The total crypto market capitalization has recovered from the Sep. 6 lows near $314 billion but it is struggling to sustain above the $350 billion mark, which shows that higher levels continue to attract sellers.

Bitcoin’s (BTC) dominance fell from above 68% in mid-May to about 56% in the first half of this month as DeFi tokens embarked on a strong bull run.

However, in the past few days, the DeFi assets have witnessed sharp corrections and their volatility has increased. This could possibly shift traders’ attention back to Bitcoin. It’s also possible that Bitcoin’s inability to hold above the $11,000 level could also be negatively weighing on the confidence of altcoin and DeFi-token traders.

Crypto market data daily view. Source: Coin360

Although Bitcoin has been struggling to find momentum, a positive is that the volume of Bitcoin futures trading on Bakkt has been increasing and the exchange whale ratio is near yearly lows. This suggests accumulation by the whales and institutional traders.

Currently, most major cryptocurrencies are not following a general trend as the price action has been mostly coin specific. This has opened up opportunities both on the short side and the long side. Hence, in today’s list, two short ideas have been discussed for the traders who are bearish on the crypto markets.

BTC/USD

The relief rally in Bitcoin is facing stiff resistance near the 50% Fibonacci retracement level of $11,147.60. This shows that the bears have used the current relief rally to initiate short positions.

BTC/USD daily chart. Source: TradingView

If the bears can sink the price below the uptrend line and the $10,625 support, it will signal weakness. If the BTC/USD pair sustains below $10,625, it will increase the possibility of a retest of $9,835.

However, if the pair rebounds off the $10,625 support sharply, this will be the first sign that the correction might be over. Trading momentum is likely to pick up after the rally breaks above the downtrend line.

If the price closes (UTC time) above the downtrend line, the possibility of a rally to $12,460 increases. Even though there is resistance at $12,000 it seems likely that it will be crossed.

BTC/USD 4-hour chart. Source: TradingView

The pair is currently attempting to rebound off the uptrend line, which suggests that the bulls purchased the dip to this support. The buyers will now make one more attempt to push the price above the $11,147.60 resistance.

If the bounce fizzles out and the bears sink the pair below the uptrend line, a drop to $10,625 could occur. This is an important support for the bulls because selling is likely to intensify if this level breaks down.

If the pair rebounds off $10,625, a few days of range-bound action is possible. The flattening moving average on the 4-hour chart suggests a balance between supply and demand.

NEO/USD

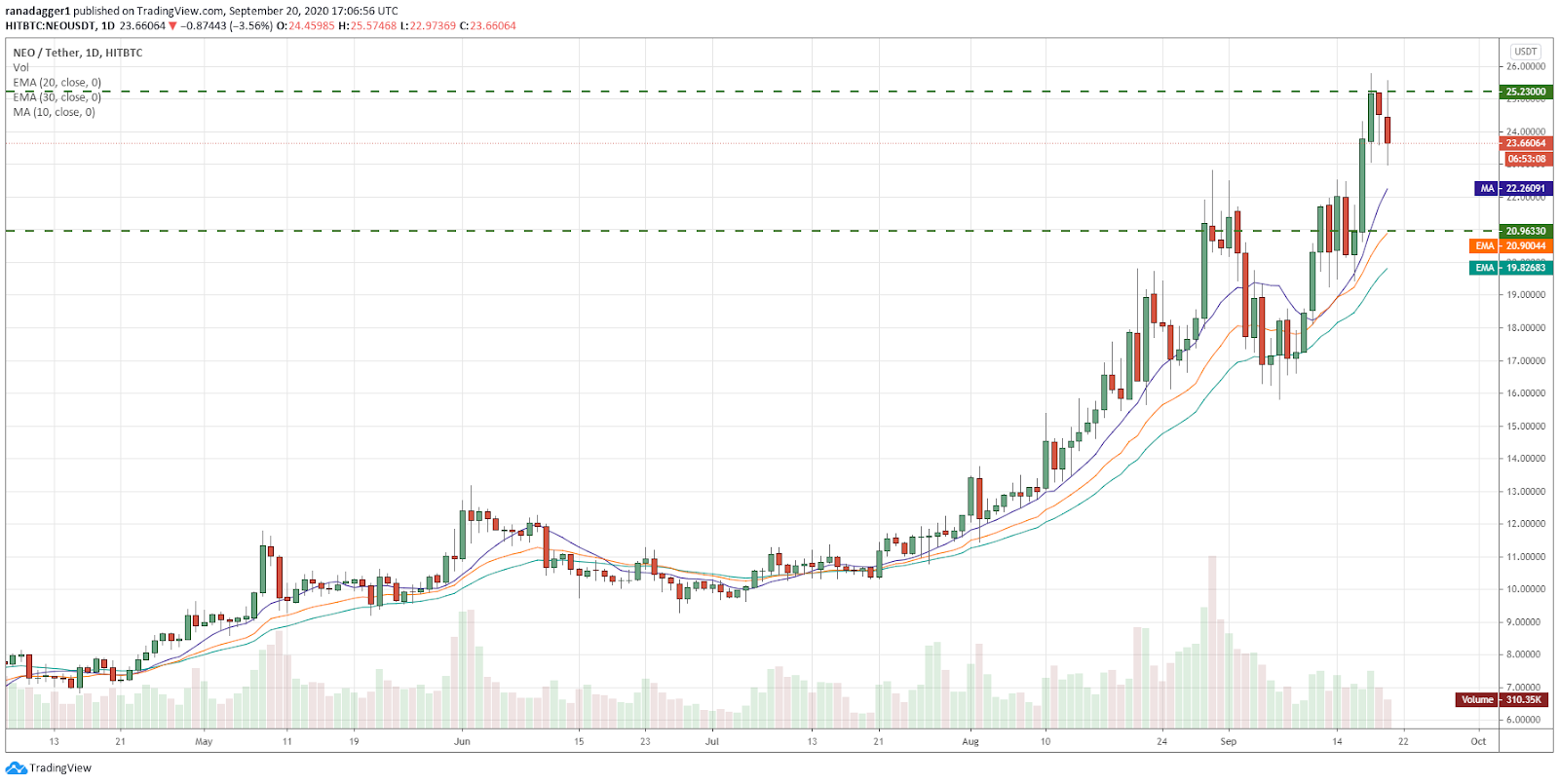

NEO is currently facing stiff resistance at $25.23, which shows that the bears are aggressively defending this resistance. However, as it is in an uptrend, traders are likely to view the dips as a buying opportunity.

NEO/USD daily chart. Source: TradingView

The immediate support on the downside is at $23 and below that at the 10-day simple moving average ($22.26). If the NEO/USD pair rebounds off either support, it will indicate that the bulls are not waiting for a deeper fall to buy which is a positive sign.

If the bulls can push the price above the $25.23–$25.78923 resistance zone, the uptrend is likely to resume. The next target on the upside is $29.

A break below the 10-day SMA will be the first sign that the momentum is weakening and a drop below $20.9633 will signal a possible change in trend.

NEO/USD 4-hour chart. Source: TradingView

The 4-hour chart shows that the bulls pushed the price above the $25.23 resistance twice but they could not sustain the higher levels. This shows that the bears are attempting to stall the rally at this resistance.

However, on the downside, the bulls have not allowed the price to sustain below $23, which shows that the buyers are accumulating on every minor dip.

This could keep the pair stuck between $23 and $25.50 for a few more days. The moving averages have flattened out, which suggests a balance between supply and demand.

XMR/USD

The recovery in Monero (XMR) from the Sep. 5 low of $74.1012 has been strong and the bulls have pushed the price back above the moving averages, which increases the possibility that the correction might be over.

XMR/USD daily chart. Source: TradingView

However, the bears are unlikely to give up without a stiff fight at the $97.4615 resistance. If the XMR/USD pair turns down sharply from the current levels and breaks below $84, a drop to $74.1012 is possible.

Conversely, if the bulls can arrest the next dip at the 20-day exponential moving average ($89), it will increase the possibility of a breakout of $97.4615. Above this resistance, a move to $105.9131–$107.3742 is possible. A break above $107.3742 can result in a rally to $120.

XMR/USD 4-hour chart. Source: TradingView

The 4-hour chart shows that the recovery from $74.1012 has been gradual. Although the bears broke the pair below the 30-EMA on several occasions, they could not capitalize on it and intensify the selling.

This shows that the bulls are accumulating on dips. Currently, the price has again dipped back below the 30-EMA. If the pair rebounds off the current levels, the bulls will try and drive the price above the overhead resistance at $97.4615.

The short-term momentum is likely to weaken if the bears can break and sustain the price below the immediate support at $87.5629.

ADA/USD

The relief rally in Cardano (ADA) from the lows of $0.0855982 on Sep. 6 hit a stiff resistance at $0.0997444 on Sep. 13. The moving averages are sloping down, which suggests that the bears are in command.

ADA/USD daily chart. Source: TradingView

In a downtrend, the bears short on pullbacks to resistance levels as that improves the risk to reward ratio of the trade. Currently, if the bears can sink the ADA/USD pair below the $0.0855982 support, the decline might resume.

Traders can consider taking positions on the short side with an appropriate stop-loss to benefit from the likely down move. The next support on the downside is at $0.074 but if this support fails to hold, the drop can extend to $0.05.

This bearish view will be invalidated if the pair rebounds off $0.0855982 and the bulls drive the price above $0.10. Such a move will suggest that the downtrend might be over.

However, it is not necessary that a new uptrend starts as soon as a downtrend ends because many times, the price remains range-bound as it tries to form a bottom.

Therefore, traders can step aside and wait for a new bullish setup to form if the price breaks above $0.10.

ADA/USD 4-hour chart. Source: TradingView

The 4-hour chart shows that the pair has been gradually declining towards the critical support at $0.0855982 and a close (UTC time) below this level is likely to start the next leg of the down move.

However, if the pair rebounds off $0.0855982, the bulls will make one more attempt to propel the price above $0.10. If they succeed, a quick relief rally is possible.

Conversely, if the price again turns down from $0.10, the pair might remain range-bound for a few days.

LINK/USD

Chainlink (LINK) is in a downtrend and it has been making a lower high and a lower low pattern for the past few days, which shows that the bears are using the relief rallies to sell.

LINK/USD daily chart. Source: TradingView

The down sloping moving averages suggest that the trend favors the bears. If they can sink the LINK/USD pair below $9.65, a drop to $9 is likely. This is an important support to watch out for because a break below this level is likely to resume the downtrend.

The next support on the downside is $7. Therefore, traders can consider benefiting from the possible down-move.

This bearish view will be invalidated if the pair turns up from the current levels or rebounds off sharply from the $9 levels and breaks above the downtrend line.

LINK/USD 4-hour chart. Source: TradingView

On Sep. 5 and 6, the bears were unable to sustain the price below $10.50, which shows that the bulls were attempting to defend this level.

However, during the current fall, the price has been sustaining below $10.50 for the past two days, which suggests that the buying has dried up.

The moving averages are sloping down gradually and the price is below the averages, which suggests that the advantage is with the bears.

A break above the 30-EMA will be the first sign that the bears are losing their grip. Until then, the path of least resistance is to the downside.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk, you should conduct your own research when making a decision.