- Yearn Finance’s YFI pops up by 55 percent in just one hour.

- The jump comes after Binance announces that it is listing YFI pairs on its trading platform.

- The Yearn Finance founder Andre Cronje further pumps the hype by making a blusterous announcement.

Yearn Finance’s native token YFI surged in an early session Monday after securing a position in Binance’s trading portfolio.

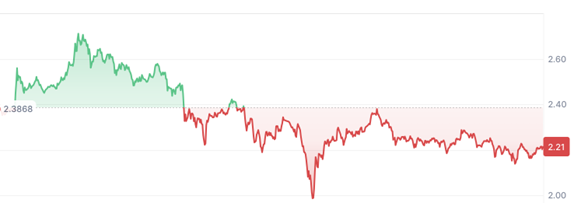

The Malta-based cryptocurrency exchange announced that it would open trading for YFI/BNB, YFI/BTC, YFI/BUSD, and YFI/USDT trading pairs by August 10, 1200-UTC. One hour after the news broke out, the YFI/USD exchange rate surged 55 percent to top at $7,100.

Yearn Finance's YFI token surged 55 percent in just one hour. Source: TradingView.com

The Real Value

The breakout move came as the part of a steady YFI uptrend. The Yearn Finance token debuted on July 25 while trading at near $3,545. Its involvement in the hype-filled decentralized finance sector helped to strengthen its upside bias, leading its price to as high as $5,610 as on August 7.

Despite some occasional turbulence, YFI kept its upside bias intact. Traders found the token’s core business model attractive. In retrospect, it serves as a governance token for Yearn Finance, a portal that finds the best available yields in the DeFi space.

People saw value in the aggregation model, and a pump ensued. It happened despite the founder of Yearn Finance, Andre Cronje, openly admitting that YFI has no monetary value. But the market largely ignored the proclamation and speculated on the token anyway.

“Each of these systems has control mechanisms, configurable fees, maintenance controls, and rules that can be modified. Thus far, these have been managed by us,” Mr. Cronje wrote in a Medium post.

“In further efforts to give up this control (mostly because we are lazy and don’t want to do it) we have released YFI, a completely valueless 0 supply token.”

He explained that users provide liquidity to their Yearn Finance pools. In return, they receive yTokens that account for their deposits. Users then stake the yTokens in the distribution contracts though Yearn Finance’s interface. For that, they earn YFI every day.

As of now, a significant portion of the yToken’s staking actions is taking place on Curve, the automated market maker primarily known for supporting lending platform Compound.

More Gains for YFI Ahead?

As of this time of writing, YFI/USD was correcting lower on profit-taking sentiments. The pair plunged by up to 15 percent from its intraday high, signaling that daytraders may continue selling the token to secure short-term profits.

Nevertheless, the hype for YFI remains. In a tweet published less than an hour ago, Mr. Cronje blatantly announced that “something sexy is coming soon,” which will increase the yield on yVaults by 400 percent. That should mean a 4 YFI reward instead of 1 YFI for stakeholders in the coming sessions.

Something sexy coming out soon. Will up yield by ~400% new yVaults waiting to be deployed 😉 https://t.co/o4sopCZdou

— Andre Cronje (@AndreCronjeTech) August 10, 2020

With a little trading history behind, YFI expects to head higher but in unchartered territory.

Bombastic announcements could help the token to pump further. At the same time, any signs of aggressive pullbacks could cause sharp declines, so bullish traders should maintain a stop loss to get out of the market on lesser losses.