Bitcoin (BTC) price dropped by as much as 10% this week and while this might be scary for day traders, the 3-day chart shows the downside move hardly made a dent on the current market structure.

This holds especially true when considering that the $12,500 level hasn’t been touched in over 13 months. Currently, analysts are making $16,000 price targets partially due to a CME gap and the expectation that U.S. inflation will rise higher.

Bitcoin 3-days chart, USD. Source: TradingView

The above chart illustrates how insignificant the past ten days of negative performance is from a broader perspective. Bitcoin (BTC) has racked up a 48% gain year-to-date and there is no evidence of weakness. The largest daily drop over the past five months was -6.4% on August 2.

Holders are unfazed by recent volatility

While short-term traders confabulate whether the Aug. 28 CME futures and options expiry caused the dip seen in the past few days, on-chain data reveals holders have become more robust than ever.

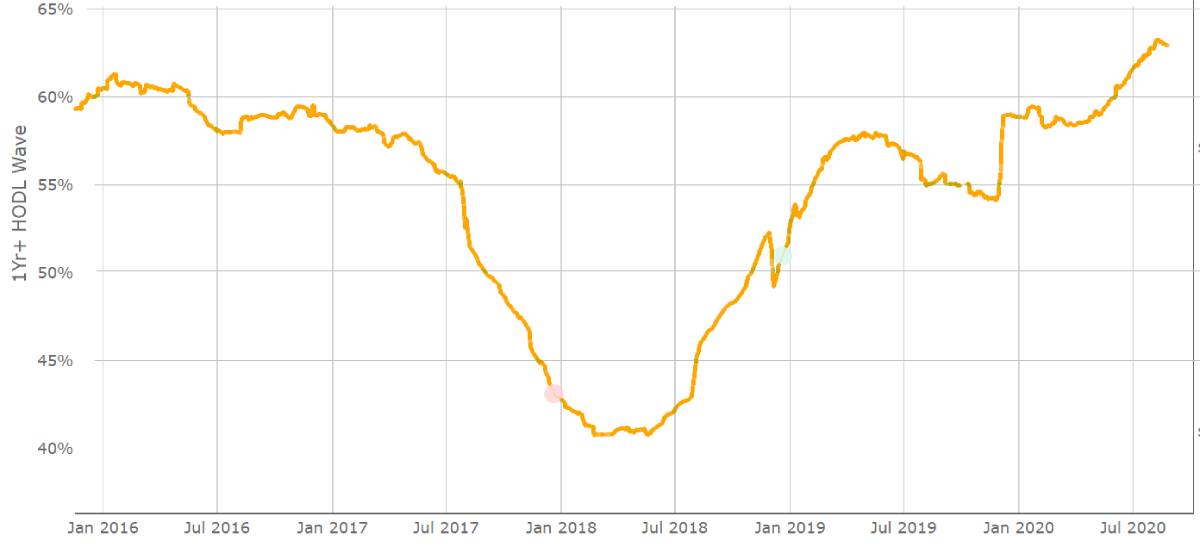

Bitcoin unspent 1-year UTXOs. Source: LookIntoBitcoin

63% of UTXOs haven’t been touched for over a year, something without precedent. These holders faced a 53% dip over the thirty days leading into March 13, but even the Black Thursday crash did not entice them to move their BTC.

Options markets show few signs of stress

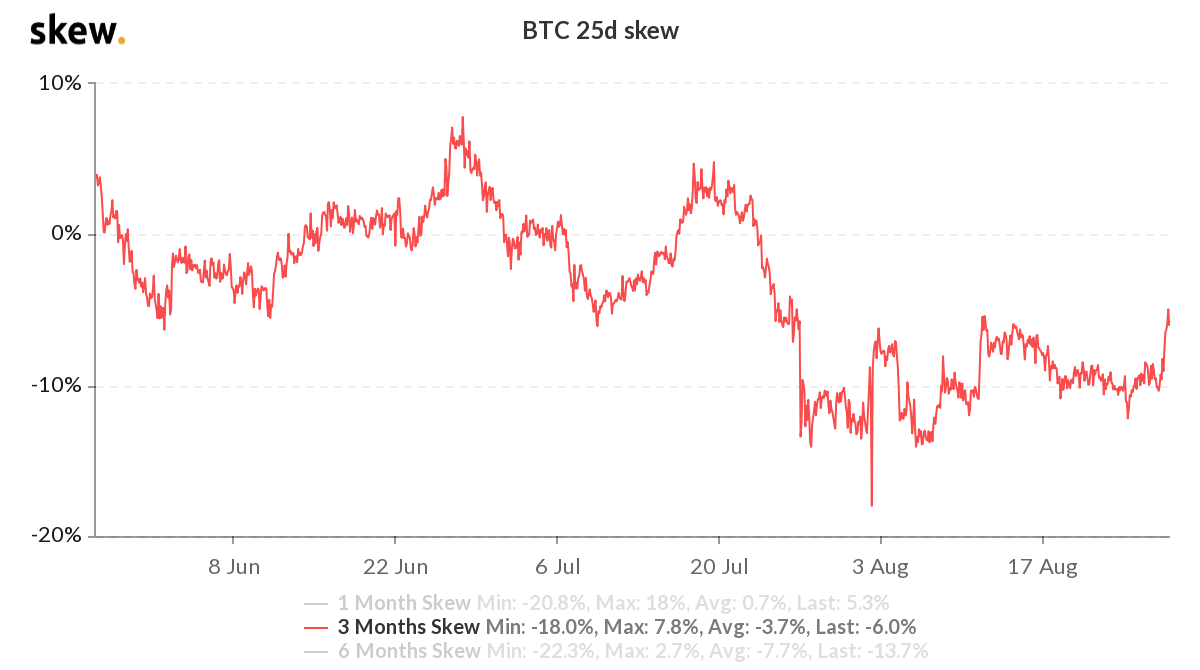

Options markets provide real-time sentiment from large traders and arbitrage trading desks. The 25% delta skew is the primary ‘fear and greed’ indicator for options markets as they measure how costly protection from an adverse price swing compared to a positive one.

Bitcoin 3-month options 25% delta skew. Source: Skew

These put options, which provide buyers with the opportunity to sell Bitcoin at a fixed price at a later date, are currently 6% more expensive than a similar call option. Although the instrument is not as optimistic as the 13% price difference measured earlier this month, a 25% delta skew indicator can still be interpreted as bullish.

Top traders remain net-long

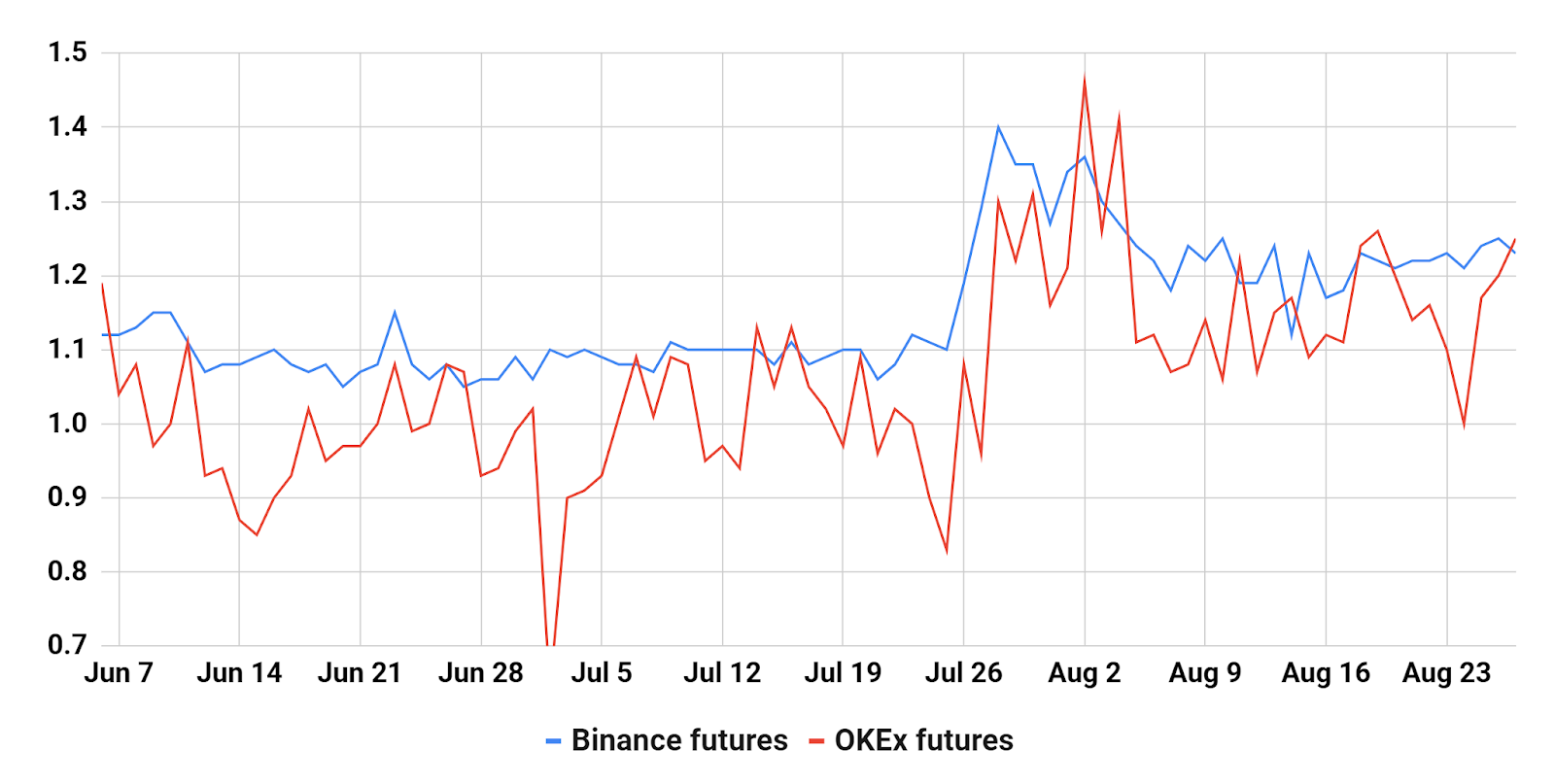

Some exchanges provide data on top traders’ long-to-short net positioning. This is an excellent way to gauge whether professional traders are leaning bullish or bearish.

Even though individual futures markets are balanced between buyers (longs) and sellers (shorts), top traders usually have their risk spread over multiple markets.

By aggregating these clients positions, exchanges can determine top traders’ net exposure.

Top traders longs/shorts. Source: Binance, OKEx, and Cointelegraph

Binance and OKEx top traders have held a bullish stance since July 27. By itself, this is an impressive feat, considering the sharp $1,500 Bitcoin price drop on August 2.

Fewer liquidations on futures markets

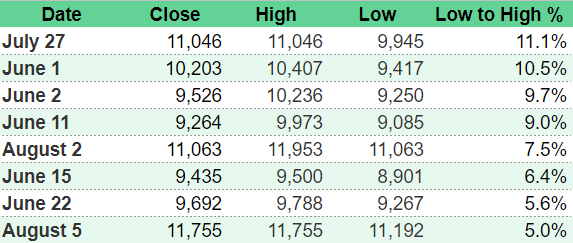

By measuring futures contract liquidations during negative price swings, one can estimate how vulnerable the buyers (longs) are. One should keep in mind that there has been 9% or more intraday price swings on four occasions over the past three months.

Bitcoin (USD). Source: Bitstamp & Cointelegraph

Had these traders been caught off-guard with 10x or higher leverage, those would have been forcefully liquidated long ago. Therefore futures open interest would vastly decrease.

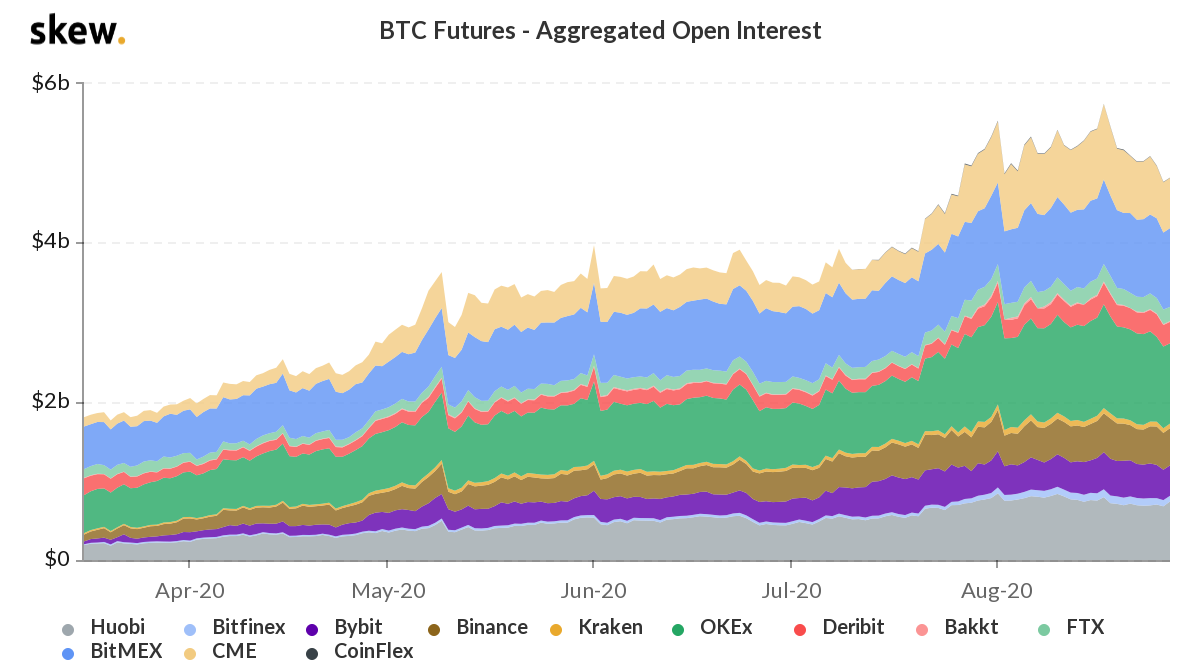

Total BTC futures open interest, USD. Source: Bybit & Cointelegraph

Total open interest on BTC futures increased by 166% over the past five months to $4.8 billion. This data provides further evidence that whales aren’t getting liquidated by the recent 10% negative move.

Every bull run has occasional corrections

Surely there will be some selling pressure as Bitcoin (BTC) consolidates after the 28% rally that occurred over the last two weeks of July. Even during the massive 240% 3-month bull run that started early April 2019, there were four occasions of 9% or higher short-term corrections.

Nonetheless, both on-chain data and top traders sentiment via derivatives remain bullish. This indicates that the market will tend to move either neutral or upwards over the next couple of weeks.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.