Bitcoin traders hit the buy button Monday while a DeFi project gains $135 million in BTC locked since the start of September.

- Bitcoin (BTC) trading around $11,689 as of 20:00 UTC (4 p.m. ET). Gaining 2.2% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,409-$11,839

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin’s price is making major gains Monday, with a rally starting around 12:00 UTC (8 a.m. ET) and the price jumping from $11,477 to as high as $11,839 on spot exchanges such as Bitstamp within hours. Since then, the price has settled around $11,689 as of press time.

Katie Stockton, a technical analyst for Fairlead Strategies, said bitcoin began a bullish run on Oct. 18, when the price per one BTC began trending above a key moving average. “Bitcoin has been consolidating since breaking out above its 50-day moving average,” Stockton told CoinDesk.

“Short-term momentum remains to the upside within the intermediate-term uptrend, suggesting the consolidation phase will give way to a test of August’s high,” she added.

The record price level for 2020 so far occurred Aug. 17, with bitcoin hitting $12,476 on spot exchange Bitstamp.

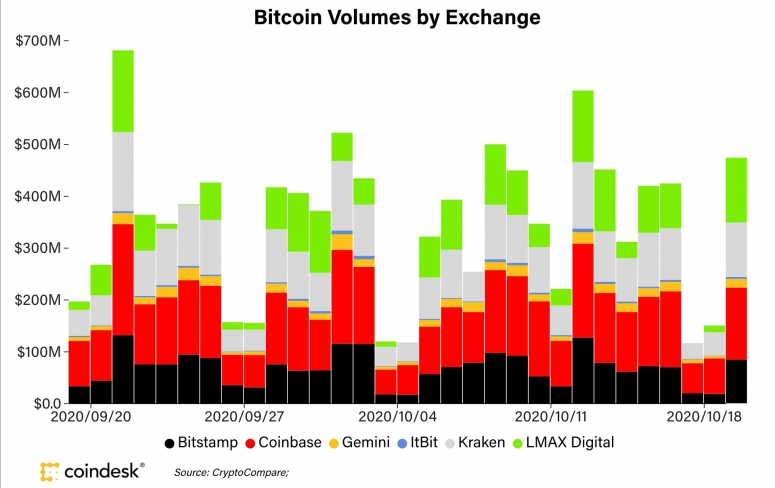

While bitcoin trading volumes and transactions have been quiet as of late, momentum, in the form of bitcoin spot volume, has been higher than usual Monday. Volumes on major USD/BTC are at $473,739,764 Monday, already higher than the past month daily average of $348,110,579.

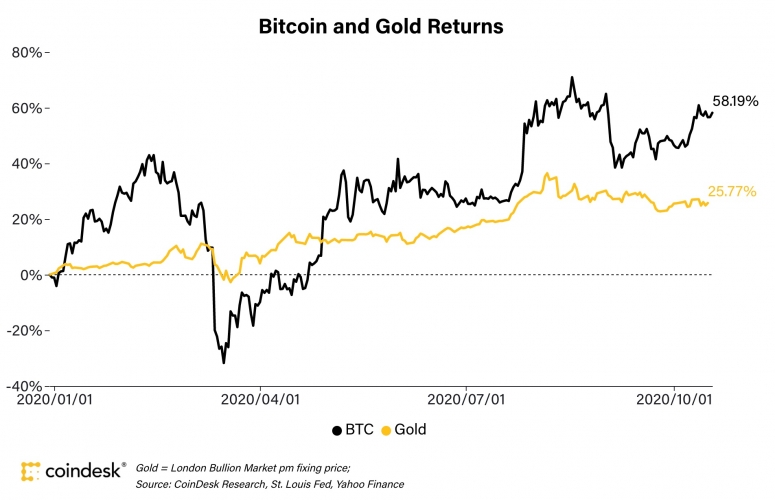

John Willock, CEO of crypto asset manager Tritum, said he sees bitcoin’s price passing $12,000 again soon. “Definitely $12,000 is easily in sight,” he said. “The potential for U.S. fiscal stimulus that is broadly anticipated is likely to result in more price surges in haven/hedge assets like bitcoin and gold.”

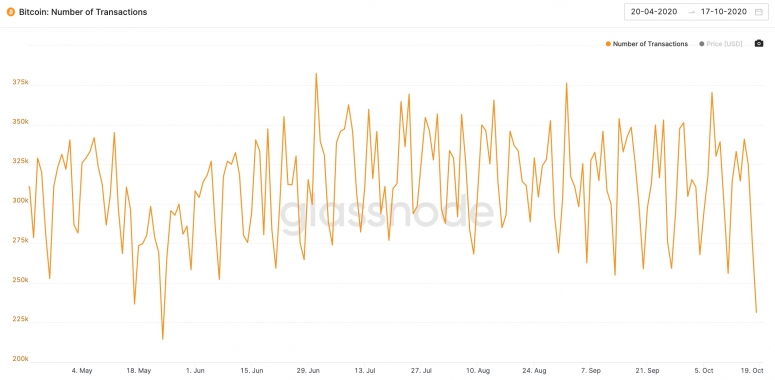

Constantin Kogan, partner at crypto fund-of-funds BitBull Capital, noted a low in bitcoin miner revenue from fees. “The share of miners’ revenues from transaction processing fees fell to a three-month low of 3.49% over the weekend,” he said.

Indeed, miners’ revenues from fees was the lowest point for that metric since July 12, when it dropped to 2.52%. Some of that can be attributed to low volatility and transactions being processed on the Bitcoin network, according to Kogan.

On Oct. 18, 231,437 transactions were processed on the network, a 40% fall from July 1, when 382,408 transactions were recorded. “Revenues of BTC miners have fallen amid low market volatility,” Kogan noted.

Investors plow BTC into Harvest Finance on Ethereum

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Monday trading around $379 and climbing 1% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

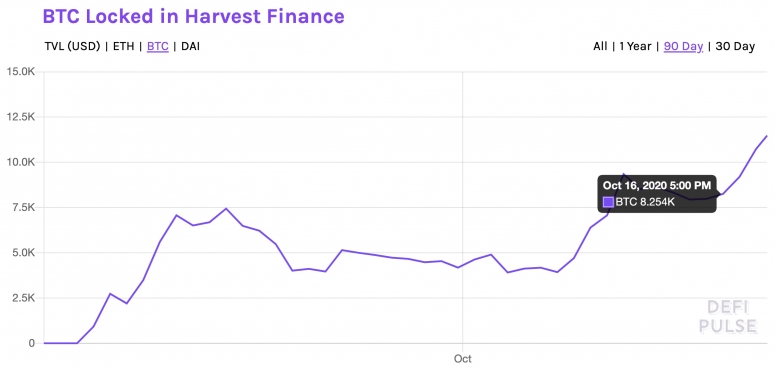

The decentralized finance, or DeFi, space is still attracting bitcoiners looking to increase profits. The project Harvest Finance, which allows users to deploy crypto automatically to popular DeFi projects, has gone from almost zero BTC in early September to surpass 10,000 BTC Sunday.

Total BTC locked in Harvest Finance Monday as of press time was 11,479 BTC, $135,394,805 at current prices and nearly $348 million in total assets locked.

Bitcoin locked in the Harvest Finance protocol since the start of September.

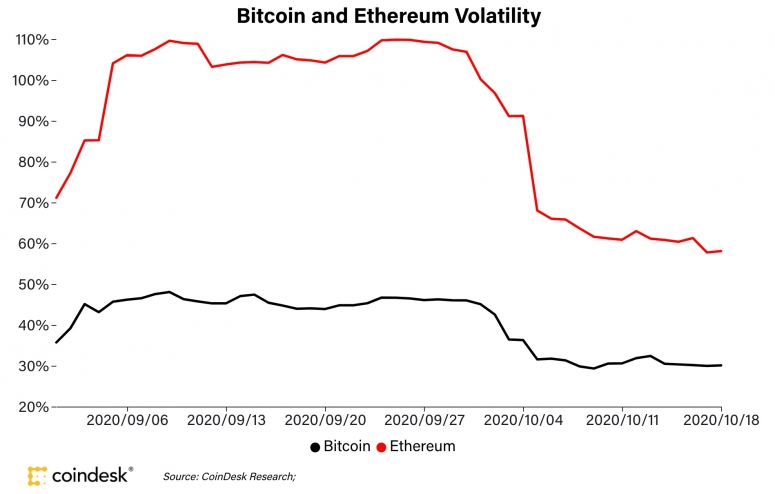

When asked about the bitcoin being parked in protocols like Harvest Finance, Brian Mosoff, chief executive officer of investment firm Ether Capital, remarked on the lower volatility and the potentially lower trading returns for bitcoin versus ether.

“Bitcoin has lower volatility than ETH so it also may be ‘safer’ to put it into DeFi, and this may be another contributing factor,” Mosoff said.

Other markets

Digital assets on the CoinDesk 20 are mostly green Monday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil was down 0.29%. Price per barrel of West Texas Intermediate crude: $40.62.

- Gold was in the green 0.18% and at $1,901 as of press time.

- U.S. Treasury bond yields were mixed Monday. Yields, which move in the opposite direction as price, were up most on the 10-year, jumping to 0.762 and in the green 1.3%.