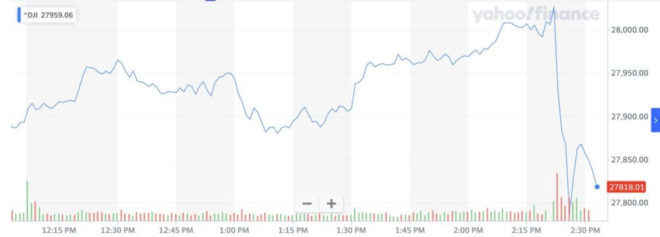

- The Dow Jones rose 360 points Wednesday, giving up a massive chunk of its intraday gains.

- Hopes of more fiscal stimulus and positive economic data lifted the mood on Wall Street.

- Senator Mitch McConnell knocked 150 points off the Dow as he stressed no stimulus deal was close.

The Dow Jones rallied strongly mid-week after the White House did its best to keep hopes of more coronavirus stimulus alive. Upbeat economic data also helped to reverse early losses after a predictably turbulent presidential debate.

Dow Falls From Peaks After McConnell Pours Cold Water on Stimulus

All three major U.S. stock market indices rallied today, with the Dow Jones leading the way. The Nasdaq and S&P 500 also climbed over 1%.

There was plenty of encouraging economic data Wednesday headlined by strong ADP non-farm job growth and an 8.8% jump in pending home sales. Second-quarter GDP was also revised higher, though it seems unlikely that the -31.4% reading had Dow bulls too excited.

Instead, it was Treasury Secretary Steven Mnuchin’s stimulus hopes that kept risk sentiment alive. The fact that the White House is returning to the negotiating table indicates a desire from both parties to inject more fiscal stimulus into the economy.

Unfortunately, Senate Leader Mitch McConnell torpedoed the Dow late in the session, as he stated both sides remain “far apart” on a deal. Watch the video below.

Biden Debate Sends Trump’s Betting Odds Plummeting

It is impossible to talk about volatility in the stock market and not mention last night’s presidential debate. Dow futures rallied, then dropped sharply overnight before today’s big jump.

Watch the video below for the “highlights.”

Boris Schlossberg at BK Asset Management provided the following take on the blockbuster showdown between Joe Biden and President Trump:

Overall, Mr. Biden certainly beat the low expectations set of him and in nearly every poll came out the winner if for no other reason than he was far more civil than the President, but he did not score any knockout punches, and the general feeling of the audience post-debate was one of distaste with almost everyone agreeing that they witnessed a verbal brawl rather than any attempt to discuss policy.

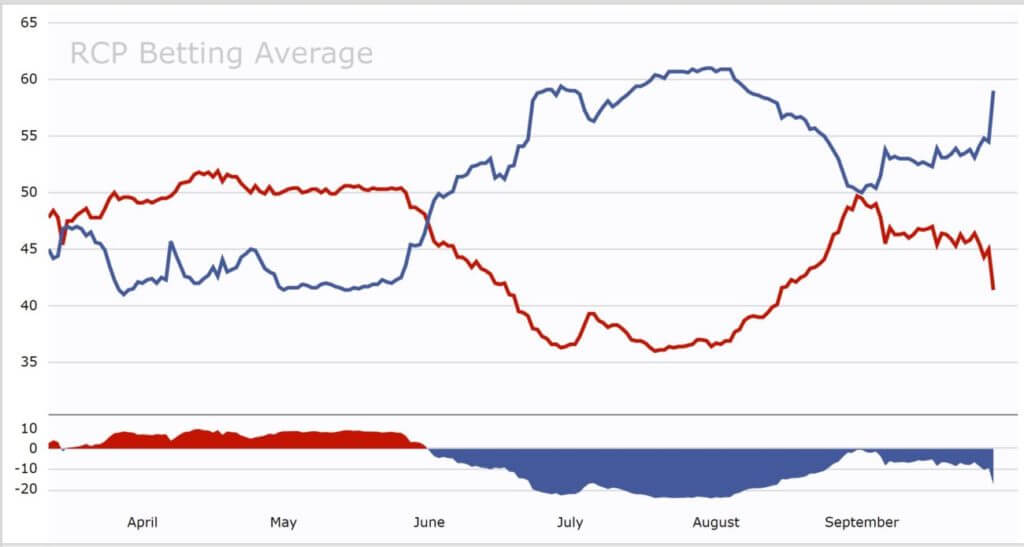

Betting odds climbed in Biden’s favor after the debate. Trump has been attacking Biden’s cognitive abilities for months, so his inability to deliver a swift knockout blow during the debate has speculators lowering his odds of winning.

As you can see in the chart below, the release of the president’s taxes and the recent debate have shifted sentiment dramatically in recent days.

As the 2016 election demonstrated, betting odds don’t always get it right. The highly polarized nature of U.S. politics makes it unlikely that a meaningful number of voters are being swayed by a debate at this stage in the campaign. However, there is no question that analysts do pay attention to the trends.

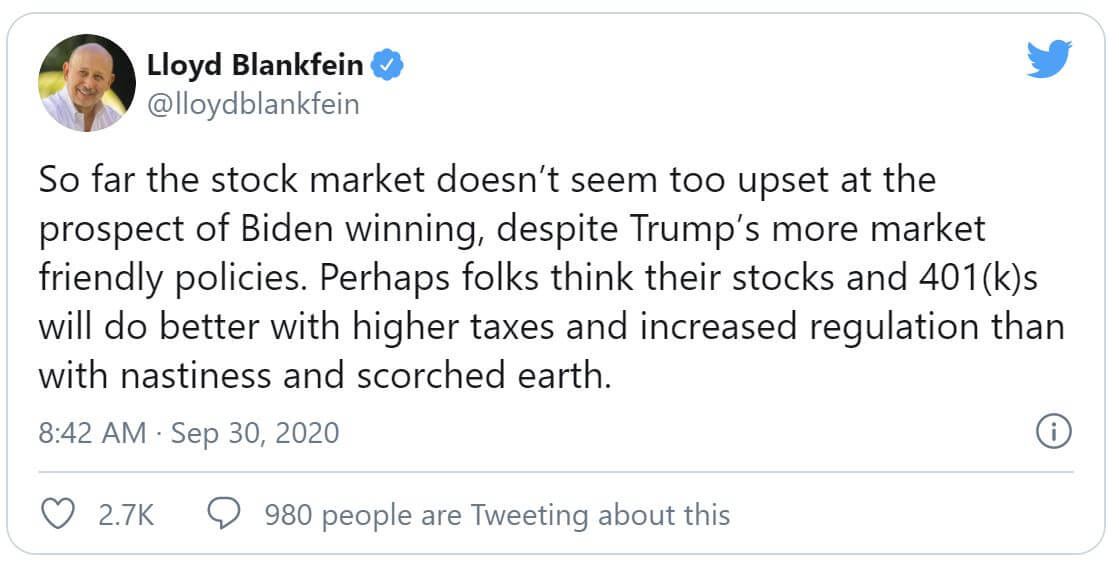

This didn’t stop former Goldman Sachs CEO Lloyd Blankfein from weighing in on the matter. He says Wall Street is warming up to the idea of a higher-tax regime under Biden. So far, there is little concrete evidence that investors are favoring either candidate.

Dow 30 Stocks: Boeing Soars Again, Disney Slumps

On a tremendous day for the Dow 30, investors helped all but two stocks rally on the day. Disney stock was one of these, losing 0.7%, after announcing 28,000 layoffs. Nike lost 0.2% as it traded into the close.

Watch the video below for some insight on what the job cuts could mean for Disney.

Elsewhere, the mood was unanimously positive, as Boeing and Goldman Sachs each rose more than 2%.