- China, Singapore, and Seoul’s housing market demand is continuing to surge, defying the pandemic-induced economic slump.

- Singapore, in particular, is seeing a consistent increase in demand all-around, even in the suburbs.

- UBS analysts believe global housing prices are nearing bubble levels, but strategists see major catalysts for home prices in 2021.

The financial markets are struggling as the fear around resurging COVID-19 cases, and the negative economic outlook intensifies. But the much-anticipated housing market crash is not coming. In fact, across major cities in Asia, there is a housing boom.

Singapore, Seoul, Shenzhen, and other metropolitan areas in Asia have seen real estate prices spike in recent months. The housing market of Singapore and Seoul, in particular, is surging rapidly amidst a pandemic-induced economic downturn.

Why Singapore and Seoul’s Housing Market is Rising Uncontrollably

Many buyers are hoping for a housing crash as the global economy continues to decline. But the figures show the housing market is demonstrating significant resilience.

Researchers say that Asia’s housing market is on track to recover in the coming months as the economy rebounds.

Singapore and Seoul’s housing market stayed resilient throughout the pandemic, and now, researchers predict the market to go up.

Christine Sun, OrangeTee & Tie. ‘s head of research, emphasized that market sentiment may continue to improve, referring to Singapore’s housing market.

The researcher explained that real estate properties’ demand could strengthen even more as major sectors begin to recover. She said:

“The property market remained resilient in spite of the uncertainties in the trajectory and development of the coronavirus. Market sentiment may continue to improve and demand of properties may remain strong in the coming months as more sectors of the economy reopen.”

The discontinuity between the housing market and the economy has been a persistent theme throughout the pandemic. Analysts expected housing to crash, but across metropolitan areas, it has done the exact opposite.

For instance, in Singapore’s case, APAC Realty’s head of research Nicholas Mak said the suburbs are also seeing high demand.

“There’s been consistent price growth in the suburbs because new residential projects are launched at higher prices. Furthermore, public housing home owners are making a profit from selling their apartments, allowing them to buy private properties.”

Other key Asian markets, including China, have seen a consistent increase in housing demand as well in the same period.

Speaking to CGTN, Hang Seng Bank China’s chief economist Wang Dan said economic recovery and the easing of monetary policies could have led housing prices to rise. He said:

“The general rise in housing prices in August suggests economic recovery is accelerating, and it is partly due to the easing monetary policy in the first half of the year.”

The U.S. and Europe have provided favorable financial conditions and low-interest rates since March. The relaxed financial markets could have buoyed the housing market as a side-effect.

The U.S. housing market is also climbing gradually, defying fears of a real estate crash due to the pandemic. Watch the video below:

Even Europe is Starting to See a Similar Spike in Demand

Reports show that Europe’s housing market has begun to rebound following the Asian market’s resilience.

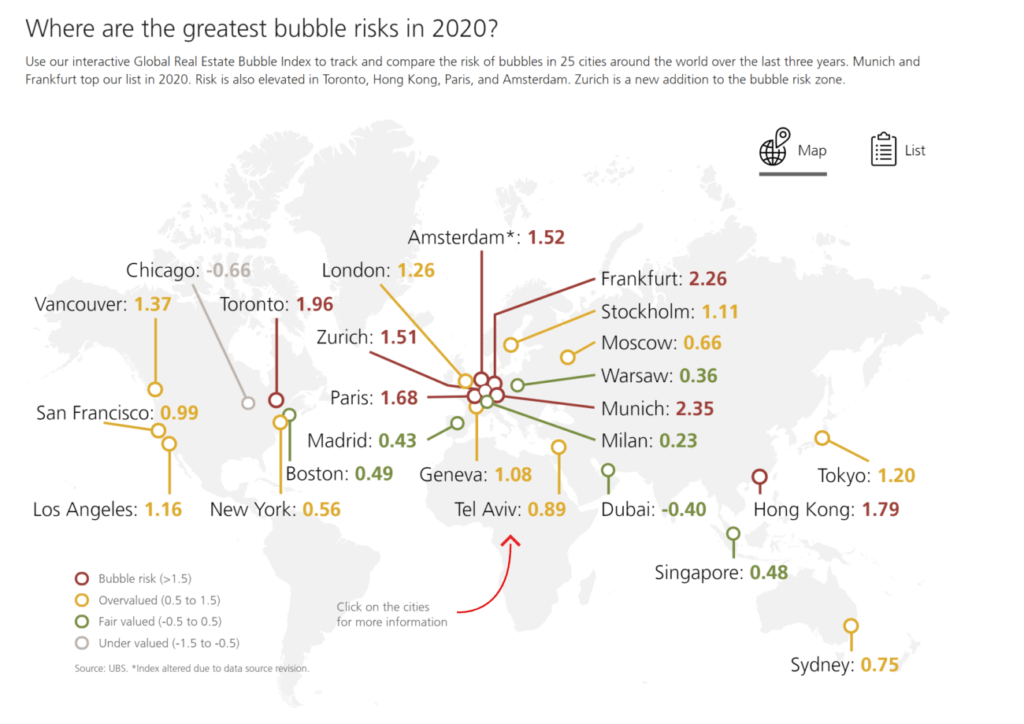

The Swiss investment bank UBS found that more than half of the world’s 25 major cities face a housing bubble. The bank cited its Global Real Estate Bubble Index 2020, which hints at a bubble with an overvalued sentiment.

Mark Haefele, chief investment officer at UBS Global Wealth Management, said the housing market’s upward trend is not sustainable in the near term. He said:

“It is uncertain to what extent higher unemployment and the gloomy outlook for household incomes will affect home prices. However, it’s clear that the acceleration over the past four quarters is not sustainable in the short run.”

Whether the housing market would correct in the wake of bubble concerns remains to be seen. The global economy’s recovery from the pandemic is considered a critical catalyst for housing prices in 2021.