Bitcoin’s option market continues to grow, signaling an increased influx of sophisticated traders and institutions into the crypto space.

Open interest (or open positions) in options listed on the Panama-based Deribit exchange jumped to a record high of $1 billion Tuesday, according to the data provided by the crypto derivatives research firm Skew. Each option contract on Deribit represents one bitcoin. On Tuesday, 101,000 options contracts were open on Deribit, the world’s largest exchange by options trading volume.

“The new record is driven by market sentiment, an increased number of diverse global participants on Deribit and the efforts made by our various partners and us to provide a premier quality market at all times with the highest capital efficiency, integrity and connectivity and trading solution,” said Luuk Strijers, Deribit’s chief compliance officer.

Options trading activity on the exchange has surged this year, as evidenced by a year-to-date gain of 270% in open interest. Daily trading volume hit two-month highs above $100 million last week and has increased by 170% this year.

Options are derivative contracts that give the purchaser the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on or before a specified date. A call option gives the holder the right to buy, while the put option gives the holder the right to sell.

“Options are one product that attract sophisticated traders,” Skew’s CEO Emmanuel Goh said at Consensus: Distributed on May 14. Big traders and institutions often use options to hedge long/short positions in the spot and futures markets.

Trading target

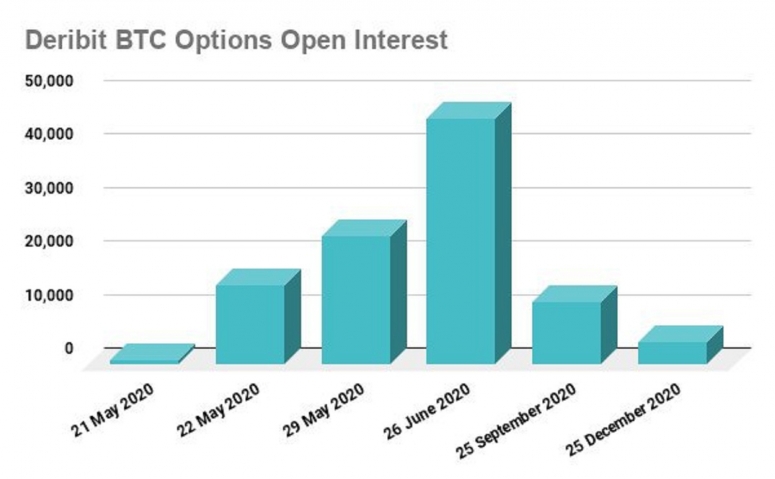

The growth in open interest is primarily being driven by options expiring next month. As of Wednesday, more than 40,000 contracts expiring on June 26, 2020, are open.

Open interest is relatively low for options expiring in September and December. That’s because longer-duration options are more expensive. “Over time you will see a pickup in September or December,” said Strijers.

Driving growth

Options are more complicated than futures contracts because their price depends on a variety of factors like volatility, time to expiration, a risk-free interest rate and so on. Further, options tend to lose value as expiry nears.

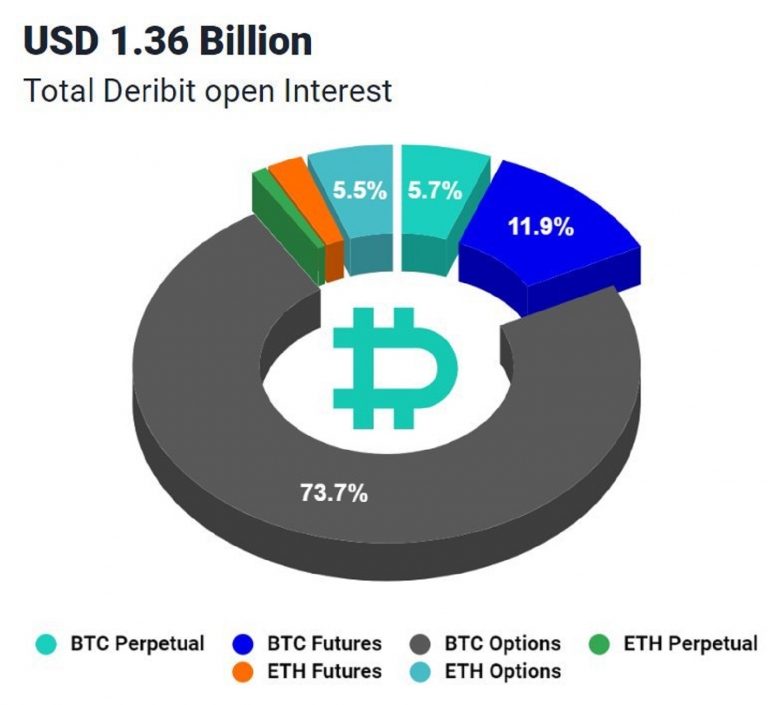

The pricing of futures contracts is relatively easier to understand. As a result, futures are more popular and usually see higher open interest than options. However, in Deribit’s case, options activity is much higher.

Currently, there are $1.36 billion worth of open positions in bitcoin and ether derivative contracts (futures and options) listed on Deribit, of which nearly 74% is being derived from bitcoin options.

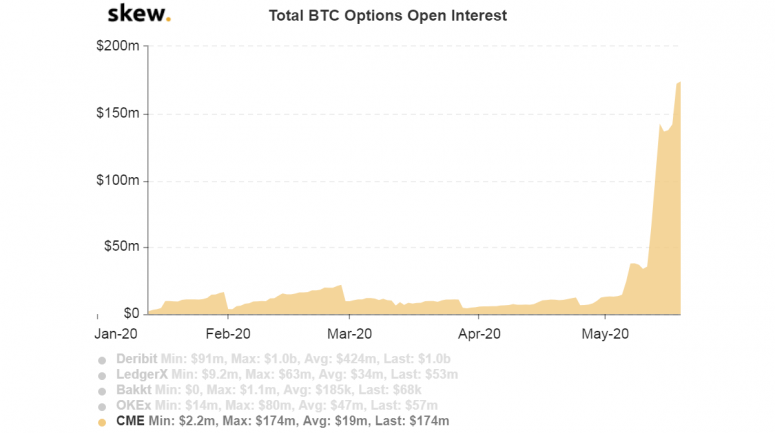

Open positions in options listed on the Chicago Mercantile Exchange (CME), widely considered to be synonymous with institutional demand, rose to a new lifetime high of $174 million on Tuesday.

Investor interest began rising ahead of bitcoin’s mining reward halving on May 11 and has continued to surge ever since. Notably, the metric hit record highs for three consecutive days after the event.

While activity in options continues to rise, it’s difficult to gauge whether investors are selling or buying calls/puts. “Those are two possibilities, although we cannot know for sure. However, implied volatility is relatively stable in the last few days suggesting the flows might be balanced,” said Skew’s Goh.

Bitcoin is currently trading near $9,700. The cryptocurrency has been largely restricted to the trading range of $8,100–$10,000 since the halving.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.