depth technical analysis. It also liberates you from the stress brought about by daily fluctuations. Believe or not, generating enormous wealth can be as simple as buying and holding all the way to the top.