The decentralized finance sector continues to charge full steam ahead as multiple tokens notch new all-time highs and the total value locked in DeFi protocols grows with the passing of each week.

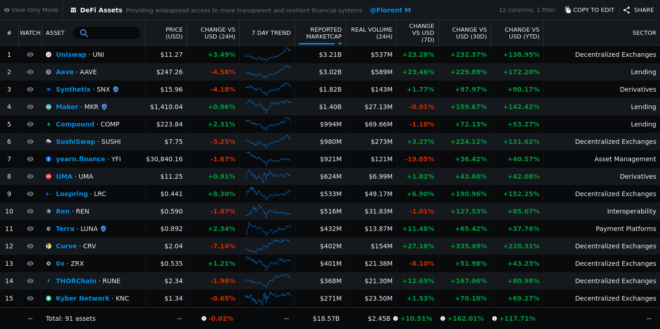

Data from Messari shows projects like AAVE, Uniswap (UNI), SushiSwap (SUSHI) and Synthetix (SNX) have all rallied by double-digits, creating a positive feedback loop as more users engage with the protocols to yield farm and capitalize on flash loans.

As the price of Bitcoin (BTC) and Ether (ETH) has reached new highs in recent months, the total value locked (TVL) in DeFi has risen as well, increasing optimism and engagement on the various decentralized exchanges and lending platforms. Data from CoinGecko shows that in the past six months, DeFi’s total market capitalization has grown to $45 billion.

From Jan. 1 to Jan. 25, DeFi platforms collectively saw the TVL rise from $15.6 billion to a record-high $26.1 billion.

In fact, according to DeFi Pulse, the total value locked across DeFi protocols has increased from $21.49 billion to $26.173 billion in the past four days alone.

This sharp increase in TVL was helped by a $400 surge in the price of Ether from $1,053 on Jan. 21 to a new all-time high of $1,459 on Jan. 25. But Ether can’t account for all the gains, as shown by the increasing number of DeFi tokens that are also securing new all-time highs.

Despite these impressive developments, the DeFi sector accounts for just 4.6% of the total cryptocurrency market capitalization, which currently stands at $976.6 billion.

Despite representing just a small sliver of the total crypto market, DeFi’s rapid growth suggests the sector is primed for explosive growth as cryptocurrency becomes more mainstream.