On Jan. 4, Ether (ETH) price rallied to $1,160, which was followed by a 24% correction within the following 4 hours.

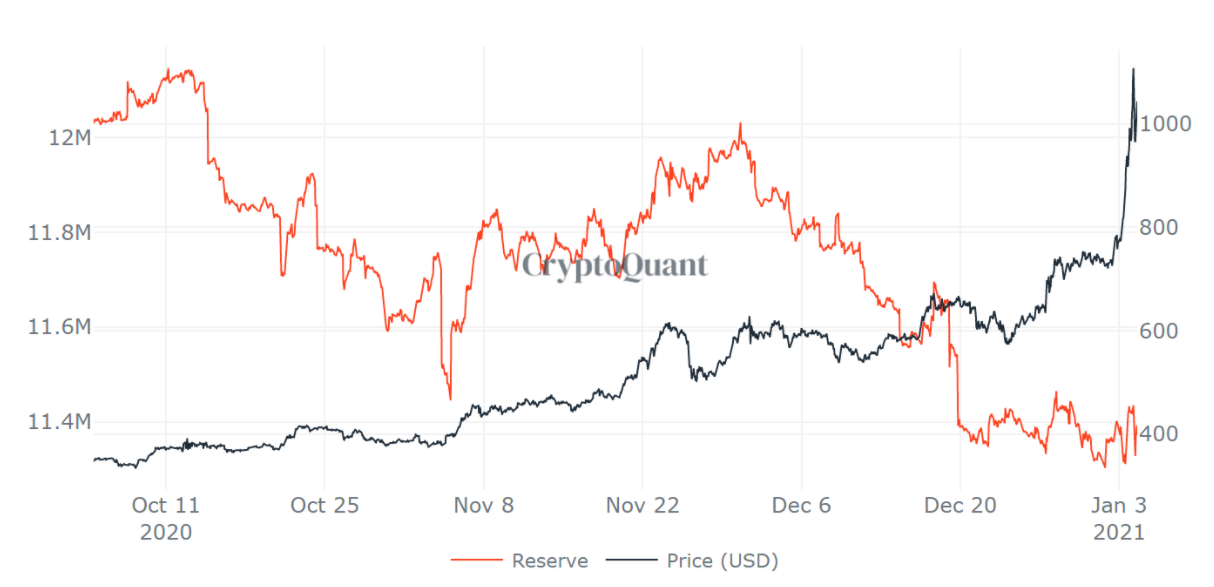

What is clear is that investors are anxiously awaiting the CME’s ETH futures launch which is scheduled for Feb. 8. Another factor driving the current rally is that Ether miners’ balances reached a two-year low, a scenario that some analysts view as bullish.

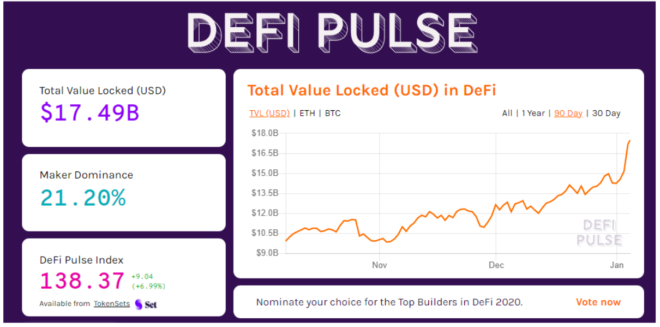

The phenomenal growth of total value locked in decentralized finance projects has also played a part, especially considering that the metric reached $17.5 billion over the past week.

For the time being, positive newsflow and solid fundamentals seem to be in play for Ether but it is still important to try and understand whether the recent crash reflects a potential local top or if it was simply a retest of $900 as a new support level.

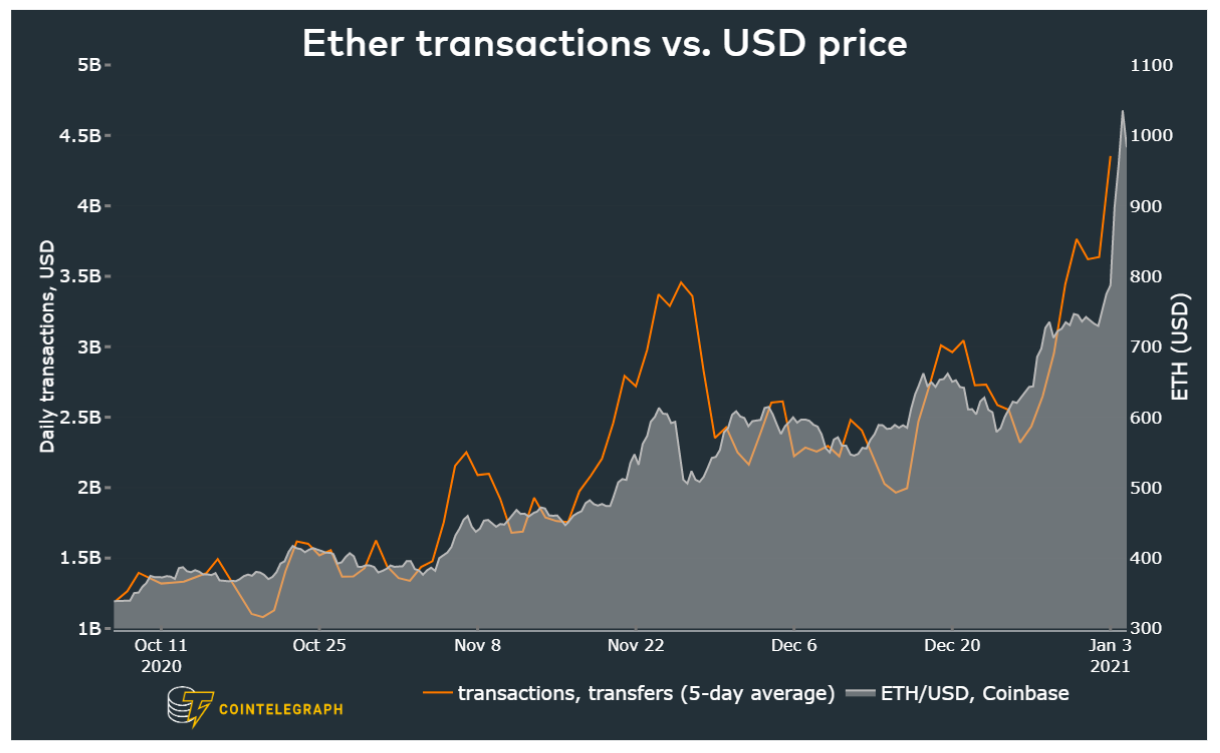

Aside from price action and technical analysis, investors should also gauge the network usage metrics on the Ethereum network. An excellent place to start is analyzing transactions and transfer value.

The chart above shows the indicator spiking above $4 billion in daily transactions, a 73% increase when compared to the previous month’s $2.6 billion. This noticable increase in transaction and transfer value reflects signals strength and also suggests that Ether price is sustainable at the current levels.

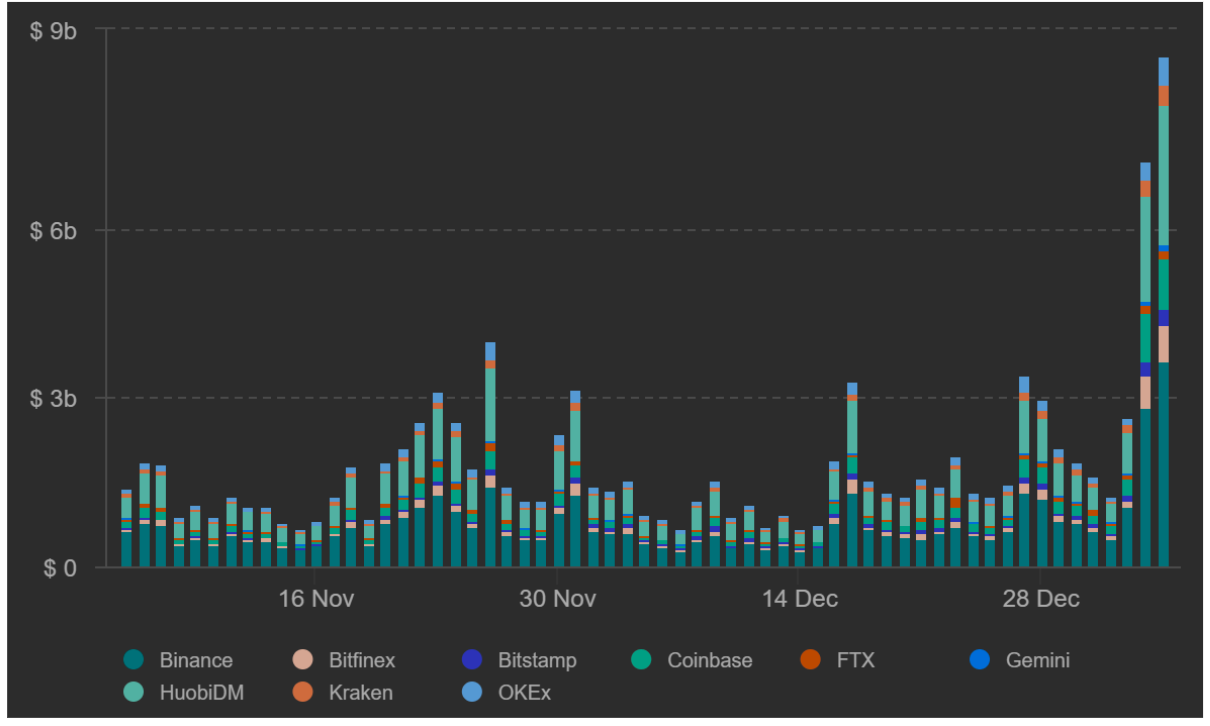

Increasing withdrawals from exchanges can be caused by multiple reasons, including staking, yield farming, and buyers sending coins to cold storage. Usually, a steady flow of net deposits indicates a willingness to sell in the short-term. From Dec. 1 to Dec. 19, exchanges faced 600,000 ETH net withdrawals. This move signals a potential accumulation from whales, either transferring to cold wallets or putting those Ether into the DeFi ecosystem. It is worth noting that over the past two weeks, there has been some stabilization. Selling activity was expected as Ether price peaked and this lead to larger deposits. Therefore, the indicator stands slightly positive. Professional traders tend to dominate longer-term futures contracts with set expiry dates. By measuring the expense gap between futures and the regular spot market, a trader can gauge the level of bullishness in the market. The 3-month futures should usually trade with a 1.5% or higher premium versus regular spot exchanges. Whenever this indicator fades or turns negative, this is an alarming red flag. This situation is known as backwardation and indicates that the market is turning bearish. The above chart shows that the indicator peaked at 6.4% on Jan. 4 as Ether touched its highest price since May 2018. The current 4.7% rate above equals a 20% annualized premium and is significantly above the levels seen in previous months. This data shows that despite the recent $280 dip, professional traders are still confident in Ether’s price potential. In addition to monitoring futures contracts, profitable traders also track volume in the spot market. Breaking resistance levels on low volumes is somewhat intriguing because, typically, low volumes indicate a lack of confidence. Therefore significant price changes should be accompanied by robust trading volume. The previous two days saw an impressive $8 billion average volume and this is considerably higher than the trend of recent weeks. New price highs accompanied by volume spikes are an excellent indicator of sustainable price levels. This event holds especially true considering that the recent 42% move occurred since Dec. 30, when traditional markets closed. Had there been low volume days recently, investors would question what was really behind the surge to $1,160. By measuring whether more activity is going through call (buy) options or put (sell) options, one can gauge the overall market sentiment. Generally speaking, call options are used for bullish strategies, whereas put options for bearish ones. A 0.70 put-to-call ratio indicates that put options open interest lag the more bullish calls by 30% and is therefore bullish. Since Dec. 25, investors have been trading a higher volume on put options. Therefore, the indicator increased to 0.81 from 0.65. This signals a trend reversion from a more bullish move that lasted two weeks. Despite the protection-seeking movement, put options still lag the more bullish call options by 19%. This data is very encouraging, considering that Ether rallied 60% since Dec. 25, yet there is no sign that investors have flipped to more neutral-to-bearish (put option) strategies. Despite some signs of weakness after Ether tested its $1,160 high on Jan. 4, each of the five indicators discussed above has held a bullish level. As Ether managed to recover quickly from its recent sub $900 dip, investors gained further confidence that the uptrend hasn’t been broken. The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Exchange withdrawals are paused for now

The futures premium peaked, but nothing abnormal has occurred

Spot volume spiked throughout the rally

Options put/call ratio

Related posts