Recently the Grayscale Bitcoin Trust Fund (GBTC) premium to net asset value (NAV) reached its lowest level since November 2018. This premium shows that traders are paying more for GBTC shares than the underlying Bitcoin (BTC) quantity held by the fund.

This difference is caused mostly due to retail investors inability to purchase shares directly from Grayscale Investments, whose funds are aimed exclusively for accredited investors.

Currently, GBTC is the largest cryptocurrency listed investment fund with $3.5 billion assets under management, totaling over 386,000 BTC under custody. Therefore, it is considered a relevant indicator of investors appetite.

The recent decreases in this premium raised some eyebrows amongst analysts and crypto pundits who claimed it might signal the beginning of a significant move, as per previous similar moments.

What’s behind the GBTC premium?

Grayscale Bitcoin Trust (GBTC) premium to net assets. Source: YCharts

Over the past two years, there have been four instances where the GBTC premium marked a local bottom and bounced back up. As shown above, upticks in the premium marked short-term bull moments in three out of four occurrences.

The only exception was the notorious November 2018 crash that occurred after Bitcoin lost its longtime $6,000 support. Given the decreasing premium, investors will now question if the ‘signal’ could be predicting a similar movement. July 16 marked the lowest levels in twenty months, and now the premium seems to be bouncing back to 9%.

To correctly assess whether the current moment resembles the past negative outcome, one needs to analyze investor sentiment back then. One of the best metrics trading wise is the futures premium (contango) and market volume.

Futures markets show some similarities

Contango measures longer-term futures contracts premium and provides a reliable indicator to investors’ expectations.

There’s usually a 0.5% to 1.5% premium on 3-month contracts in healthy markets, indicating a normal contango. When this indicator goes negative, known as backwardation, it is a signal of bearishness.

OKEx 3-month BTC futures premium. Source: TradingView

The 3-month futures contract premium stands at a modest 1% to the current Bitcoin price, similar to the level found in November 2018. Although not a bearish level, such contango does not show any excessive optimism from professional traders.

Volume fluctuations paint a similar picture

Volume is unarguably the most relevant metric investors track. Although there can be an infinite number of reasons for increased investor interest, there’s nothing positive to be gleaned from dwindling trading activity.

To better assess such metrics, one should also look at futures contracts. While conflicting trends are not common, they could explain any volume changes in the underlying asset.

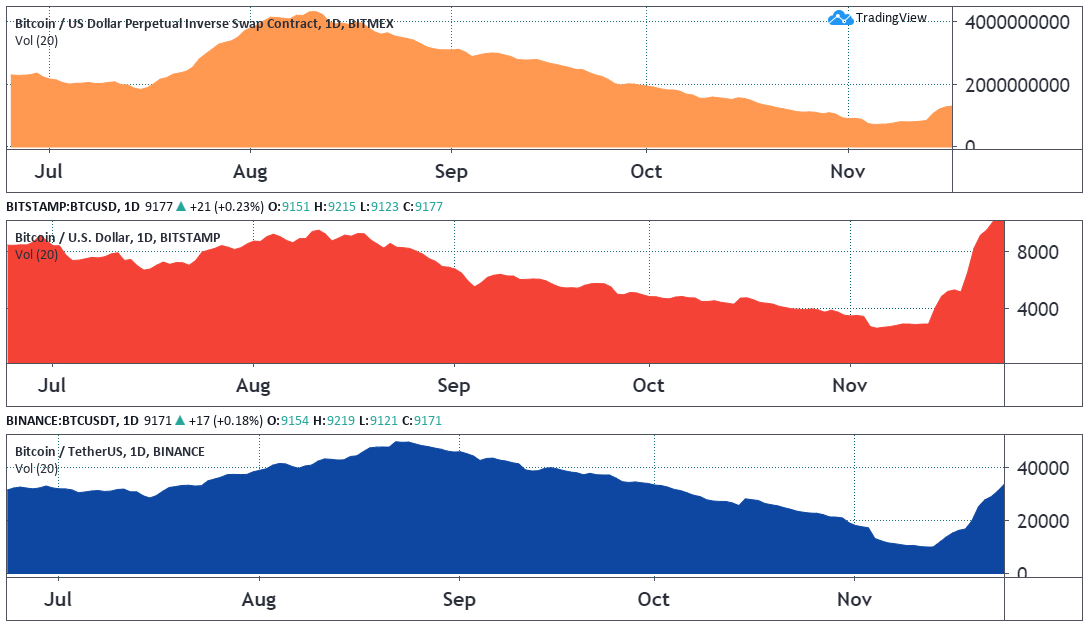

20-day average BTC volumes in 2018. Source: TradingView

Volume in derivatives, fiat, and USDT-based exchanges were in a steep reduction in the November 2018 crash. As shown in the chart below, the same set of worrisome indicators exist.

20-day average BTC volumes. Source: TradingView

The GBTC premium ‘signal’ is not bulletproof

In addition to the GBTC premium, contango, and volume, traders should also investigate the traders’ sentiment during the most recent occasions when the premium bottomed.

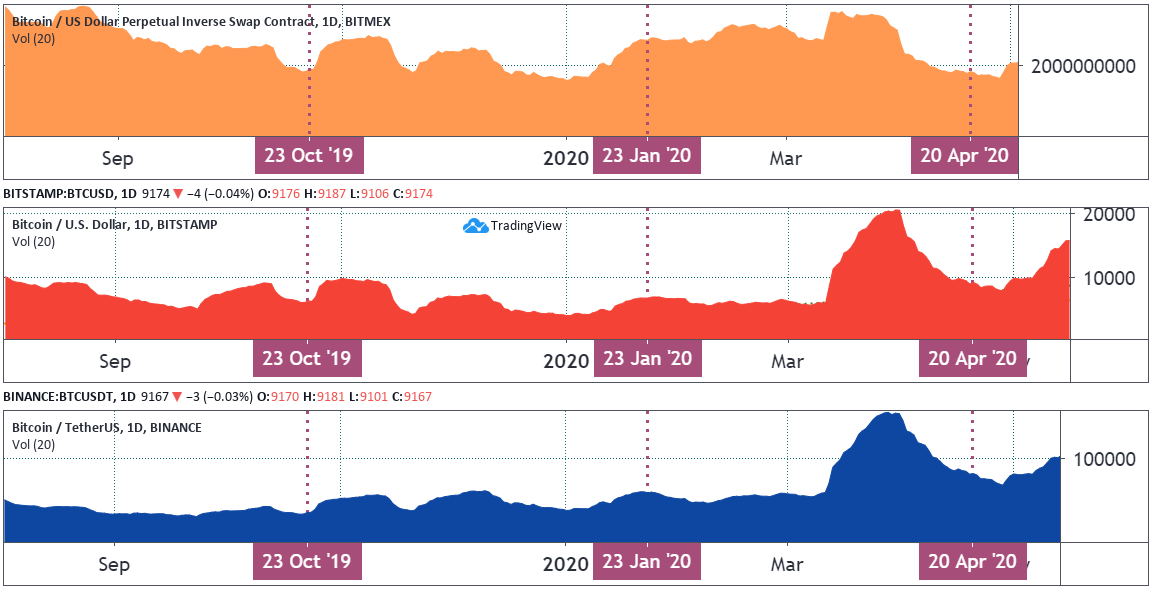

OKEx 3-month BTC futures premium. Source: TradingView

The 3-month upfront contract premium shows three drastically different scenarios, marked by excessive optimism in January 2020 at 2%, and bearish sentiment in April 2020 at -1%.

BTC futures trading below the spot price is a typical signal of discomfort from professional investors and this scenario is referred to as backwardation.

October 2019 was the only instance resembling November 2018 and the current level at a rather neutral 1% premium. To gain further insight into this, one should check volume trends to understand if previous GBTC low premium instances correlate to the present moment.

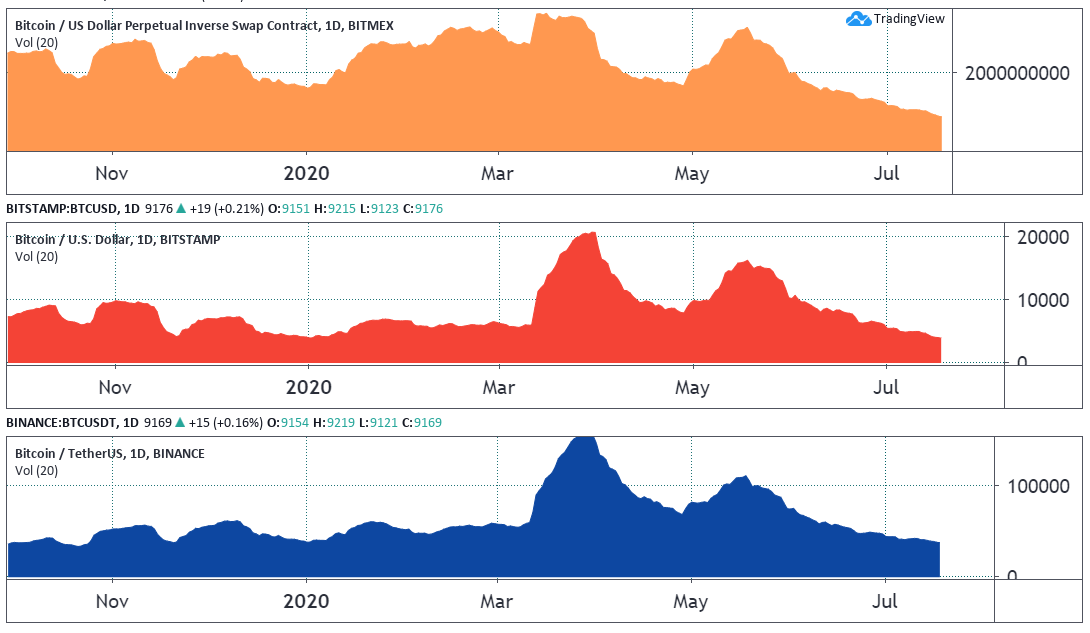

20-day average BTC volumes. Source: TradingView

The only instance showing a downtrend in volume seems to be April 20. However, the volume spike was caused by the market activity on March 13 when Bitcoin faced a 20% crash in a single hour. The figures from April 20 can’t be deemed low compared to the previous couple of months.

Current indicators mirror the November 2018 crash

Three indicators are currently mirroring the pre-November 2018 crash: decreasing volume, a rather neutral 1% 3-months futures premium, and the GBTC premium bouncing from lows.

The thing to remember is history doesn’t repeat itself, but it tends to rhyme. There is no such thing as an unfailing indicator, even if many point in the same direction. Investors get nervous each time Bitcoin tests its $9,000 support, and they have many reasons for that.

It’s possible that relying on the GBTC premium as a signal will be another self-fulfilling prophecy as so many analysts are calling for a sharp negative move from Bitcoin, but only time will tell.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.