Bitcoin and most altcoins could consolidate for a couple of days before resuming their uptrend.

Bitcoin (BTC) trading volumes in spot and derivatives markets have been surging since the digital asset rallied above the $10,000 level earlier this week. Bakkt reported record Bitcoin futures volume on July 28 and 29, which indicates that the traders who had been waiting for a trending move to start have established fresh positions.

A similar volume increase was seen in the Chicago Mercantile Exchange (CME) and the other crypto exchanges that offer futures trading.

A breakout that is followed by an increase in activity and higher open interest is usually a positive sign as it shows that the traders expect higher prices in the next few days.

However, traders should be careful and keep a close watch on the price action because if the rally fizzles out Bitcoin might trap a number of bulls, leading to long liquidation.

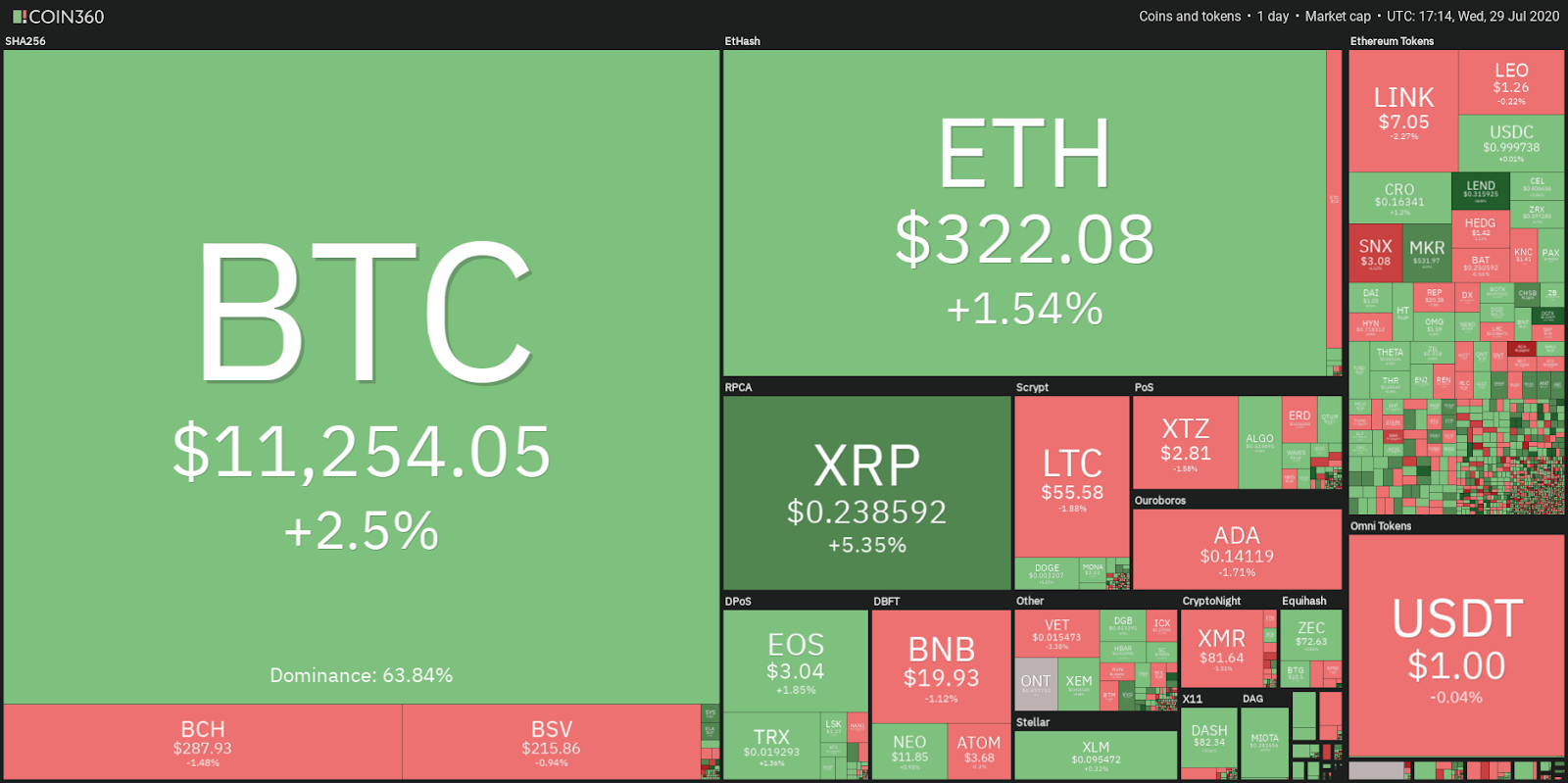

Daily cryptocurrency market performance. Source: Coin360

Nigel Green, the CEO and founder of financial consultancy firm deVere Group, believes that Bitcoin could replace gold as the ultimate safe haven asset as “the world becomes more tech-driven.” The escalating tension between the US and China could act as one of the triggers for investors to shift from traditional markets to “decentralized, non-sovereign, secure digital currencies.”

BTC/USD

Bitcoin (BTC) surged above the critical overhead resistance zone of $10,000–$10,500 on July 27 and hit an intraday high of $11,377.55, which shows aggressive buying by the bulls and short covering by the bears.

BTC/USD daily chart. Source: TradingView

The BTC/USD pair witnessed profit booking on July 28, which dragged the price to $10,569 but the bears could not sustain the lower levels and by close (UTC time) the price had recovered to $10,910.32. This suggests strong demand at lower levels.

If the bulls can push the price above $11,377.55, the uptrend is likely to resume. There is a minor resistance close to $11,870.50 but if this level is crossed, the uptrend can extend to $14,000.

The 20-day exponential moving average ($9,840) has turned up and the relative strength index is in the overbought zone, which suggests that the bulls are in command.

This bullish view will be negated if the price turns around from the current levels and plummets back below the $10,500–$10,000 zone.

ETH/USD

Ether (ETH) turned down from $332.931 on July 27 as short-term traders decided to book profits following the blistering rally of the past few days. However, the correction could not even reach the 38.2% Fibonacci retracement level of the latest leg of the rally, which suggests strong demand on dips.

ETH/USD daily chart. Source: TradingView

The bulls will now attempt to resume the uptrend by pushing the second-ranked cryptocurrency on CoinMarketCap above $332.931. If they succeed, the uptrend can reach $366 and if this level is also scaled, the next target is $480.

Contrary to this assumption, if the ETH/USD pair again turns down from close to $332.931 resistance, it can decline to $288.599–$284.261 support zone. The bulls are likely to defend this zone aggressively. If the price sustains above this zone, the possibility of the resumption of the uptrend is high.

XRP/USD

XRP rebounded off the neckline of the inverse head and shoulders pattern on July 27, which is a positive sign as it suggests that the bulls are accumulating on dips.

XRP/USD daily chart. Source: TradingView

The buyers will now try to push the fourth-ranked cryptocurrency on CoinMarketCap to $0.25. This level is likely to attract aggressive selling by the bears as they try to stall the up move. This may result in a minor correction or consolidation.

If the bulls do not give up much ground, then it will increase the possibility of a breakout above $0.25 and rally to the next target objective of $0.284. This bullish view will be invalidated if the bears sink the XRP/USD pair back below the neckline of the setup.

BCH/USD

Bitcoin Cash (BCH) broke above $280.47 on July 28 after spending about four months in a consolidation. This is a positive sign as this suggests that the bulls have finally overpowered the bears.

BCH/USD daily chart. Source: TradingView

If the bulls can sustain the price above $280.47 for three days, it will confirm the breakout and could result in the start of a new uptrend, with the first target objective at $360 and then $400.

However, the bears are likely to have other plans. They will try to sink the fifth-ranked cryptocurrency on CoinMarketCap back below $280.47. If that happens, it will suggest that the current breakout was a bull trap.

BSV/USD

Bitcoin SV (BSV) has reached the resistance of the $146.20–$227 range for the first time since April 30. The bears are likely to defend the $227 level aggressively.

BSV/USD daily chart. Source: TradingView

If the sixth-ranked cryptocurrency on CoinMarketCap turns down from the current levels and slides below $200, it will suggest a lack of buyers at higher levels. Such a move could extend the range-bound action for a few more days.

The 20-day EMA ($189) has started to slope up and the RSI has risen into the overbought zone, which suggests that the bulls are attempting to make a comeback.

A breakout and close (UTC time) above $227 will indicate the possible start of a new uptrend that has a target objective of $308.

ADA/USD

Cardano (ADA) has been consolidating between $0.13–$0.15 range for the past three days, which shows that the bears are trying to stall the uptrend while the bulls are attempting to absorb all the selling and extend the up move.

ADA/USD daily chart. Source: TradingView

While the upsloping moving averages suggest an advantage to the bulls, the bearish divergence on the RSI points to weakening momentum.

A breakdown and close (UTC time) below the 20-day EMA ($0.128) will be the first sign that the bulls are losing their grip. Below this level, the seventh-ranked cryptocurrency on CoinMarketCap can drop to $0.11.

Conversely, if the bulls can propel the ADA/USD pair above the $0.15–$0.1543051 resistance, the uptrend is likely to resume with the next target at $0.173.

LTC/USD

Litecoin (LTC) soared above $51 on July 27, which indicates a change in trend from consolidation to an uptrend. The first target objective of this new uptrend is $64.

LTC/USD daily chart. Source: TradingView

However, the sharp move of the past few days has pushed the RSI deep into the overbought territory, which suggests that a minor correction or consolidation is possible.

On the downside, the critical support to watch out for is $51. If the eighth-ranked cryptocurrency on CoinMarketCap rebounds off this level, it will confirm that the sentiment has turned bullish and the buyers are accumulating on dips.

A successful retest of a breakout level offers an opportunity for traders to initiate long positions if they missed buying the breakout.

It is better to wait for the price to rebound before considering a purchase because sometimes the breakout turns out to be false and the price traps the aggressive bulls.

CRO/USD

Crypto.com Coin (CRO) surged on July 27 to a high of $0.169481, which was close to the target objective of $0.174114. This attracted profit booking on July 28 but the positive thing is that the altcoin did not break below the $0.15306 support.

CRO/USD daily chart. Source: TradingView

Generally, in strong uptrends, the corrections do not last for more than three to five days. Currently, the bulls are attempting to resume the uptrend, which is likely to pick up momentum above $0.169481.

If the bulls can scale the ninth-ranked cryptocurrency on CoinMarketCap above $0.174114, a rally to $0.20 is possible. The trend remains strong with the moving averages rising up and the RSI in the overbought zone.

A break below $0.15306 will be the first sign of weakness and a decline below the 20-day EMA ($0.148) will indicate a possible short-term top.

BNB/USD

Binance Coin (BNB) rebounded sharply from the breakout level of $18.20 on July 27, suggesting that the bulls aggressively bought this dip. The 20-day EMA ($18.48) has started to slope up and the RSI is close to the overbought zone, which indicates advantage to the bulls.

BNB/USD daily chart. Source: TradingView

The first target on the upside is a rally to $22.93, which is the pattern target of the breakout from the ascending triangle. If this level is crossed, the tenth-ranked crypto-asset on CoinMarketCap can rally to $24.

This bullish view will be invalidated if the bears sink the BNB/USD pair below the critical support at $18.20.

EOS/USD

EOS broke above the $2.83 resistance on July 27 and has reached the $3.1104 resistance for the first time since April 30. This suggests that the bulls are attempting to make a comeback.

EOS/USD daily chart. Source: TradingView

The RSI has risen into the overbought zone and the 20-day EMA has started to turn up gradually, suggesting a mild advantage to the bulls. A close (UTC time) above $3.1104 will signal the possible start of a new up move that can rally to $3.8811.

However, the bears are unlikely to give up without a fight. If the 11th-ranked cryptocurrency on CoinMarketCap turns down from $3.1104, it could drop to $2.83 and consolidate between these levels for a few days.

Also, don’t miss our upcoming conference Cointelegraph Crypto Traders Live.

More than 30 star speakers including Raoul Pal, John Bollinger, Mike Novogratz, DataDash and Jon Najarian will gather on July 30th to discuss the challenges of crypto trading. Join the show for over 9 hours of crypto trading content!

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.