Bitcoin’s price has been dragging downward and on March 29, BTC’s fiat value slipped beneath the $6K zone. Most of the top ten cryptocurrencies are down between 5-8% in the last 24 hours. As the global economy falters and the halving approaches, people are uncertain about the future price of bitcoin as “safe-haven” theories have been steadily vanishing.

Also read: In-Between Bitcoin Halvings: Analyst Proves Bitcoin’s Price Not Bound to 4-Year Cycles

Top Ten Cryptos See Some Percentage Losses During Sunday’s Trading Sessions

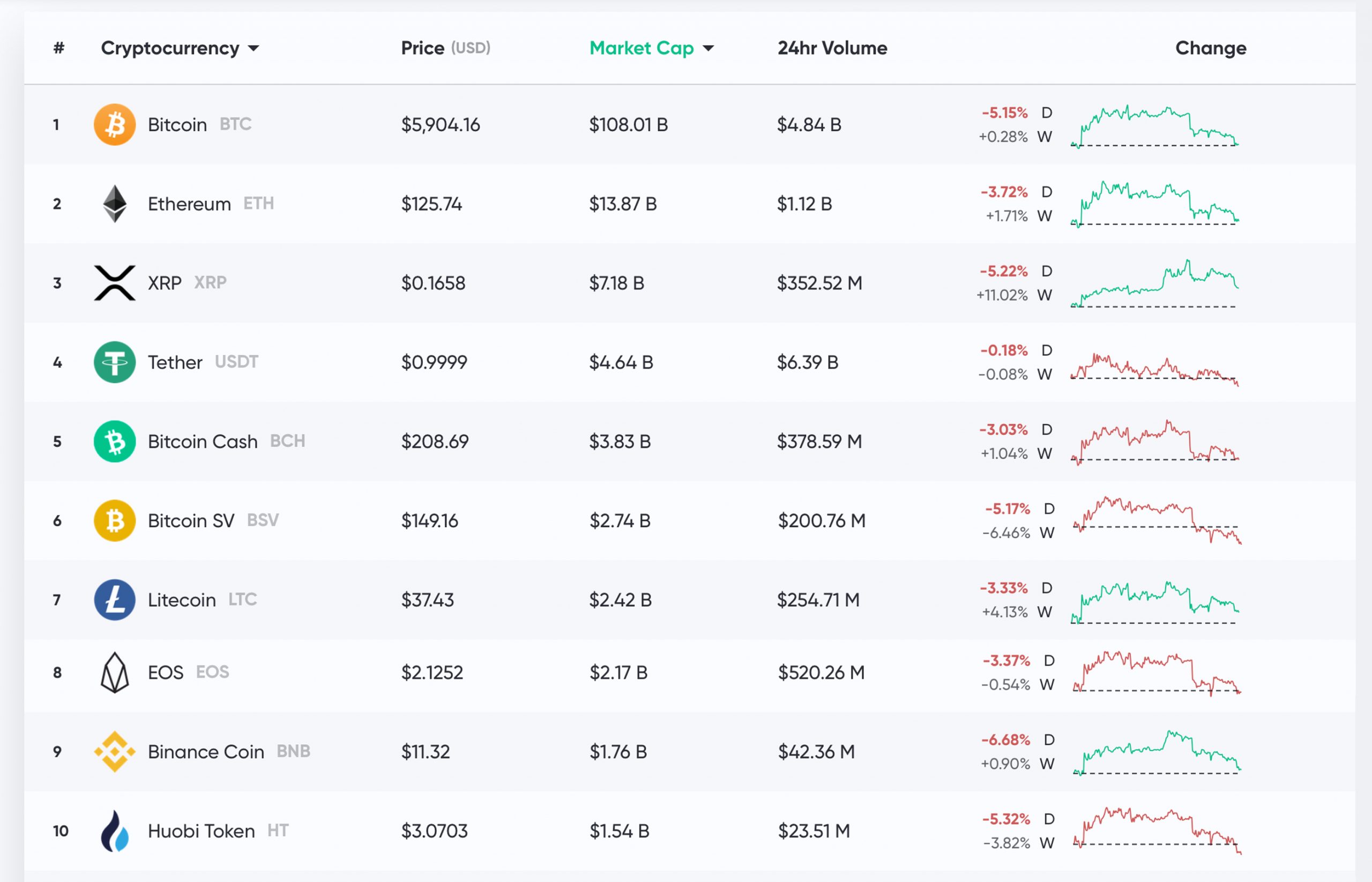

The price of bitcoin affects the entire cryptoconomy most of the time and on Sunday, March 29, the story is no different. BTC has slipped beneath the psychological $6K mark after hovering around $6,450 for a while and then $6,200 during the last day and a half. At the time of publication, BTC is swapping for $5,904 per coin and has a market capitalization of roughly $108 billion.

As usual, tether (USDT) is the top pair with BTC on Sunday capturing more than 67% of the day’s trades. This is followed by pairs like USD (8.6%), JPY (6.2%), PAX (5.69%), USDC (5.4%) and EUR (2.18%). The two stablecoins PAX and USDC have been commanding a lot of BTC trade volume since the initial market carnage that started on March 12. At $5,904 per coin, BTC has lost 5.15% during the course of Sunday’s trading sessions.

The second-largest blockchain by market capitalization, ethereum (ETH), is down 3.6% today and trading for $125 per coin. ETH has a market cap hovering around $13.8 billion and about a billion in reported trade volume on Sunday. Ethereum prices are down 18% during the last 30 days, 4.3% for the last 90, and negative 12% for the last 12-months against the U.S. dollar.

The fifth-largest blockchain by market cap, bitcoin cash (BCH) is down 3% today and is swapping for $208 a coin. BCH has around $330 million in global trade volume and the coin’s market valuation is $3.8 billion today. Just like BTC, the top trading pair with bitcoin cash is tether (USDT) capturing 59% of the day’s swaps. BTC is below tether followed by USD (14.5%), ETH (1.5%), KRW (1.4%), and EUR (0.55%). Bitcoin cash is down 3% for the last 30 days, the coin is up 0.27% for the last 90, and BCH is also still up 24% for the last 12-months against the U.S. dollar.

Uncertainty Remains Thick Among Crypto Traders

Right now many traders on forums, Youtube, social media and other avenues are uncertain about the future of BTC’s price and the rest of the crypto market. The popular analyst Peter Brandt noted on March 27 that for BTC, “This is the perfect storm.” However, Brandt added: “If Bitcoin cannot rally on this, then crypto is in BIG trouble.”

“I do not personally think BTC even has that much time to declare itself true or false,” Brandt tweeted the day prior.

Digital asset trader Crypto Michaël tweeted to his 50,000 followers that he thinks “every cycle takes longer than the previous one.” The trader’s opinion was similar to our recent report on Benjamin Cowen’s video about debunking four-year cycle periods.

“What if that also means that we’re going to find support at the 300-Week MA?” Crypto Michaël asked. “100-Week MA was supported in 2012, 200-Week in 2014-2017. 300-Week MA accumulation before the peak to 2025-2026 with BTC at $150,000?” the trader added.

“So you’re saying BTC will be in the range between 3k and 6k over the next 2+ years? I don’t think that BTC holders will be happy with that,” one person replied. “You are right. But I think there will be a new Bitcoin hodler emerging if the price will be $3K,” another crypto proponent added.

The Twitter account The Crypto Fam told his 20,000 followers that he thinks $6K as a long term price is good. “But it’s possible that all markets make another big leg down, even gold, in which case BTC would go with it. Gotta have some cash to buy new lows,” he tweeted.

“In the last 24 hours, I’ve watched BTC climb in the short-term while XRP remains stable in bitcoin price countless times in which it somehow did not affect the USD price of XRP in the meantime. Mathematically, it just doesn’t compute,” the trader Tommy Tourettes said. Presently, a number of traders and analysts have a range of different theories about where crypto prices will lead, but these days most of them are uncertain of what lies ahead.

Where do you see the cryptocurrency markets heading from here? Let us know in the comments below.

Read disclaimer

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Twitter