The market has taken a bearish turn and Bitcoin and altcoins will need strong relief rallies in order to restore their uptrends.

Legacy and crypto crypto markets saw a strong correction today as traders fear that the second round of economic stimulus might be delayed as the White House, Senate and Congress could become entangled in a fight to fill the vacancy created by the passing of Supreme Court Justice Ruth Bader Ginsburg.

In addition to this, financial stocks are leading the bloodbath as reports emerged that several banks could have been involved in facilitating the movement of over $2 trillion over a two-decade period. These suspicious transactions have been flagged as possible money laundering or criminal activity by the banks internal compliance officers.

While Bitcoin price is correcting today, this exposure of potentially illegal behavior by banks will only strengthen the narrative for why investors should buy Bitcoin (BTC).

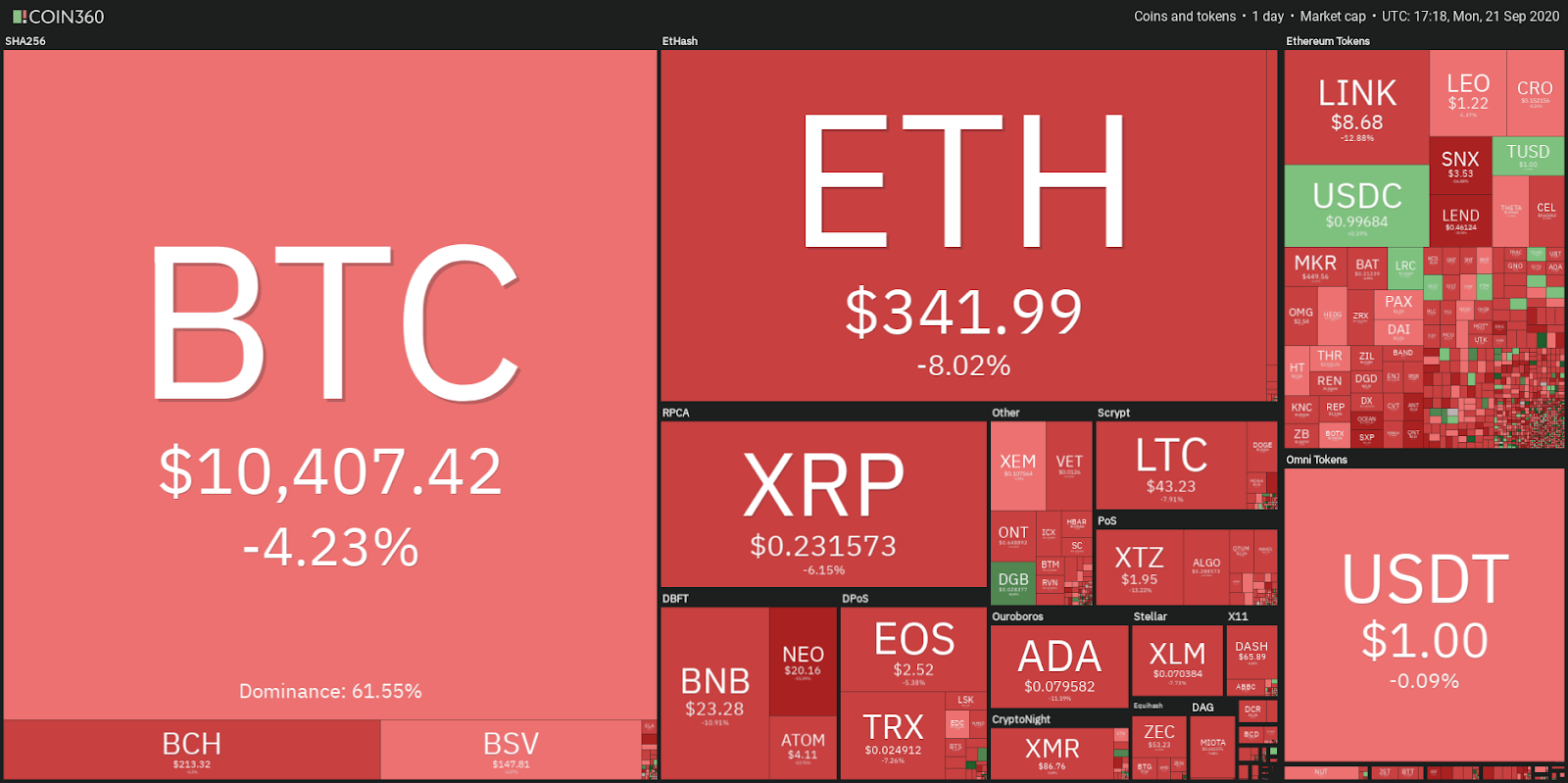

Daily cryptocurrency market performance. Source: Coin360

The increasing number of coronavirus cases across the world is also adding to the negative sentiment seen in the market today. This has led to panic selling by traders who are dumping equities, gold, crude oil and cryptocurrencies and instead are buying the U.S. dollar.

However, after the initial round of selling, most asset classes are likely to chalk their own course depending on their long-term fundamentals and cryptocurrencies may be among the first to rebound.

Let’s study the charts of the top 10 cryptocurrencies to spot the critical support levels that could attract buyers.

BTC/USD

Bitcoin turned down from the 50-day simple moving average ($11,225) on Sep. 19 and broke below the 20-day exponential moving average ($10,781) and the $10,625 support today. This fall suggests that the bears used the recent relief rally to $11,000 to initiate short positions.

BTC/USD daily chart. Source: TradingView

The bears will now try to sink the price below the $9,835 support and if they succeed, it could result in panic selling that may drag the price down to $9,000 or even further.

If this sharp fall was followed by a strong rebound, it would suggest that the bulls are accumulating at lower levels and such a move might attract several buyers once again.

However, if the BTC/USD pair fails to rebound quickly from the lower levels, then the recovery is likely to take much longer as the bulls will then wait for a bottoming formation to complete before buying.

Contrary to these assumptions, if the pair rebounds off the $10,000–$9,835, support, the bulls will once again attempt to push the price above the downtrend line. If they succeed, then the uptrend is likely to resume.

ETH/USD

The pullback in Ether (ETH) stalled close to the 50% Fibonacci retracement level of $398.263 and turned down on Sep. 20. The selling intensified after the bears broke the immediate support at $353.443.

ETH/USD daily chart. Source: TradingView

The next support on the downside is $308.392 and below it $288. If the ETH/USD pair rebounds off this support zone aggressively, it will indicate that the bulls are accumulating on dips.

However, the bears are unlikely to give up their advantage easily. They will attempt to stall any pullback attempts at the downtrend line and then at $398.263. If they succeed, it will be a huge negative and will increase the possibility of a break below $288.

This bearish view will be invalidated if the bulls can push the price above the downtrend line and the overhead resistance at $400.

XRP/USD

The bears are trying to sink XRP below the $0.235688–$0.229582 support zone and if they succeed, the altcoin can decline to $0.19, completing a 100% retracement of the up-move that started in mid-July.

XRP/USD daily chart. Source: TradingView

The lack of a strong bounce off the support zone indicates that buyers are currently not defending this zone aggressively. They are likely to wait for the decline to end before venturing out to buy.

This bearish view will be negated if the XRP/USD pair rebounds off the current levels and breaks above the downtrend line.

BCH/USD

The failure of the bulls to propel Bitcoin Cash (BCH) above the 20-day EMA ($235) attracted profit booking by the short-term bulls and shorting by the aggressive bears. This has resulted in a sharp fall to the critical support zone of $215–$200.

BCH/USD daily chart. Source: TradingView

If the bears can close (UTC time) the price below $215, the BCH/USD pair can drop to the critical support at $200. This is an important support because the bulls have not allowed the price to break below this level since the end of March.

Aggressive bulls might buy the dip to $200 but they will have to push the price back above the 20-day EMA to invalidate the bearish sentiment. If they fail to do so, the bears will again sell on the relief rally to the 20-day EMA.

A break below the $200 support will be a huge negative as it can start a downtrend that has a target objective of $140.

DOT/USD

Polkadot (DOT) broke below the rising wedge pattern on Sep.19 and quickly dropped to the $4.00 support. The bulls will attempt to defend the $4.00–$3.5321 support zone while the bears will try to break below it.

DOT/USD daily chart. Source: TradingView

If the bears succeed, the DOT/USD pair can drop to $2.60 and then to $2.00. Such a move will be a huge negative as it is likely to drive away the bulls and reduce the possibility of a sharp recovery.

However, the pair could remain range-bound for a few days if it rebounds off the support zone and breaks above the 20-day EMA ($4.87).

BNB/USD

Binance Coin (BNB) broke below the $25.82 support on Sep. 20 but the price recovered from the intraday lows and closed (UTC time) at $26.31. However, renewed selling today has resulted in a sharp fall that has broken below the $25.82 support.

BNB/USD daily chart. Source: TradingView

The bulls are currently attempting to arrest the decline at $23 but the bears are likely to sell on pullbacks to the downtrend line and to the 20-day EMA ($25.68).

If the BNB/USD pair turns down from the downtrend line or the 20-day EMA, the bears will once again attempt to sink the price below $23. A break below this support could result in a decline to the next support at $18.

This bearish view will be invalidated if the bulls can push the price back above $25.82. Such a move will suggest that the current decline was a bear trap.

LINK/USD

Chainlink (LINK) is in a downtrend as it continues to make lower highs and lower lows. The break below $8.908 support shows that the bulls are not aggressively defending this level as they are not confident that the bottom is in place yet.

LINK/USD daily chart. Source: TradingView

If the LINK/USD pair closes (UTC time) below $8.908, the selling is likely to intensify. The next support is at $6.90 from where the pair had bounced off in July.

However, if the bears fail to sustain the price below $8.908, the aggressive buyers might step in and buy. A strong bounce off this support can reach the 20-day EMA ($11.5) where the bears might again step in and short.

This bearish view will be invalidated if the bulls can push the price above the 20-day EMA. Such a move will be the first sign that the downtrend might be over.

CRO/USD

Crypto.com Coin (CRO) turned down from the resistance line and broke below the moving averages on Sep. 20. The altcoin can now drop to the critical support at $0.144743.

CRO/USD daily chart. Source: TradingView

If the bears can sink and sustain the price below $0.144743, it will suggest that the CRO/USD pair has topped out at $0.191101.

The next support on the downside is the 38.2% Fibonacci retracement level of $0.12749 and if this breaks down, the decline can extend to $0.11.

This bearish view will be invalidated if the pair rebounds off $0.144743 and rises above the downtrend line.

LTC/USD

The indecision between the bulls and the bears resolved in favor of the bears when Litecoin (LTC) broke below the symmetrical triangle pattern on Sep. 20. The next support on the downside is $39.

LTC/USD daily chart. Source: TradingView

Some buying can be expected at the $39 support because this level has not been breached convincingly since April 1 and the buyers have been rewarded every time they purchased on dips to this support.

The strength of the rebound off this critical support will provide insight into the conviction of traders.

If the bounce is strong, it will suggest that the bulls have again purchased closer to the support because they expect it to hold. However, a weak rebound will show a lack of confidence and this will increase the possibility of a break below $39.

BSV/USD

The tight range trading in Bitcoin SV (BSV) resolved to the downside on Sep. 20 as the altcoin plunged below the $160 support. Repeated retests of a support level tend to weaken it as traders lose conviction that the support will hold, hence, they stop buying.

BSV/USD daily chart. Source: TradingView

The bears will now use the opportunity and try to sink the BSV/USD pair below the $146.20–$135 support zone. If they succeed, it could start the next leg of the downtrend that can reach $100 where buying might emerge as it is a psychologically important level.

This bearish view will be invalidated if the pair rebounds off the current levels and rises above the 20-day EMA ($167). Until then, the bears are likely to view the relief rallies as a selling opportunity.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.