Four years ago, when the Seychelles-based cryptocurrency exchange BitMEX announced a new product called the “perpetual bitcoin leveraged swap,” few traders in nascent digital-asset markets could have anticipated what a major impact the obscure roll-out would have on the industry.

But the instrument, which made it easy for customers to trade the equivalent of $100 of bitcoin for every $1 down, proved hugely popular and successful among risk-hungry traders, vaulting BitMEX into the top ranks of the world’s biggest cryptocurrency exchanges.

Now, digital-asset analysts and investors are scrambling to assess the market damage after U.S. authorities on Thursday brought a series of regulatory and criminal charges against BitMEX and its CEO, Arthur Hayes.

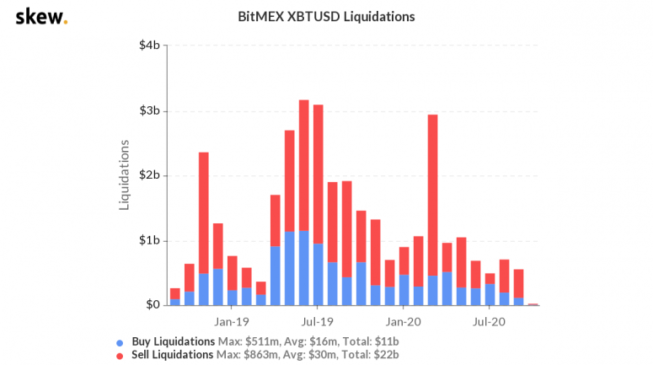

One change could be less market volatility, since BitMEX’s perpetual swaps were infamous for exacerbating price swings: It’s a well-known trope among bitcoin traders that every time the market tilts one way or another, BitMEX customers’ thinly-capitalized positions get liquidated in a series of rapid margin calls, exacerbating price swings that reverberated to other exchanges.

“Long term, it’s so much better for the spot market,” said Steve Ehrlich, CEO of Voyager Digital, an online cryptocurrency trading platform.

A nagging question going forward is whether some BitMEX customers in the U.S. — apparently in violation of the country’s laws and regulations — will be forced to close their accounts, and possibly sell their bitcoin. That could put downward pressure on prices.

Bitcoin dropped 4% after the charges were unveiled on Thursday, but a few hours later prices had pared some of their losses and were changing hands around $10,580, staying in a range where they’ve traded for several weeks.

BitMEX officials said in a statement that they “strongly disagree” with the charges and intend to defend against them vigorously. In a Telegram channel, the company said that its trading platform is operating normally and that all funds were safe.

Competitors in the leverage game

Many other cryptocurrency exchanges in recent years had copied BitMEX’s model, rolling out bitcoin-trading instruments with leverage of 100 times or greater. And some traders have shifted to those alternate venues, causing BitMEX’s share of the overall bitcoin-derivatives market to recede.

That might reduce the market impact from any additional customer defections in the wake of Thursday’s charges, said John Todaro, director of institutional research at crypcorrency analysis firm TradeBlock.

“Two years ago, this would have been catastrophic, because BitMEX was such a huge percentage of everybody who’s playing leveraged trading,” David Weisberger, co-founder and CEO of CoinRoutes Inc., said in a phone interview. “Now, there are quite a few alternatives to BitMEX and several of them have always been more stringent about trading or not allowing U.S. clients to trade on those platforms.”

A snapshot of bitcoin futures trading on Thursday ranked BitMEX fourth among exchanges on 24-hour volumes, behind Binance, Huobi and OKEX, according to the data site Skew. Open interest, or the value of outstanding contracts, stood at $680 million, trailing OKEx.

“Coming for a while now”

Traders were well aware that BitMEX was under scrutiny and may have moved to get ahead of any crackdown, according to the digital-asset firm QCP Capital.

“This has been coming for awhile now, and while the charges are heavy and coordinated, it remains to see how much bite it actually has,” the firm said on its Telegram channel.

Based on QCP’s tally, BitMEX has about 190,000 bitcoins in its vaults, worth about $2 billion at current prices, with another 36,000 bitcoins in an insurance fund.

It’s possible that BitMEX’s example might provide a shot across the bow to overseas cryptocurrency exchanges that might be cutting corners on compliance, while potentially giving regulatory clarity to those exchanges trying to court U.S. customers. Regulated commodities exchanges in the U.S. also typically offer trading leverage, but the most common bitcoin futures contract, from the Chicago-based CME, only allows positions with about three times the initial money down.

“It clearly sets a tone for other exchanges that compete with Bitmex – and there’s more and more of them popping up every day – that you can’t do that with U.S. customers,” Voyager’s Ehrlich said. “If I was at one of those competing exchanges, I’d be going through my customer records immediately.”

One of the defendants involved in the BitMEX’s case went as far as to “brag” that “bribing” regulators in a jurisdiction outside the U.S. cost just “a coconut,” according to a statement by assistant FBI director William Sweeney Jr. The Foreign Corrupt Practices Act (FCPA) bars Americans from bribing overseas officials.

It might have simply been too brazen for regulators to overlook.

“One thing I know with regulators, is if you say things that are antagonistic in discoverable information places, you’re much more likely to be punished than people who do something very similar but keep their nose clean and not say anything and act respectfully,” Weisberger said.

– With reporting by Omkar Godbole