The price of Bitcoin (BTC) dropped to $11,219 on Bitstamp on Aug.7 after the United States stock market declined. BTC recovered quickly from the brief crash, stabilizing at above $11,600.

The price of Bitcoin drops steeply on Bitstamp. Source: TradingView.com

The release of new job data caused the U.S. stock market to slump in mid-day. Non-farm payrolls rose by 1.763 million in July, surpassing Wall Street expectations by 10.6%.

Despite the optimistic job data, analysts are seemingly concerned that the job market is not growing fast enough. Since the pandemic began in March, the U.S. still has 13 million unemployed individuals.

A variety of factors affected Bitcoin

Over the past several months, the price of Bitcoin saw relatively volatile movements ahead of new job data. The volatility likely comes from the recent correlation between BTC and stocks.

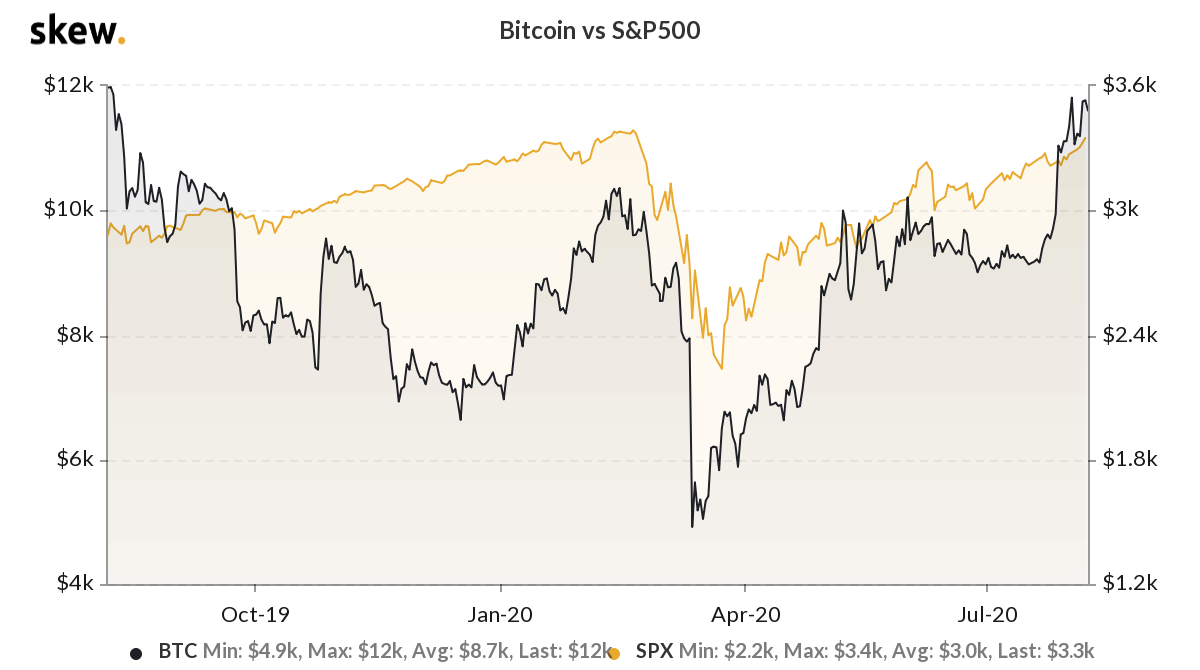

The correlation between Bitcoin and the S&P 500. Source: Skew

Data from Skew shows that Bitcoin has shown some correlation with stocks since April. Since the stock market reacts strongly to unemployment data, BTC has typically followed the trend of stocks in the first week of the month.

Strategists were skeptical of the new job data, factoring in the abrupt increase in part-time workers. Washington Center for Equitable Growth’s economist Kate Bahn said many of the newly added jobs would likely pay less. She said:

“We added more jobs than most people expected, but the gains really were disproportionately part-time workers. To me that means even if workers are coming back it’s to jobs that pay less, and families will be worse off.”

The job data, which seemed positive on paper, eventually led the U.S. stock market to drop-off. The Dow Jones Industrial Average declined slightly by 0.28%, after a minor 0.6% drop the day before.

As the U.S. stock market dipped, major cryptocurrencies such as Bitcoin and Ethereum’s Ether (ETH) saw a steep plunge. While BTC dropped to $11,219 on Bitstamp, Ether declined to around $371 across major exchanges.

Macro factors that could affect BTC in the coming week

In the near term, there are several macro factors and geopolitical risks that could impact Bitcoin. First, U.S.–China relations are worsening over WeChat and TikTok bans. Second, the talks of a stimulus deal have slowed down.

The tension between the two superpowers is seemingly ramping up after U.S. President Donald Trump issued executive orders to ban Tencent’s WeChat and ByteDance’s TikTok. The chances of countermeasures by China could increase, which might potentially affect stocks and, therefore, Bitcoin.

Reports also say that the chances of a stimulus deal are dim after Republican and Democratic representatives clashed. U.S. Treasury Secretary Steve Mnuchin said:

“I think there is a lot of issues we are close to a compromise position on, but I think there are a handful of very big issues that we are still very far apart. We’ll see. I think we always said our objective is to try to reach an overall understanding tomorrow. If the Democrats are willing to compromise and do something, I think we’ll get something done.”

The confluence of a delayed stimulus deal and the intensifying tensions between the U.S. and China could place pressure on both stocks and Bitcoin in the short term.