On Oct. 25 Bitcoin (BTC) unexpectedly gained 42%, one of the largest daily gains witnessed since 2011. A number of altcoins benefitted from this startling upside move and Ether (ETH) rallied 24.23% alongside Bitcon.

Daily crypto market data daily view. Source: Coin360

This week also saw a deluge of positive news from decentralized finance (DeFi) companies which are expanding, increasing interest payments, and reducing loan interest rates on many of the crypto-based products and services they offer.

A few of the major DeFi-related announcements this week were:

– Dharma relaunched it’s DeFi platform and now supports DAI and USD Coin (USDC)

– Crypto-lending platform Nexo reduced its loan rates to 5.9% on all instant credit lines.

– Celcius Network increased the interest of Tether (USDT) deposits to 9.75% and 12% for investors who opt to receive interest payments in CEL token.

– Digital asset broker Voyager Digital announced that it would provide 3% interest on all Bitcoin held on it’s platform.

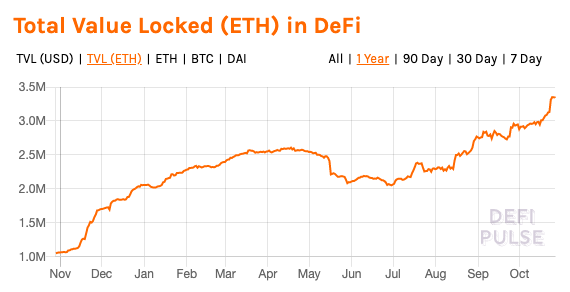

While these developments might not be directly connected to the Ether, investors are aware that the number of Ether locked into DeFi platforms has risen tremendously risen throughout 2019 and the majority of DeFi platform are built on the Ethereum Network. According to data from DeFi Pulse there is currently $598.5 million worth of cryptocurrency locked into DeFi platforms and 3.3 million Ether tokens in lockup.

Total Value (ETH) Locked in DeFi. Source: Defipulse.com

In a way, DeFi has become somewhat synonymous with Ether and the Ethereum network which could be leading investors to interpret all DeFi news as potentially bullish events for Ether.

Will Ether follow Bitcoin Price?

This week’s 30.29% gain from Ether backs up the claim that the altcoin’s price action has been riveting as of late. The week started with Bitcoin’s collapse from $8,050 which rocked Ether and caused its price to drop out of the descending wedge pattern to form a double bottom at $152.95.

Prior to Friday’s massive Bitcoin led rally which saw BTC gain 42% and Ether 24.23%, the altcoin traded in a gray area, nudging quietly against the bottom trendline of the descending wedge. The historic Oct. 25 rally sent Ether price well above the trendlines of the descending wedge to set a near 2-week high at $199.61.

ETH USD daily chart. Source: TradingView

Currently Ether is situated right at the 50-day moving average after setting a 16-day high at $199.61 which was well above the 100-day moving average. A move back to $200 would place price on top of the upper Bollinger Band arm and right at the 200-day moving average (DMA). This move would also align with the steep drop from $204 that took place on Sept.24 and was previously the first sell target for any Ether position opened from $152.

The volume profile visible range (VPVR) shows that in the current range from $180 to $206 there is limited overhead selling pressure so in addition to yesterday’s 24.23% gain, momentum traders might pull up their stop orders with the anticipation that volume sustaining on Bitcoin and Ethereum, Ether could still have an additional 11% to run.

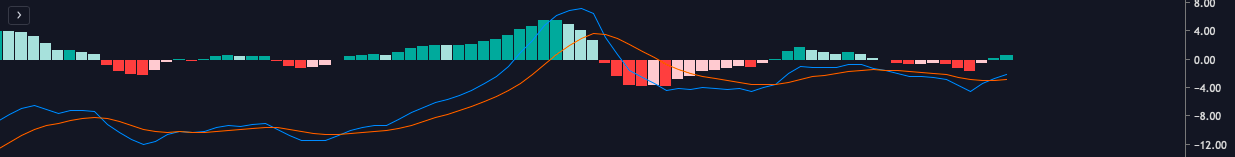

ETH USD daily MACD. Source: TradingView

The daily moving average confluence divergence (MACD) also shows promise. The MACD and signal line pulled off a bullish crossover and the histogram flipped positive and currently sits above 0. The magnitude of this move is shown on the shorter time frames and the momentum on the 4-hour MACD histogram reached a high not seen since Sept. 28. The daily RSI has also entered bullish territory (50)

Improvement on the weekly timeframe

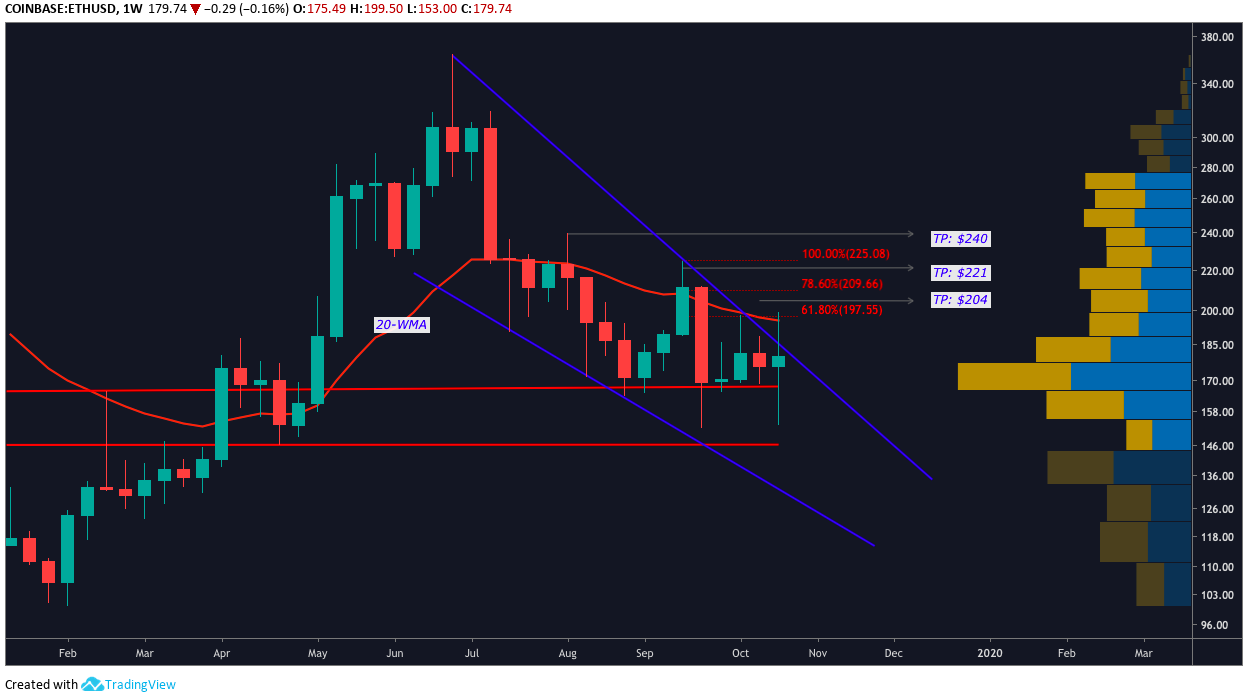

ETH USD weekly chart. Source: TradingView

The weekly time frame shows Ether broke above the descending channel and briefly pierced the 61.8% Fibonacci retracement level, a point which is significant to many traders. Above the first take profit level ($204) Ether needs to surmount the 78.6% Fibonacci retracement level $211.48 which would also represent a higher high above the 27.8% dump that occured on Sept. 23.

An upside move to $211 would also nearly cross above the 20-week moving average on the weekly Bollinger Band indicator.

ETH/BTC

ETH BTC daily chart. Source: TradingView

The ETH/BTC pairing does not exhibit the same bullish scenario as the USD pairing. The 10% drop on Oct. 26 formed a monthly low (Sept. 26) and a double bottom at 0.018847 satoshis (sats) which is typically a reversal pattern. Ether remains below the 200-DMA and Friday’s drop also plunged the altcoin below the 50-DMA.

Without reading into the situation too deeply, it’s possible that as Bitcoin made its stunning upside move, traders shifted into BTC to catch the action. The daily MACD, RSI and Stoch RSI are all also uninspiring.

Traders can keep an eye on volume and the recently formed double bottom to see if this leads to a reversal. One would expect that if the ETH/BTC pair turns bullish, similarly significant price action will be mirrored on the ETH/USD pairing.

In the event that the ETH/USD pairing turns bearish and drops below $170, there is support by the previous double bottom at $152.95 and the support at $146.60.

The views and opinions expressed here are solely those of the author (@HorusHughes) and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.