The options market is becoming a prominent part of Bitcoin’s ecosystem, with the total open interest seen across all platforms rocketing higher in recent times.

Late last month, the benchmark digital asset saw its largest options expiry ever, with nearly $1 billion worth of monthly and quarterly contracts expiring on a single day.

At the time, this represented over 60% of the total outstanding OI.

This expiration caused the OI for options contracts to plunge, and data now shows that the CME was hit hardest by this decline.

Institutional investors may also be growing less interested in trading contracts for Bitcoin, as the platform is now losing its share over the options market.

CME Hit Hard by June’s Bitcoin Options Expiry

On June 26th, a combination of monthly and quarterly Bitcoin options contracts expired, with their value totaling at just under $1 billion.

This marked the largest single-day expiry ever seen within the crypto industry and is a sign of the options market’s immense growth over the past year.

Naturally, OI for contracts plummeted after this expiry took place, falling from $1.8 billion to lows of $894 million.

The CME – a platform that caters to family offices, active funds, and institutions due to its high minimum contract requirements – was particularly hit hard by this recent contract expiry, as interest on the platform declined by 67% following the expiry.

Arcane Research spoke about this in a recent report, saying:

“The total bitcoin open interest halved (falling from $1.8 billion to $894 million) following the large contract expiry of June 26th. CME was hit the hardest as its open interest dropped 67% from $439 million to $145 million on the day of the contract expiry.”

It doesn’t appear that institutional traders are too eager to jump back into new Bitcoin positions either, as the CME’s dominance of the options market has since slid from 25% to 15%.

“The loss in open interest caused CME’s relative shares of the total open interest to plummet from 25% of the market to below 15%.”

Image Courtesy of Arcane Research.

Over the same period, Deribit’s dominance over the options market rose by 8%.

What Options are Saying About BTC’s Outlook

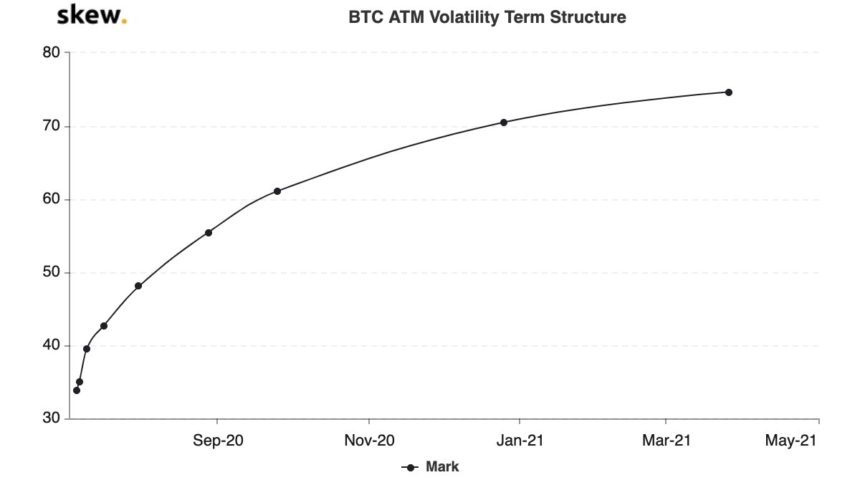

NewsBTC reported yesterday that Bitcoin’s options market seems to be suggesting that the benchmark crypto will continue to extend its bout of consolidation in the weeks ahead.

A research firm cited in the report said:

“Bitcoin having one of its very quiet moment, implied volatility term structure is record steep.”

This steep volatility term structure indicates that the implied volatility for short-term contracts is low, as investors don’t anticipate any imminent movements.

Featured image from Shutterstock.