Almost 24,000 Bitcoin (BTC) have been withdrawn from exchanges since Bitcoin’s halving on May 11, according to Bitcoin Exchange Net-Flow data from on-chain market analysis platform Glassnode. The trend of Bitcoin flowing out of exchanges started in mid-April and has continued with only a short reprieve in the hours before and after the halving:

In the hours before and after #Bitcoin‘s halving, exchange net flow decreased significantly.

So far, the event has had no impact on 2020’s trend of investors withdrawing $BTC from exchanges.https://t.co/KqezAI9HsM pic.twitter.com/ClCdYJ90wG

— glassnode (@glassnode) May 13, 2020

This trend could signify two new developments — that current users are taking more responsibility for their own funds rather than trusting exchanges, or that a large portion of new users are looking at Bitcoin as a store of value rather than as a trading asset.

Are funds safe with exchanges?

The crypto community have regularly questioned exchanges’ security and the wisdom of users holding large balances of crypto on them. Bitcoin’s unofficial twitter account of over 1 million followers says in their profile:

“Not your keys; not your coins.”

Exchange hacks are increasing with more sophistication Crypto data analytics group Chainalysis reported in their 2020 Crypto Crime Report. In the last two years over $1.1 billion in crypto has been stolen in exchange hacks alone with an all-time high of 11 attacks occurring in 2019.

Source: Chanalysis.com

The top 10 exchanges hold almost 13% of the total circulating Bitcoin supply with over 2,300 ($21.7 billion) BTC in on-chain wallets. Coinbase tops the list with almost 1 million (5.2%) in their control which many argue is enough to manipulate Bitcoin’s price at whim.

More Bitcoin holders than ever

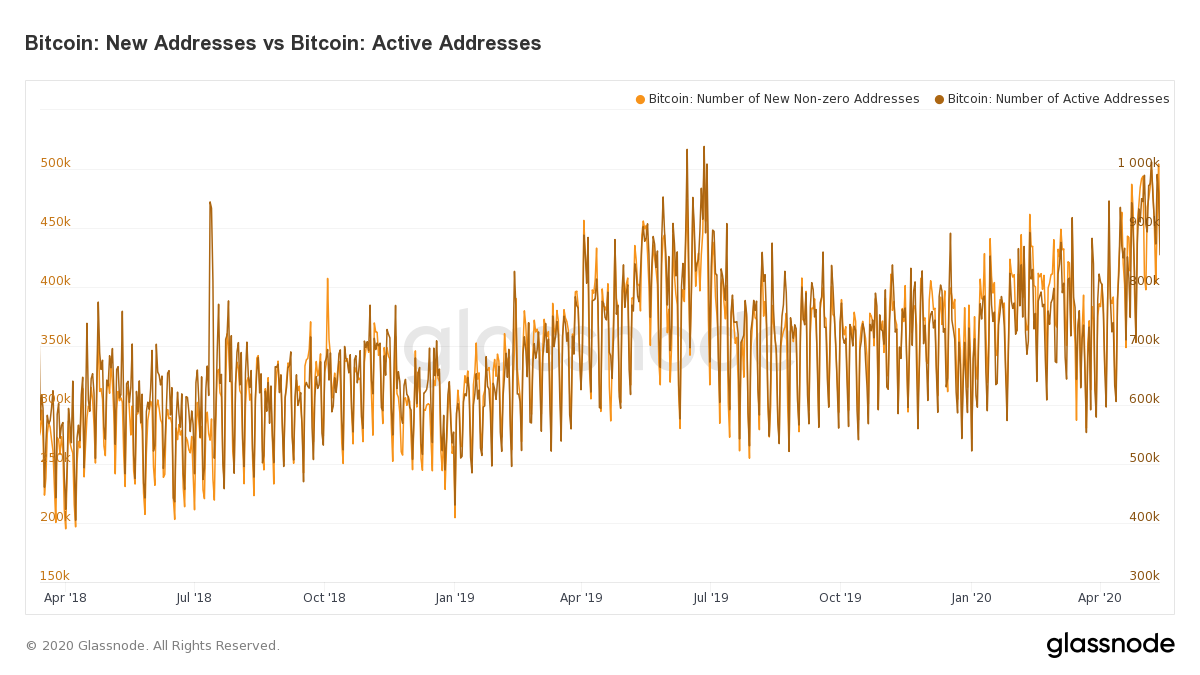

The number of daily active Bitcoin addresses has surpassed 1 million for the third time ever. Prior to this the number of active users saw similar volumes only during mid-June 2019 and the bull run in late 2017.

Source: studio.glassnode.com

The number of new addresses has also been steadily on the rise with the weekly average hitting a two-year high during this week.